Trust me, I’m a chief executive

Public trust in government is waning, as the 2021 Edelman Barometer of Trust revealed recently.

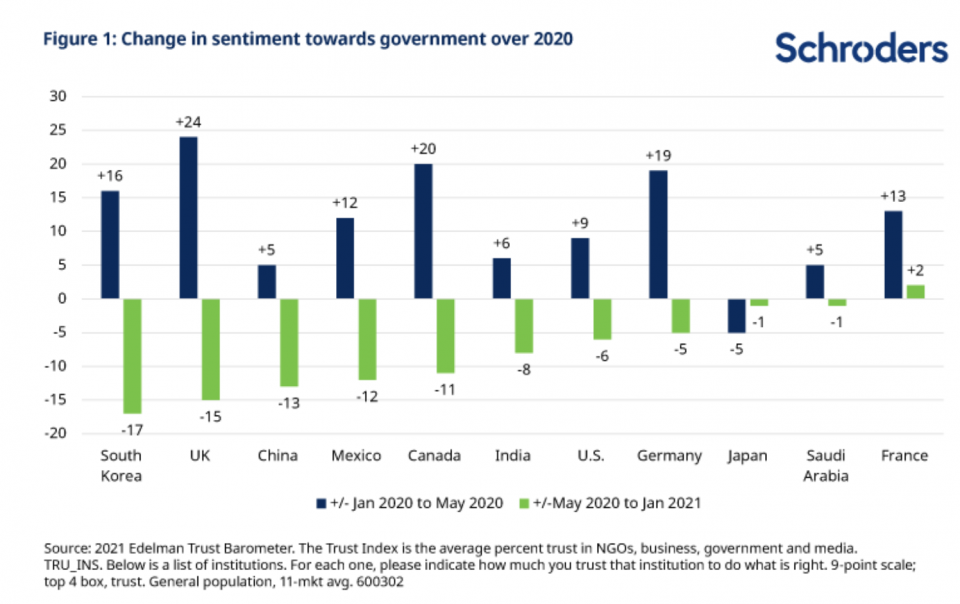

Between January and May 2020, trust in government rose in almost all countries: people all over the world put faith in their leaders as the global pandemic took hold.

But, interestingly, this trust has subsequently eroded, in some cases to below pre-pandemic levels. The pandemic has been more severe and long-lasting than almost anyone expected, putting extreme pressure on health systems and causing unprecedented economic damage.

Will government distrust put the recovery in jeopardy?

Here in the UK, the government has been accused of flip-flopping and U-turns, undermining the ‘wartime mentality’ that prevailed in the spring of 2020. In the US, it seems likely that Trump would have been re-elected if not for the pandemic. Lower levels of trust are threatening the recovery as many people are wary of accepting the vaccine amid swathes of misinformation online.

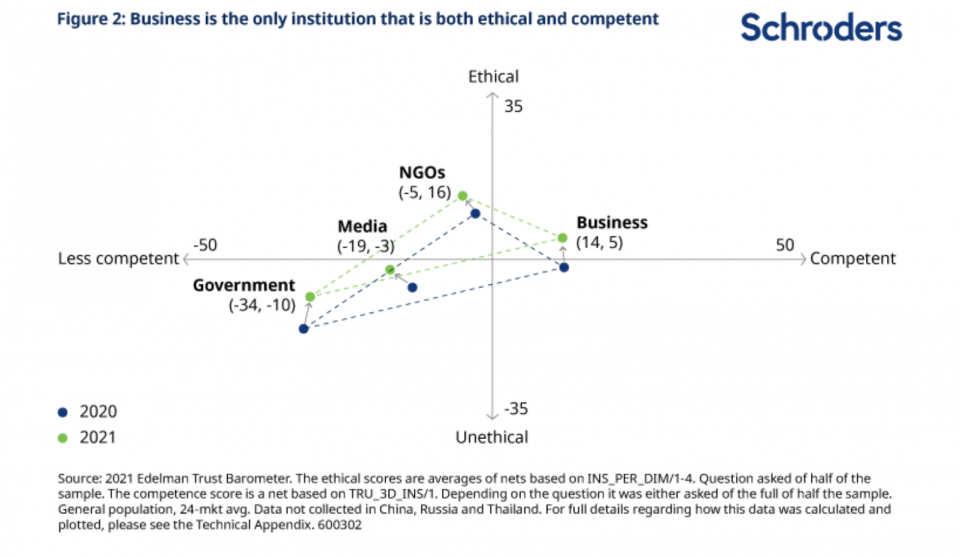

While trust in government is still up slightly on aggregate, Figure 2 shows that respondents see government as the least competent and the most unethical of all institutions.

Who can we turn to?

But it’s not all bad news.

There is one institution that is considered both ethical and competent: business.

Business is now the only institution to score over 60 on the Edelmann survey, the level which is considered the threshold for public trust.

It is gratifying to us that the big improvement has been in the perception of business ethics, reflecting well on the private sector’s response to the pandemic.

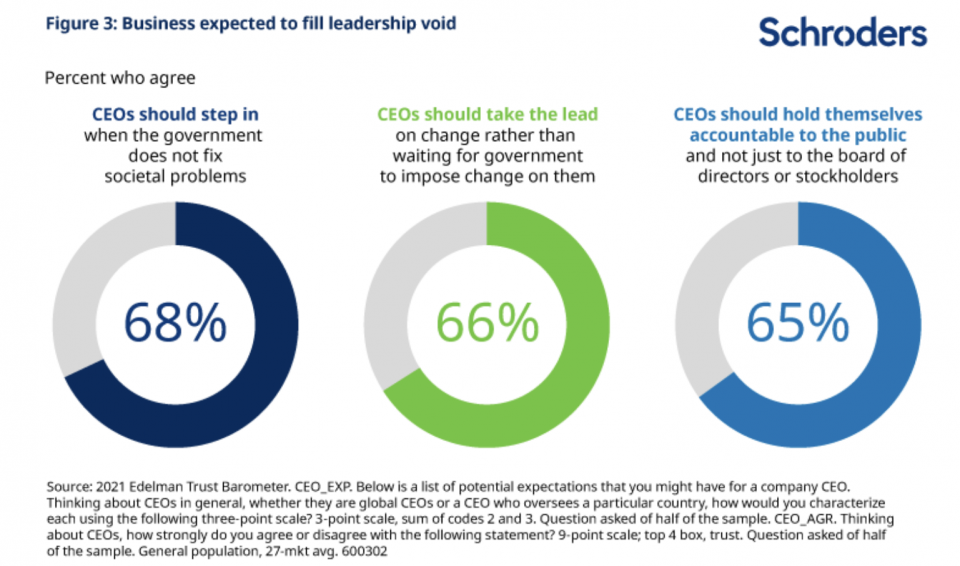

People are increasingly looking to corporates to step up and lead us not just out of the coronavirus crisis, but also to address wider societal problems.

What is means for the social contract

This is consistent with our previous work noting greater public scrutiny on companies’ treatment of their stakeholders during the pandemic, especially with regard to employees.

We see this as the start of a new social contract between business and wider society.

We’ve seen growing evidence that investors expect companies to manage their impact on the wider environment and society, and lead on societal issues.

One relatively new phenomenon is that this trust is increasingly placed not just in the business community as a whole but on specific individuals within it. This creates challenges for executives, who are now expected to publicly comment on contentious issues in order to maintain the loyalty of their customers, staff and shareholders.

Another question reveals that 86% of respondents expect CEOs to address societal problems, including the pandemic.

For example, now that “Black Lives Matter” has moved firmly into the mainstream, the vast majority of Americans surveyed by JUST Capital expected CEOs to respond to the BLM protests. It could be in the form of statement about ending police violence, promoting peaceful protest or, at very least, elevating diversity and inclusion in the workplace.

Business can and should rise to the challenge

The business community has a responsibility to be a force for good as this pandemic rages on. And we as investors have a responsibility to encourage and incentivise this behaviour. As stewards of client capital, we need to hold executives to account, encourage transparency, and support business leaders to act in the best long-term interests of society and the environment.

We have long believed that this behaviour will ultimately be in the best interests of shareholders, thanks to what we describe as ‘corporate karma’. 2020 was a powerful proof point, as we saw stocks and funds with higher ESG rankings outperform, especially during the sharp sell-off in March. We expect this to continue as customers, talent and capital flow to companies seen to be ‘doing the right thing’.

The public has put its faith in our hands; we – literally – can’t afford to let them down.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.