Londoners pay ‘astonishing’ 30 per cent of UK’s capital gains tax

Londoners pay nearly 30 per cent of the UK’s capital gains tax, with taxpayers in Kensington and Chelsea forking out the most, according to a new study.

The research published this morning showed that London accounts for 29 per cent of the tax, despite being home to just 13 per cent of the UK’s population.

Londoners paid £2.5bn last year, up 24 per cent from the previous year, while the total paid in the UK was £8.8bn, the analysis by private equity firm Growthdeck found.

The London borough of Kensington & Chelsea is the UK’s hotspot, with residents paying £516m last year – six per cent of the bill – despite housing just 0.2 per cent of the country’s population.

Westminster and Mayfair were the second highest taxed areas, paying £348m.

The wealthy London areas, home to affluent neighbourhoods including Knightsbrige, Holland Park and Belgravia, are likely to have made large capital gains by selling high-value assets such as second homes and shares.

Outside of the capital and the south east, the bill was in East Cheshire, including Alderly Edge, Wilmslow and Prestbury, which is home to many Premier League footballers.

Growthdeck recommended that taxpayers can defer paying the bill be re-investing the capital gain in a business that qualifies for tax relief under the government’s Enterprise Investment Scheme.

Gary Robins, head of business development at Growthdeck, said: “For over £500m of capital gains tax to be paid a year in Kensington & Chelsea is astonishing. That’s less than five square miles of central London.”

“The government’s take from capital gains tax rises virtually every year, and it’s taxpayers in London that are carrying a huge amount of that burden.”

“More taxpayers should look into whether EIS investment might be a sensible way for them to defer enormous capital gains tax bills, as well as saving on income tax and inheritance tax.”

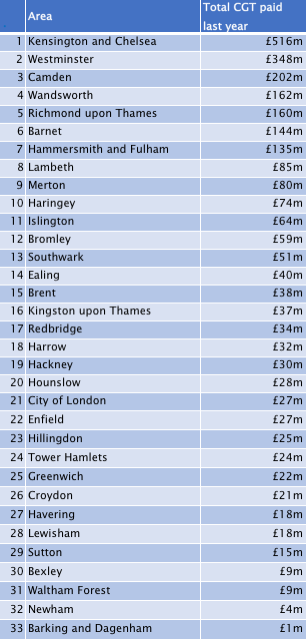

Which London boroughs paid the most capital gains tax last year?