Chasing “financial independence retire early” (FIRE): is it possible?

At what age are you planning to retire?

For many the standard answer to this is “somewhere in my 60s or beyond”.

Schroders analysis suggests that if you start saving for your retirement at age 20, you’ll need to save between 12% – 15% of your salary for 40 years to retire on 50% of your salary.

But there’s a growing cohort of people that aim to save harder and retire much earlier.

FIRE, which stands for “financial independence, retire early”, is a way of life that’s attracting followers like, well, moths to a flame.

The idea is to live frugally during your working years, aiming to save as much as 50% – 80% of your salary.

The simple theory is that by making big sacrifices early on, you buy your freedom later – meaning you can stop earning at a younger age.

For many followers, FIRE is about a way of life as well as money. The aim of building a savings pot as early as possible is linked to the aspiration of pursuing more meaningful activities than a regular – but possibly unfulfilling – 9-5 working life.

But how feasible is FIRE? Is it achievable for those on all levels of earnings? And can FIRE savers make plans that are sufficiently robust to survive economic and market shocks brought about by seismic events such as the Covid-19 pandemic?

A short history of FIRE

The movement started in the 1990s and has built its support base in the decades since. There are a number of key bloggers and websites promoting FIRE, presenting it both as a personal financial strategy and also to promote a simpler way of living that reduces consumption and saves the planet.

An important part of the FIRE movement are the formulas that try to inform investors how much capital they might need to amass in order to provide sufficient income for the rest of their lives.

One of the better-known formulas is “the 4% rule”, for example. By assuming an average investment return of 7% per year and an inflation rate of 3%, this “rule” predicts that retirees should be able to withdraw 4% of their invested portfolio every year.

Of course, this formula is based on a range of assumptions which link back to the historic performance of stock markets. What might have worked out based on past market returns is not necessarily guaranteed to work out in future.

The 4% rule is also a big ask of any saver. It requires you to put away at least 25 times your current annual expenses. Is it likely to hold true? We explore this in more detail below.

The financial crisis is said to have played a part in raising the profile of FIRE. The fear and uncertainty prevailing in the years after the crisis left millennial workers anxious about the future. One response has been an increased focus on saving as anxiety mounts about individuals’ future security.

While it’s impossible to estimate the number of the movement’s followers, it’s telling that there are just shy of 800,000 members on a FIRE reddit and Mr Money Mustache – one of the key bloggers in the FIRE movement – has seen more than 33 million unique page views since its launch.

FIRE: What’s the plan?

In a nutshell, FIRE requires that you cut your expenses to the bare minimum and channel every spare cent into growing your savings and investments. The sooner you do this the better so you can maximise the length of time you can be retired for.

- Limit the outgoings. But what sort of expenses should get the chop?

It’s recommended you start with your high-interest debt: eliminate any and all of your credit card debt, personal loans and student debt. Low-cost debt, such as mortgage loans, are less of a priority as they eat less of your income. As a reference point, the Schroders Global Investor Study*, an annual survey of over 20,000 investors around the world, found that on average, people put away around 15% of their salary specifically for their retirement.

Then you should look at your daily expenses and remove non-essentials. How draconian you want to be is down to you and your family. Some more extreme adherents of FIRE advocate no eating out, losing the designer clothes and purses, and swapping gym memberships for outdoor exercise.

- Maximise your sources of income

Reducing expenses helps maximise your savings, but so can other sources of income, such as a side-hustle. Is there a way in which you can generate more income? Extra freelancing? Taking on another project outside your regular job?

Discover more from Schroders:

– Learn: Why I can stomach higher equity valuations

– Read: Why lockdown winners aren’t vaccine loser

– Watch: Will 2021 be the time for investors to stop hibernating?

Sounds easy – so what are the problems?

Lowering expenses and increasing savings are undoubtedly worthwhile habits, so why aren’t we all doing it already?

There are practical impediments. In many countries around the world, both developed and developing, some people work to get by. They don’t have the capacity to set very much of their income aside for savings and investment.

It’s also about lifestyle. FIRE promotes a drastic change centred on significant denial. The adjustment can be difficult.

FIRE entails facing up to some potentially alarming risks, too. What if there’s a market crash and you lose a significant amount of your portfolio? What if you encounter an unforeseen medical expense as a result of an accident or a critical illness? What if you run out of money in your later life?

What does “early” mean? Is the aim to retire in your 30s, or 40s? If so your money probably has to last you 40-50 years.

How do you know what is enough?

Figuring how much money you’ll need to last an unknown period is no small task. FIRE followers promote saving at least 25 times your current annual expenses so that by the time you retire you can rely on the 4% rule.

However, as you’ll notice, there are a number of assumptions that must hold true for the 4% rule to work.

The first of these is that your portfolio needs to grow. The “4% rule” rests on an assumption that an invested portfolio will grow an average 7% per year.

Taking very long term views of historic market performance this assumption is feasible. However, there have been long periods where significant falls have reduced the average annual returns well below this number (and vice versa).

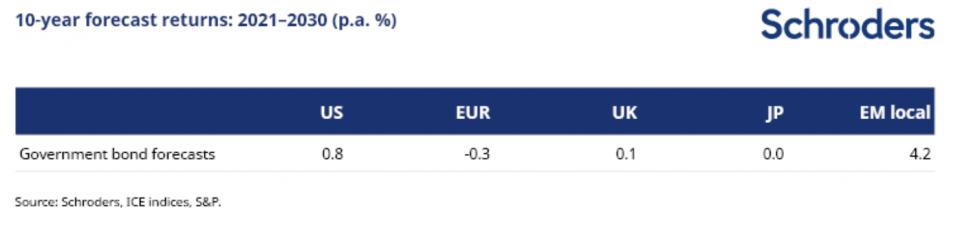

One of Schroders’ inescapable investment truths about the decade ahead is that returns are going to be lower over the next 10 years than they were over the last 10 years across both stock markets and government bonds. The effect is predicted to be especially pronounced with bond returns, as shown in this chart.

A third problem is time period. The original 4% rule formula assumed 7% average annual growth and 4% annual deductions – and worked out that this would reliably last for 30 years, taking into account a typical range of potential market swings experienced through history. But what if your “retirement” was longer? With increasing longevity and younger retirement ages, this could easily occur.

Working with real numbers: a UK saver goes all out for FIRE

The following average wages and expenditures are drawn from the Office of National Statistics, the UK’s official data gatherer. Let’s call our case study Janet, and say she’s 28 years old.

Annual salary: £27,468

Annual expenses: £25,595

Maximum saving: £1,873

Based on today’s numbers, Janet will need to save a pot worth £639,875 in order for a 4% annual withdrawal to equal her spending today of £25,595 a year.

So she will need to increase her savings significantly. At the moment, she’s saving just £1,873 per year – or £156 per month. Assuming this earns 7% compound, it will take her between 47 and 48 years to reach the target £639,875 – which would mean she’d be in her late 70s.

These calculations show just how hard the challenge is.

Let’s say Janet can arrange her life and outgoings so as to save dramatically more than the average. If she can save 50% of her wage – that’s £12,798 per year or £1,066 per month – the calculations suddenly look more compelling. She would reach the target sum after 22 years, meaning she’d be free to “retire” – under the formula of the 4% rule – at around age 50.

In reality of course there are many variables. Janet’s wages are likely to rise over time, but she may also face periods when she earns less or nothing. Her savings may benefit, too, from windfall inheritances or other bonuses.

But to return to the simple scenario outlined above, if she retires at 50 with the target pot of 25 times her annual expenses, will that see her out?

Exactly how long her pot will last is down to the future performance of markets. According to the 4% rule – which is based on historic market returns, and is therefore not a guarantee – she can hope for 30 years’ income. That would take her to age 73. Her invested pot may run out before that date if, for example, very severe market collapses wipe out its value. Conversely it may support income payments for far longer.

FIRE: theory and reality

The calculation shows how investment formulas are great in theory – but we know real life works out differently.

Things start to fall apart when you’re faced with unexpected expenses, for example. What happens if you’re suddenly responsible for another dependent – a child, or parent? Or if you lose your job or become incapacitated?

On the positive side, the financial dynamics might change because you inherit a windfall or enjoy a rapid increase in earnings.

Each of these instances will alter the time it takes you to reach your desired retirement age.

Neil Walton, Head of Investment Solutions says: “We know the concept of FIRE has spurred some to consider downsizing, retiring, investing and changing their lives. But even for those who don’t intend to do anything so radical, FIRE provides a useful blueprint for planning. Good investment will sit on a good financial plan, and that’s inevitably about building investments over time to provide an income in the future.”

– For more visit Schroders insights and follow Schroders on twitter.

*About the Schroders Global investor Study

Schroders commissioned Raconteur to conduct an independent online study of 23,450 people in 32 locations around the world between 30 April and 15 June 2020. This research defines “people” as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last 10 years.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.