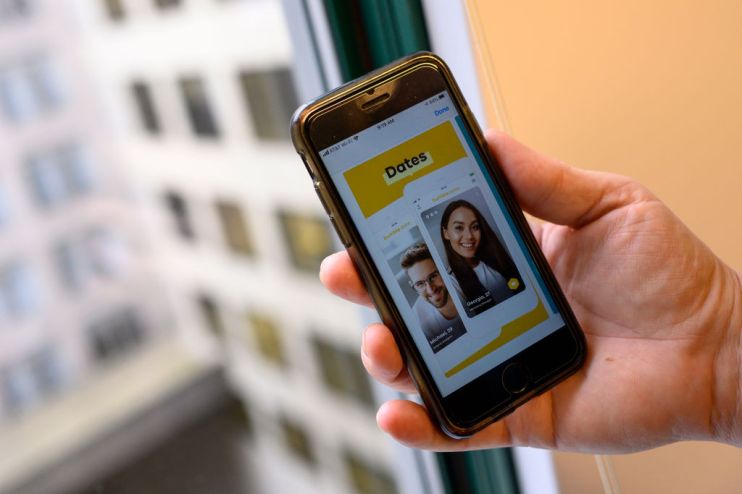

Dating app Bumble files for US stock market float

Dating app Bumble has filed for a US initial public offering, joining a host of major tech companies expected to go public this year.

The app, which is backed by private equity giant Blackstone, registered for a float of up to $100m (£74m), though this is a placeholder amount and is expected to change.

Previous reports have suggested the platform is seeking a valuation of between $6bn and $8bn.

Bumble, which lets women make the first move, is plotting to go public on or around Valentine’s Day, Bloomberg reported.

The filing revealed a steady period of revenue growth for the app, though higher operating costs pushed the company to a loss.

The dating app, which competes with rivals such as Tinder and Hinge, said it had 42m monthly active users as of the third quarter, and 2.4m paying users in the nine months to September.

Bumble’s revenue for the first nine months of the year came in at $376.6m, up from $362.6m in 2019.

The platform swung to a net loss of $84.1m in the same period, compared to a profit of $68.6m the previous year.

Bumble also revealed that it had identified problems in its internal controls over financial reporting.

“The deficiency we identified relates to a lack of defined processes and controls over information technology,” it said in the filing.

Bumble was founded in 2014 Whitney Wolfe Herd, a cofounder of rival app Tinder.

She left Tinder after two years and filed a sexual harassment case, which was settled for a reported $1m.

The dating app’s stock market debut will come amid a surge in IPO activity, which is largely being led by tech firms.

Bumble plans to float on the tech-heavy Nasdaq index. Goldman Sachs and Citigroup are the lead underwriters on the IPO.