Billionaires buy Bitcoin

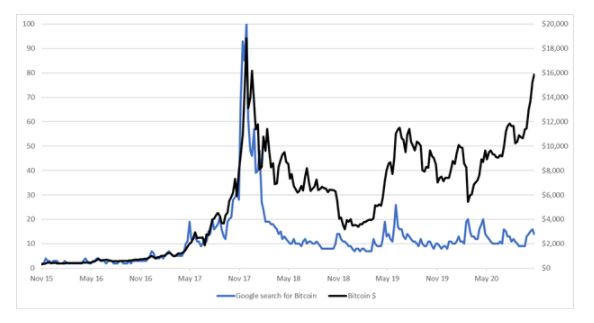

We are seeing an almighty squeeze in the Bitcoin price. There is a tsunami of buying power up against reluctant sellers. These buyers are putting real money behind Bitcoin, not the old dribs and drabs normally seen from retail investors. The world’s billionaires are scrambling aboard and the numbers prove it. In 2017, there was a frenzy, driven by retail investors. Google searches for Bitcoin exploded, and price with it. Yet today, Google searches are 86% lower than at the peak, yet the price is within a whisker.

Bitcoin price surges without the hype

Source Bloomberg, Google: Bitcoin price $ and Google “Bitcoin” search since 2015

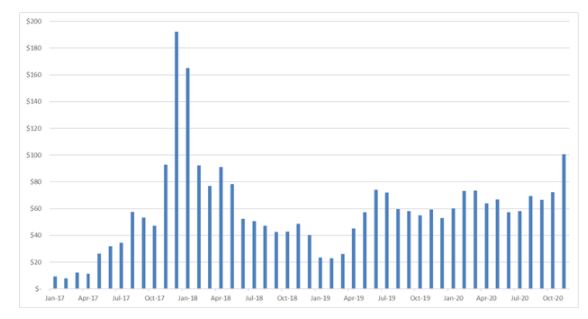

This recent strength is neither a bubble nor a frenzy; it is backed by real money. Back in 2017, the network grew too quickly. There was $9 billion of transaction traffic in January growing to $192 billion by the year end. Too much, too soon for sure. The network has since readjusted, and traffic has settled down to $60 billion (on average) over the past 18 months. This has been building over the summer, and ByteTree data forecasts $100 billion of Bitcoin network transaction value traffic for this month.

Network traffic back on the rise

Source ByteTree.com: monthly transaction value on the Bitcoin network since 2017

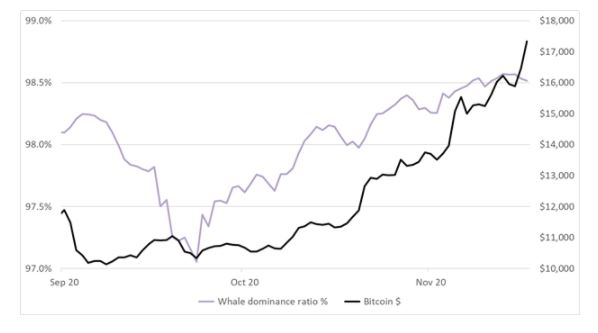

Interestingly, that higher network demand doesn’t come through in the number of transactions, which has remained fairly stable around 2.1 million per week. That means recent transactions have been larger. Obvious you might say, given the higher price, but that would inflate all transactions. ByteTree data shows how the whale dominance has risen. This tells us that the largest transaction quintile by value, is rising relative to the lower four quintiles. The implication is that big money is entering the network, which is bullish.

Whale dominance drives the price higher

Source ByteTree.com: Bitcoin price $ and the ByteTree Whale Dominance ratio. Largest transaction value quintile relative to the lower four quintiles. Since September 2020.

The network is growing again. More on-chain activity is being driven by the big money, but it’s not just the billionaires driving the price higher. The funds open to the public, outside the UK at least, are growing rapidly. The Grayscale Bitcoin Trust (GBTC) is valued at a whopping $10.8 billion, but trades at a 20% premium to net asset value. The European Exchange Traded Products (ETPs) are listed in Germany, Switzerland and Sweden and trade at par. They are smaller than Grayscale but growing rapidly as seen by the increasing number of shares outstanding.

Bitcoin growing over the exchange

Source Bloomberg: Bitcoin funds shares outstanding since August 2020

I suspect these funds will see significant growth from here. I keep hearing how complex and risky it is to buy Bitcoin, and these funds solve the problem. Especially since most people have their liquid wealth tied up in their retirement plans.

Macro developments

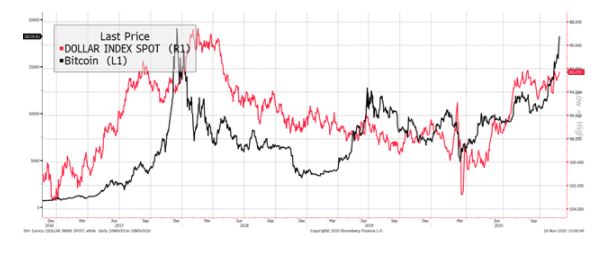

With the US election behind us, or at least I think it’s behind us, the markets have gone back to Covid-19, vaccines and stimulus. The US dollar made a low in early September, which is being challenged as we speak. Looking at the past four years, Bitcoin has tended to perform best when the dollar has fallen (shown inverted).

A weak dollar is a tailwind

Source Bloomberg: Bitcoin $ and the US Dollar Index inverted (DXY) since 2016

It’s a simple relationship that is similar for gold and commodities in general. Many assets love a weak dollar and it goes much further than the simple translation. The dollar rose 16% from the low in early 2018 to the peak in March 2020. That translated into a 75% fall for Bitcoin. In contrast, since the March high for the dollar, it has fallen 10%, while Bitcoin has rallied 250%. Bitcoin is new gold on crack.

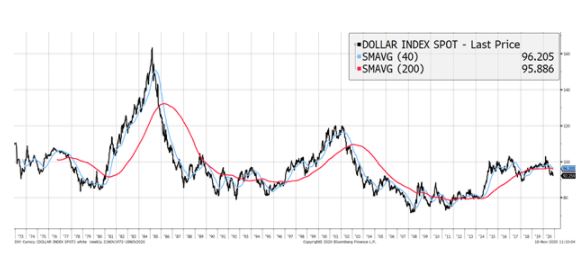

Looking longer-term, the Dollar Index has turned south. The 200 and 40 week moving averages have turned negative (gradient) and a death cross is imminent. Bitcoin is too young to have seen a decent dollar bear market and has thrived despite that. Now imagine what happens when the dollar really does start sinking.

A dollar bear market is inevitable

Source Bloomberg: US Dollar Index (DXY) with 40 and 200 week simple moving averages since 1973.

Charlie Morris, CIO of ByteTree

Twitter @AtlasPulse

LinkedIn http://linkedin.com/in/charlie-morris-1610b22

Website https://bytetree.com

Crypto AM: Technically Speaking in association with Zumo