Uber Bullish?

In range…

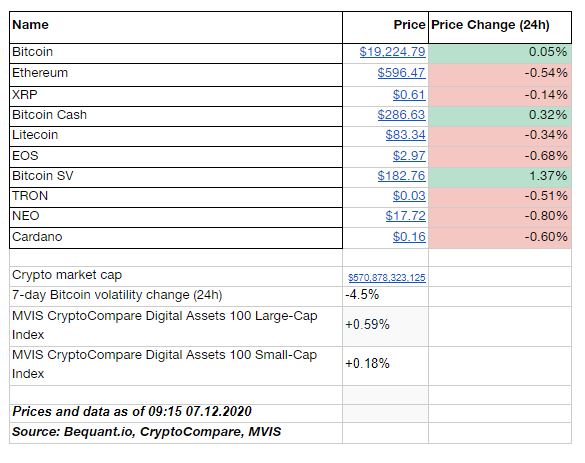

The market remained well within the recent range and given the persistent leverage interest as evidenced by the steep contango term structure and futures & options open interest (OI) near record highs, suggests further upside barring any unexpected developments.

The major risk associated with the “uber bullish” market is crowded trades and this is particularly evident when looking at the recent CME Commitment of Traders Report (COT).

In the Markets

Futures Growth

Leverage funds trading Bitcoin futures on the Chicago Mercantile Exchange (CME) continue adding to their short positions. As a guide, leveraged funds represent 62% of the total OI on CME’s bitcoin futures market. There is a simple explanation for this and that is basis trading, encouraged by over extended steep term structure.

The CME is on the 3rd place after Binance and OKEx, for its total contribution to total OI and it is likely that the CME will only gain ground as more traditional market participants enter the marketplace and facilitate cheaper access to capital.

Also, the trend of using stablecoin margined products, as opposed to Bitcoin margined products, remains very much intact and is also expected to gather further momentum.

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: A Trader’s View withTMG

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on The Universal Protocol Alliance