Total crypto market cap hits $1 trillion

Crypto at a Glance

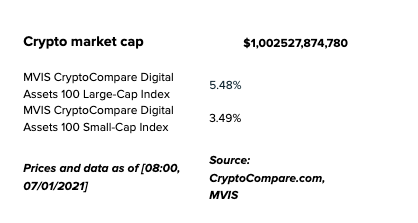

It should get boring writing the same thing every day, but surprisingly typing out NEW ALL-TIME HIGH never really loses its thrill. Today though, it’s not just a new bitcoin all-time high ($37,000, see you later) – the total cryptocurrency market cap has surged past $1 trillion for the first time ever. At its prior peak in late 2017, the market’s total capitalisation was just above $760 billion, according to TradingView. How high can it go in this market cycle?

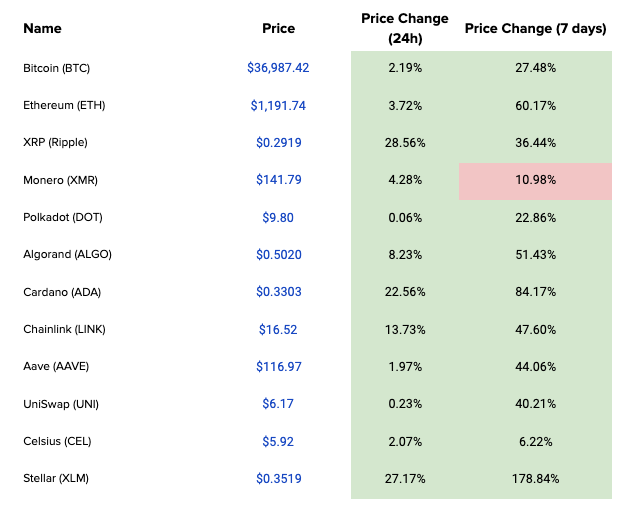

It’s not just Bitcoin driving this boom though – Cardano’s recent explosive growth has seen its market cap soar to over $10 billion for the first time, Ethereum continues to rise and still has some way to go before it hits its all-time high, and Stellar is up almost 180% over the past 7 days. Even XRP continues to rise, despite its legal issues in the US. The XRP community is strong – is it strong enough to resist the might of the SEC?

Speaking of regulators, in the UK, the FCA is also looking to start 2021 with a bang, flexing its new crypto powers this weekend. As Crypto AM: Talking Legal contributor Claude Brown, partner at Reed Smith LLP, explained, this Sunday could mark the end of the road for crypto-asset firms that failed to register with them last year. “As a result of the pandemic and the quality of registration applications received, the FCA introduced a temporary regime to allow those who had already registered with it before 16 December 2020 to carry on trading into 2021″, said Brown. “But those who did not must shut up shop and return client’s assets by this Sunday.” What impact will this have?

In the Markets

What bitcoin did yesterday

We closed yesterday, 5 January, 2020, at a price of $36,824.36 – up from $33,992.43 the day before. That’s the highest daily closing price in Bitcoin’s history.

The daily high yesterday was $36,879.70 and the daily low was $33,514.03. Those are both new highs.

This time last year, the price of bitcoin closed the day at $7,769.22 and in 2019 it was $4,076.63.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Market capitalisation

Bitcoin’s market capitalisation is currently $686,995,403,765 – up from $643,541,344,617 yesterday. To put that into context, Tesla’s market capitalisation is now $716.59 billion. Hopefully Bitcoin flips that soon so we can focus on Amazon – which currently has a market cap of $1.575 trillion. That wouldn’t even need Bitcoin to hit $100,000. Come on everyone, we can do it! Put Jeff in his place.

Bitcoin volume

The volume traded over the last 24 hours was $78,748,294,394. This is among the highest 24-hour trading volumes on record for Bitcoin. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 72.46%.

Fear and Greed Index

Unsurprisingly, the sentiment remains in Extreme Greed territory but has fallen to 91, down from 95 yesterday. That’s the lowest it’s been since 30 December, 2020. The last time the sentiment was not in Extreme Greed was 5 November, 2020.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.26. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 84.96. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

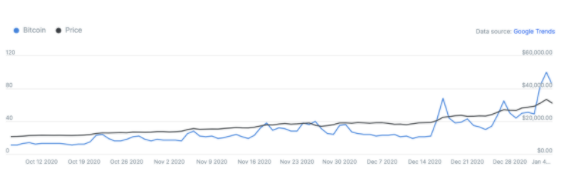

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 84 – taken from 4 January.

Convince your Nan: Soundbite of the day

Cash is a refuge from risk, but there is a price to pay. Would you sacrifice 98% of your opportunity to avoid the uncertainty of tomorrow? Volatility is Vitality. Bitcoin is Hope.

– Michael Saylor

What they said yesterday…

Quick reminder of just how far we’ve come…

A meme in the making

*Not investment advice

Crypto Twitter hates round numbers…

Crypto AM: Longer Reads

Crypto AM: In conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno