Bitcoin 2021 outlook and challenges in charts

2020 has been crucial for Bitcoin, we see it as the year of legitimisation for the broader public and investors, accelerated by the COVID crisis and the consequent rapid escalation of QE.

Our conversations with institutional clients have changed considerably over the course of 2020, what was typically a desire to speculatively invest has now become one of being fearful of extreme loose monetary policy and negative interest rates, with clients looking for an anchor for their investments. As understanding of bitcoin improves, clients have grasped that bitcoin has a limited supply and fulfils this role as an anchor for your assets while fiat is being debased.

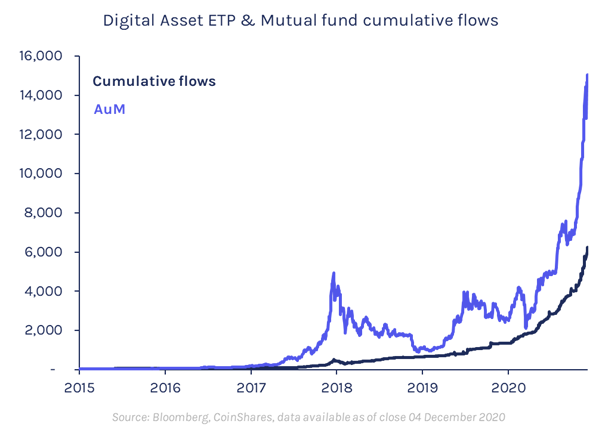

This year we have seen cumulative flows (stripping out the price effect) into digital asset investment products rise from US$1.35bn at the start of the year to US$6.1bn today, with only 24 days of outflows for a total of 241 trading days this year. Investors are buying and holding, a good indicator that it is slowly developing into a store of value.

Bitcoin remains a volatile asset, many expect a store of value to have much lower volatility, but as gold was developing into an investment store of value in the 1970s, it too had extremely high volatility. As it has matured as a store of value, so too has its volatility declined. We expect volatility in bitcoin to continue to decline over the course of 2021.

Bitcoin, gold & loose monetary policy

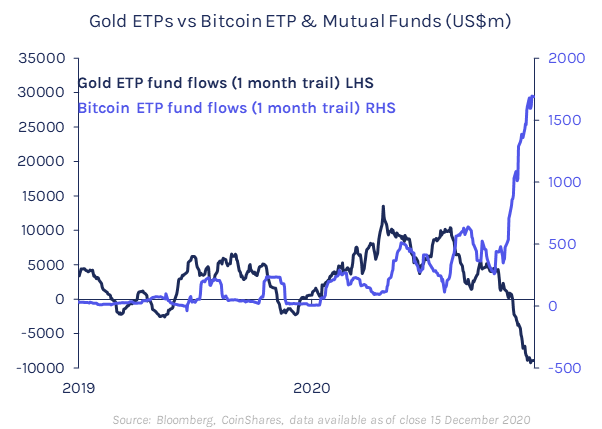

Until recently, bitcoin and gold fund flows had been following a similar path. Since the beginning of the year, a combination of loose monetary policy and a weak economy precipitated by COVID-19 led to fund inflows into both gold and bitcoin. However, following the news of a vaccine and consequent hopes of an improving economy, we have seen gold prices fall and gold fund outflows. Conversely, bitcoin prices have continued to rise alongside inflows of US$2.5bn over the last 9 weeks (see chart below).

We believe the increasing trend of legitimisation and corporate adoption are the likely reasons for bitcoin’s recent price rise. Some fund newsletters also suggest a trend of investors selling gold positions and diversifying their hedges by adding bitcoin.

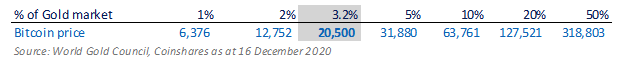

At present, bitcoin’s market capitalisation represents just 3.2% of gold’s. If it were to take further market share from gold, its price would increase commensurately. If bitcoin were to take 5%, we estimate, its price would equate to US$31,880 (as shown in the table below).

Rhetoric around government ban (unlikely)

The gold ban of the 1930s was quite unconstitutional and was a deeply political move – it was an attempt to prevent bank runs with huge penalties for hoarding it. The political risks for gold remain, one entails the dollar debasement pushing gold levels higher, and the other is gold being used as a governmental scapegoat for not fixing its paper-based money regime – a similar argument could be made for Bitcoin.

We think Bitcoin does have risks of being banned but is unlikely. It has been banned in China and India, although this hasn’t stopped it being used. China bitcoin volumes used to represent 18% of world volumes, it now represents 5%. We think it is much harder to completely eradicate due to its pseudonymous features – hence why we call it a non-sovereign store of value. But it could be effectively banned for any investor operating in a standard regulatory regime.

On balance, governments will more likely try to compete with Bitcoin by issuing their own Central Bank Digital Currencies as there is a larger risk of it becoming a widely used as black-market currency. Furthermore, banning Bitcoin will likely have far greater political consequences than it did in the 1930s as government/central bank profligacy is much more widely known than it was back then.

Bitcoin and Inflation

One could surmise that as an increasing number of the world population is vaccinated, so too will demand for goods and services recover while supply chains have been decimated, leading to potential supply bottle-necks. It is inconclusive that inflation will rise in 2021, little evidence in macro data suggests that it will. Nonetheless, it remains a tail risk.

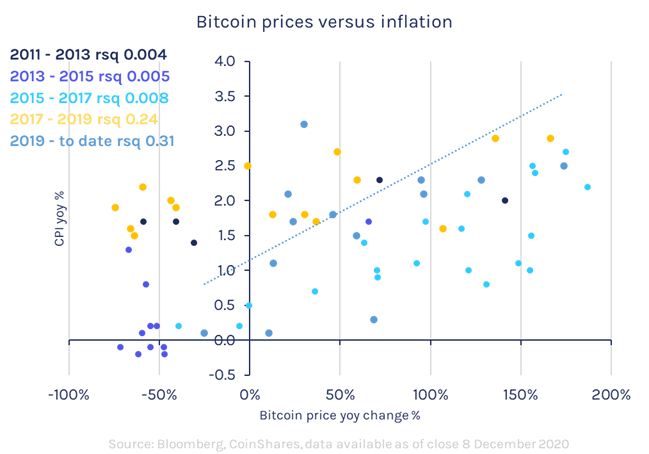

Unlike gold, Bitcoin has not been around long enough to endure a period of hyper-inflation to establish its credentials as a true inflationary hedge, but conceptually it makes sense that it is. Early observations suggest that bitcoin’s relationship with inflation since 2017 has been improving as it started being used as a store of value. Admittedly, 12 years isn’t enough data, but we are encouraged by the improving relationship.

Because of its characteristics (scarcity, liquidity, high uptime), evidence suggests investors are increasingly using it as a store of value, the very features that theoretically help protect from inflation and debasement of fiat money supply.

Bitcoin, Authoritarian Regimes & Negative Yields

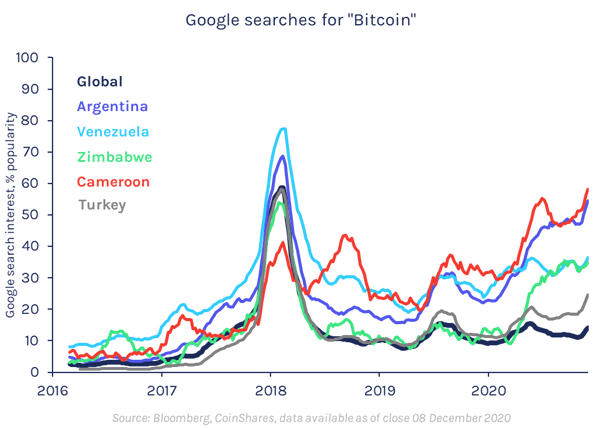

Global searches on Google for the phrase bitcoin highlighted that 2017 was the year that bitcoin entered the broader public consciousness. Since then, searches for bitcoin have declined and not really picked-up during this more recent rally. In economically weak and authoritarian regimes we have seen a rise in searches for bitcoin. Take Argentina as an example, where there has been a sharp decline in the Peso in recent years, there has also been a corresponding rise in searches for bitcoin.

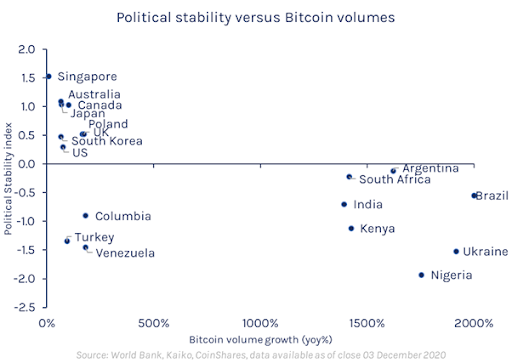

We believe this is due to individuals looking for a non-sovereign store of value that is easily accessible and provides an anchor relative to their native currency. The World Bank Political stability index versus bitcoin volume growth helps strengthen this theory.

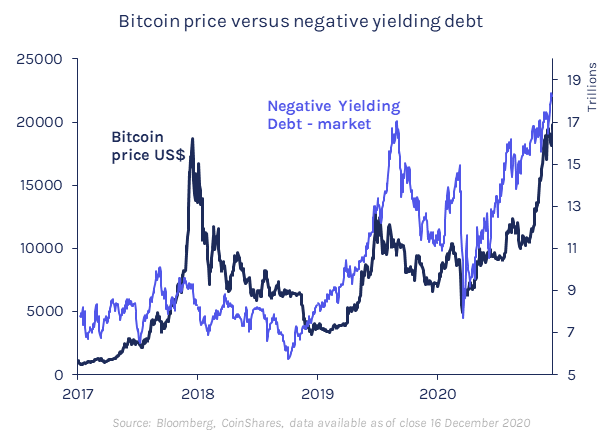

Political stability in the western world is better but there are other prompts for greater bitcoin adoption. The rapidly increasing pot of negative yielding debt increases the risk of negative yielding deposits in commercial banks, and in some cases negative yields already exist in deposits over a certain size. This coupled with the onset of COVID-19 (leading to a drastic reduction in the use of physical cash) makes it much easier for central banks to enforce negative yields on the ordinary person if they choose to.

We are witnessing an improving relationship between bitcoin prices and negative yielding debt. This will be an interesting trend to follow in 2021.

CBDCs will become a buzzword in 2021

The concept of Central Bank Digital Currencies or CBDCs as they are commonly known, have garnered considerable attention from central banks in the second half of 2020. We expect there to be increased hype and confusion in 2021 as the details on how they are structured is revealed.

It appears likely that more CBDCs will enter live testing in 2021. The European Central Bank is set to make a decision on whether to pursue the digital euro project in January. Here are some key considerations.

- CBDCs present an array of compelling merits, including the promise of near instantaneous payments and settlements, the eradication of black-market transactions, reductions in the costs of cash management and efficiency gains in accounting.

- They also present certain risks. Of these, privacy is perhaps the most pressing. CBDCs could potentially be programmed to control the spending of citizens, enforce negative yields on deposits and bail-ins, as well as to monitor spending and income in a way that is far more intrusive than we are accustomed to.

- While the momentum established in 2020 has been significant, we should not expect fully functional CBDCs to emerge for some years – certainly not in the western world. There are a plethora of questions still to be answered, including whether central banks will adopt a direct ‘core ledger’ with the central bank or use an existing wallet provider utilising Distributed Ledger Technology, how KYC (know your customer) and anti-money laundering checks will be carried out, and how to manage the risk of hollowing-out systemically important commercial banks.

- CBDCs are likely to become very large and therefore a scalable wallet infrastructure will be required, this could become a big theme in 2021 as central banks look for credible wallet providers.

Finally, we at CoinShares feel it is important to stress that CBDCs are not a candidate to replace bitcoin. The two are inherently different instruments, the latter being a distributed ledger, peer-to-peer system, with a predetermined monetary policy where the supply cannot be altered, which acts as an attractive non-sovereign store of value. CBDCs, on the other hand, look as though they will be designed to mirror their respective issuer’s fiat currency.

In summary, we believe 2021 will be a pivotal year for bitcoin, with much greater institutional investor and corporate adoption. We expect there to be much hype and confusion on the timing and implementation of CBDCs but ultimately CBDCs and bitcoin are very different. If bitcoin is viewed with a pair of gold spectacles, there is the potential for even further price rises on top of its meteoric rise in 2020.

James Butterfill has over 18 years of experience in fund management, economics and asset allocation gained most recently as an Investment Strategist at CoinShares. Previously James acted as Head of Research at ETF securities with prior experience as a multi-asset fund manager and investment strategist at Coutts & Co, HSBC & ING Barings.

Crypto AM: Technically Speaking in association with Zumo