Asos purchases Arcadia’s principal brands to improve its own quality perception

Online fashion giant Asos has announced it has beat competitors to purchase the four main Arcadia brands – Miss Selfridge, HIIT, Topman and Topshop – in order to become the number one fashion destination for young, fashion-conscious shoppers worldwide.

Chief executive Nick Beighton said that the brands were a “natural fit” and resonated with their “core, fashion-loving 20-something customers”. He explained that Asos were looking forward to benefiting from the brand equity of the new labels, as they were beginning with “great customer awareness and a strong brand history”.

Read more: Asos buys Arcadia’s Topshop and Miss Selfridge in £330m deal, leaving thousands jobless

While there are obvious benefits to adding a much-loved brand like Topshop to Asos’s growing multi-brand platform, YouGov data shows that Asos already has a strong brand.

The e-tailer scores highly among consumers for value (9.2), impression (9.9), reputation (5.4), customer recommendation (8.8) and satisfaction (10.5) compared to other high street fashion brands, and scores higher than the four Arcadia brands just purchased. Comparatively, Topshop, the most well-known of the brands bought, has a value score of 1.8, 4.9 for impression, 2.3 for reputation and 9.3 for satisfaction. (Scores are averaged over the past year.)

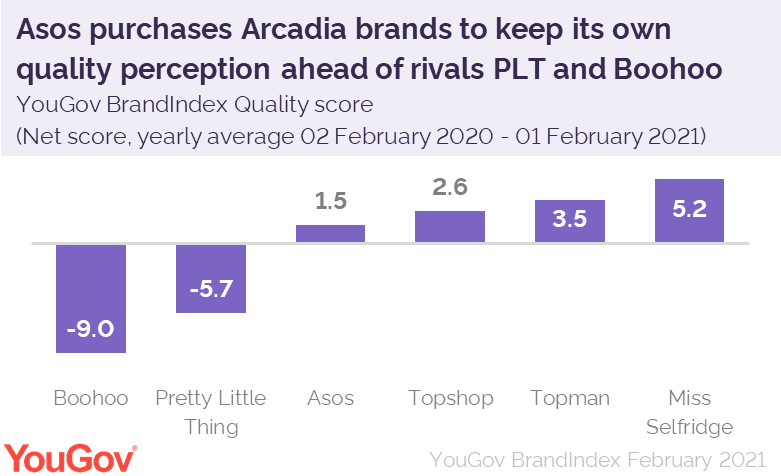

The main gain for Asos from this acquisition is in improving its own quality perception, something that Arcadia’s brands are known for and Asos hopes to absorb. Asos has a quality score of (1.5) whereas Topshop (2.6), Topman (3.5) and Miss Selfridge (5.2) score much higher among the British public. Asos will want to build on this to stay ahead of competitors like Pretty Little Thing and Boohoo. Both of these companies offer similar services and products to Asos but score much lower for quality: -5.7 for Pretty Little thing and -9.0 for Boohoo.

Asos plans to retain and use some of Arcadia’s design and buying teams, with support from their own team who are reactive to trends and relevant to younger consumers, something that’ll be welcomed by the more than half of Topshop shoppers who like to keep up to date with current fashion trends (54%).

By focusing on turning Topshop and the other labels into digital-first, fashion forward brands, Asos will not only elevate its own fashion credentials but improve its own brand in the one area it’s currently lacking in.