Why are UK mid caps in such an M&A sweetspot right now?

It would be difficult to miss the fact that UK mid cap companies are attracting a renewed level of bid interest at present. So much so that, every morning, when I log in to my virtual workplace, I am mentally preparing myself to see a new headline about the next one to be bid for.

In particular, renewed demand for UK-quoted companies from large and experienced foreign buyers suggests to me that other investors continue to overlook an opportunity. Mid cap companies are at the centre of this interest from overseas companies (so-called “strategic buyers”), private equity (PE) or PE-backed purchasers.

It’s always helpful to observe what the corporate and PE sectors are doing since we share their long-term mentality. If the pick-up in “inbound” activity is a guide, it seems to me these bidders are currently thinking: “UK shares are cheap, sterling is weak, this is our opportunity to buy some prized assets outright.”

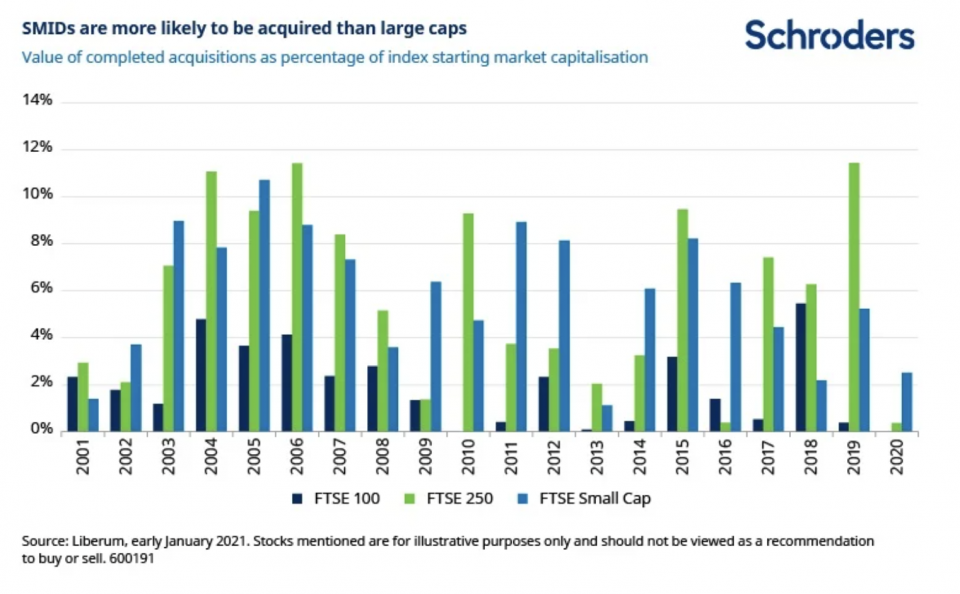

Mid caps are a synonym for the FTSE 250 index, which is the next most established group of shares trading on the London Stock Exchange outside the FTSE 100. These companies can be the target of choice for bidders – not too big, but sufficiently large to make a difference – and in 2019 close to 12% of the FTSE 250 was acquired (see below).

Global deal-making has resumed with gusto as debt financing has cheapened again, with policymakers slashing interest rates and restarting monetary easing in response to Covid-19. The crisis has also accelerated a number of structural trends and companies are either re-sizing their operations or capitalising on opportunities with the help of M&A.

Against this backdrop, could 2021 be another vintage year for mid cap M&A? At present it seems very possible.

Discover more from Schroders:

– Learn: Why I can stomach higher equity valuations

– Read: Trust me, I’m a chief executive

– Watch: Will 2021 be the time for investors to stop hibernating?

Bidding for control

We’ve seen a tussle for mid cap bookmaker William Hill, where the eponymous owner of Las Vegas’s iconic casino Caesars has seen off PE group Apollo. Meanwhile, two North American rivals (both of them PE backed) appear at the time of writing to still be vying for FTSE 250 security group G4S.

More recently, US PE groups Blackstone and Carlyle have been in competition for control of Signature Aviation. At the time of writing the mid cap aviation services company had recommended a bid from Global Infrastructure Partners, a US infrastructure fund manager.

To my mind, this interest is further evidence of the opportunity offered by UK shares, which remain in the doldrums.

While UK shares have responded well to the vaccine news in early November, and then again to the Brexit trade deal, there is an awful lot of lost ground to make up after four and half years of Brexit uncertainty.

Bidders appear to be sensing a window of opportunity, with valuations still low but uncertainty removed by the Brexit deal. At the same time, good progress with the UK’s Covid-19 immunisation programme gives a glimpse of sunlight at the end of the tunnel, as opposed to the headlights of a train running at full speed.

Whilst certainty is in short supply in many ways, we do know that the economy will, at some point, be able to properly open up again (see What happens when the party starts back up?).

Refreshing the portfolio

If the experience from 2019 is anything to go by, all variety of mid cap companies could be in the frame for a bid.

Those snapped up last time ranged from air-to-air refuelling specialist Cobham (sold to US PE group Advent) to Suffolk brewer Greene King, which was bought by Hong Kong-based investors.

Hasbro of the US purchased mass media group Entertainment One, and Blackstone (alongside the investment company of The Lego Group’s Danish founding family) bought back theme park operator Merlin Entertainments. US PE firm Thoma Bravo acquired cyber security business Sophos.

Aside from shining a light on the unloved status of UK shares, such M&A activity helps make room for the next tranche of exciting mid cap companies in a rapidly-evolving world.

These can be new (or returning companies) which join the stock market via initial public offerings (IPOs). They can also be small cap companies vying for promotion to the FTSE 250 – for this reason we’re also always watching M&A and IPO activity lower down the market for tomorrow’s potential mid caps.

Since mid caps are generally better able to capitalise on new opportunities than their larger counterparts, they tend to be more dynamic – it also helps to have a smaller base from which to achieve growth.

For all of these reasons, we’re often heard referring to the FTSE 250 as the “Heineken Index”, given its potential to “refresh” a portfolio in a way other parts of the market can’t. Cheers!

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.