Crypto Extreme

Macro Trends

Narratives and broader macro trends can push valuations and multiples to extremes (too high or too low), even if the underlying fundamentals tell a different story.

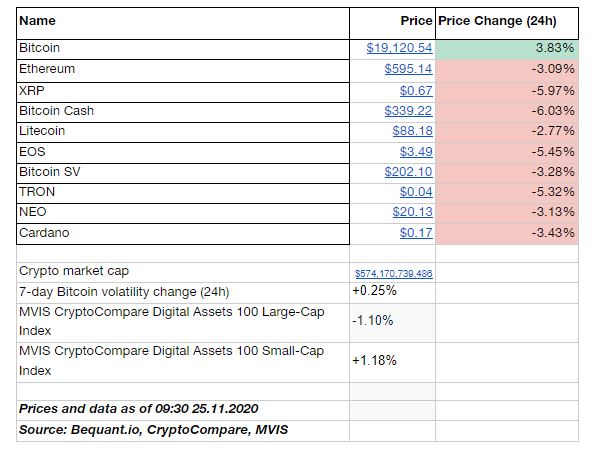

On that note, the Dow reached record highs amid what John Hussman of Hussman Funds described as capitulation in the face of overwhelming liquidity. With that in mind, Bitcoin continued to power on higher and the relentless trend will likely see the largest digital asset by market capitalization top the key $20,000 any moment now.

At the same time, gold continued to trade softer and the much-prized correlation is now nowhere to be seen. As a reminder, not long-ago analysts at Deutsche Bank pointed out Bitcoin’s increasing demand to use Bitcoin where gold was used to hedge dollar risk, inflation and other things.

In the Markets

Steady CeFi

As Bitcoin continues its steady advance to a new all-time high, something that the crypto community is seemingly overlooking is that if one goes by the narrative that the rally is largely driven by professional asset managers, this means that Bitcoin will play a more active part in portfolio construction, going forward.

The implications for Bitcoin and its once cherished non-correlated asset appeal are unclear but it makes sense that if more institutions hold it, the more likely it will become correlated to traditional assets. If Bitcoin loses this non-correlated appeal altogether, is there another segment of the digital asset ecosystem that can replace it?

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM shines its Spotlight on ByteTree Asset Management