Deutsche Bank and Morgan Stanley to join the wave of institutions entering the Crypto fray. It begs the question – when $50,000 for Bitcoin?

Crypto at a Glance

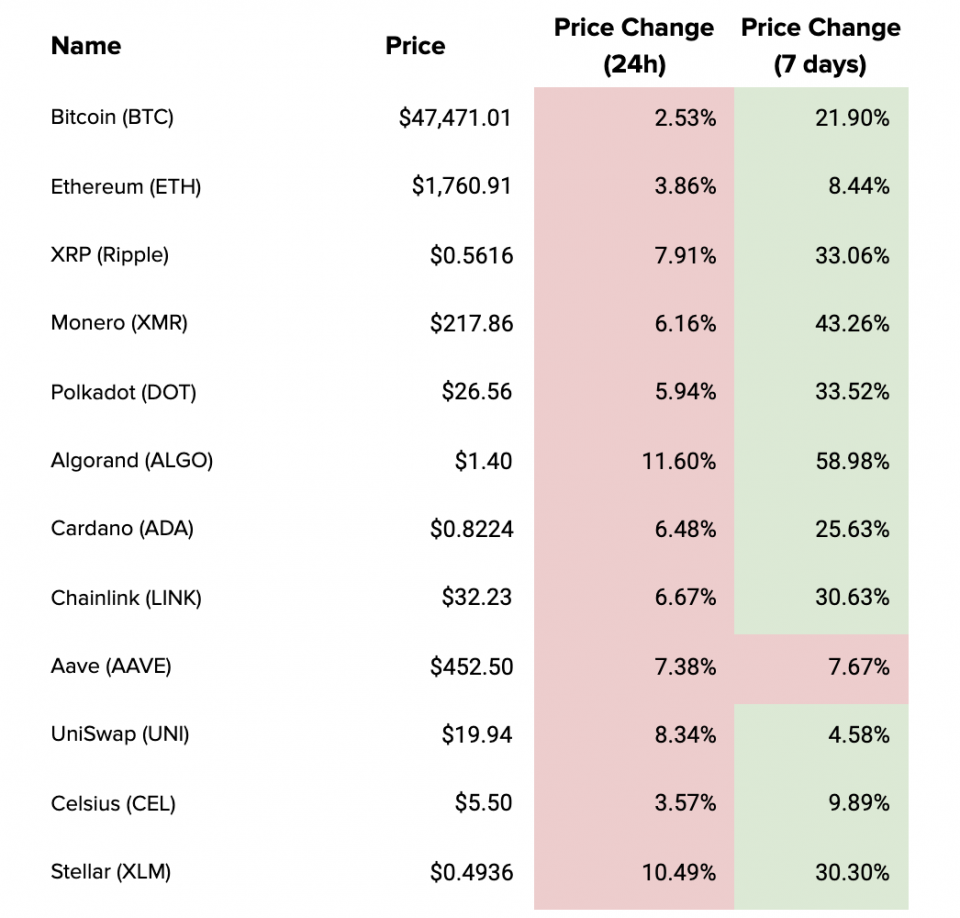

It was an eventful weekend in the markets, though one characterised primarily by near misses. Bitcoin came within a nose hair of $50,000, Ethereum still hasn’t quite made it over the $2,000 line, and Cardano is yet to hit that dollar mark. The total market cap of all crypto markets did spend a good part of Valentine’s Day hovering just above $1.5 trillion at least, though it appears to have been short lived as we’ve got off to a rocky start to the week. There have been retraces across the board over night, wiping out a good portion of this weekend’s gains. Does this morning’s set back mean some of these landmarks will have to wait a little longer? Is it the start of a bigger correction?

There was still a bucket load of major crypto-related news to chew on though, particularly coming out of large financial institutions . Following BNY Mellon’s announcement on Friday that it would introduce Bitcoin, reports this weekend suggest Morgan Stanley’s $150 billion Counterpoint Global investment unit is considering placing a bet on bitcoin. Deutsche Bank’s aspirations also came to light, with a little-noticed report by the World Economic Forum outlining their plans for a Digital Asset Custody prototype, which aims to develop: “A fully integrated custody platform for institutional clients and their digital assets providing seamless connectivity to the broader cryptocurrency ecosystem.”

If the good news does manage to keep the momentum going, watch out for bitcoin at $53,680 – the price at which Bitcoin becomes a trillion dollar asset. Will it make it this week?

Start your investment journey into crypto with Luno with £10 on us!

If you’ve not started your crypto journey yet, we’ve joined forces with Luno to offer you £10 absolutely free. Click on the graphic below and simply use the code CITYAM10 when you sign up.

In the Markets

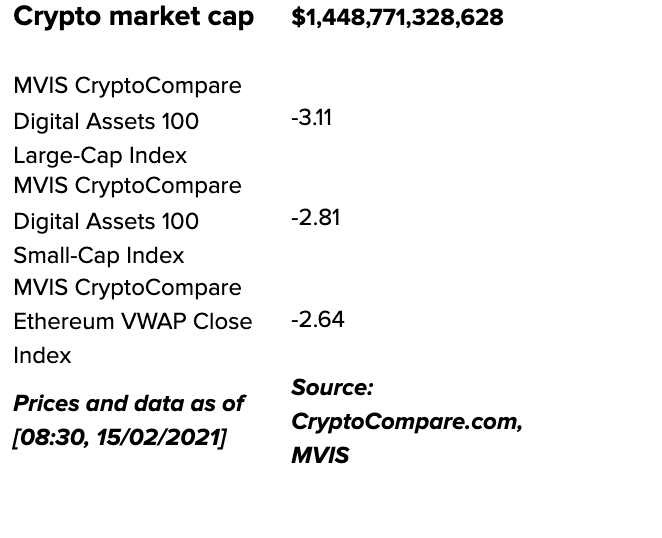

The Bitcoin Economy

What bitcoin did yesterday

We closed yesterday, 14 February, 2021, at a price of $48,717.29 – up from $47,105.52 the day before. That’s the highest closing price in Bitcoin’s history.

The daily high yesterday was $49,487.64 and the daily low was $47,114.51. That’s the highest daily high and highest daily low in Bitcoin’s history.

This time last year, the price of bitcoin closed the day at $10,312.12. In 2019, it was $3,616.88.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $884,696,479,523. To put that into context, it’s just over half the market cap of Amazon, which has a market cap of $1.651 trillion.

Bitcoin volume

The volume traded over the last 24 hours was $79,886,781,936. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 86.18%.

Fear and Greed Index

Market sentiment remains high, in Extreme Greed at 93.

Bitcoin’s market dominance

Bitcoin’s market dominance is currently 61.80. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 68.86. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“We do not think BTC is a bubble; we think BTC is the last remaining functioning fire alarm that has not been disabled by policymakers, and it is issuing an increasingly shrill alarm about the USD and fiat currencies more broadly. We have little doubt that policymakers will attempt to disable BTC as a functioning fire alarm as well, but its traits make that far more difficult to do to BTC than they have thus far done with gold.”

- Luke Gromen, Founder & President, Forest for the Trees (FFTT)

What they said yesterday…

Working out well so far

Maybe not the answers the ECB was looking for in the comments

See, Norm gets it

Valentine’s Day is weird on crypto Twitter

Darren Parkin Articles

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM: Recommended Events

CC Forum

Global Investment in Sustainable Development

31 March – 1 April 2021 – Dubai

Global Technology Governance Summit

6 – 7 April 2021 – Tokyo

https://www.weforum.org/events/global-technology-governance-summit-2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno