Bitcoin surpasses $16,000 as $30 million of BTC move after being dormant for a decade

This week CryptoCompare data shows the price of Bitcoin (BTC) moved from around $15,800 to a $15,000 low. Bounce off on the support, the flagship cryptocurrency moved to a $16,300 high in the middle of the week. After a short correction, it moved back up, and is now trading close to the $16,300 mark again.

Ether (ETH), the second-largest cryptocurrency by market capitalization, moved in a similar pattern, starting the week close to $460 before dropping to $440, a mark from which it bounced off of. Ether hit a $475 high before dropping and is now at $455.

Headlines this week were dominated by bitcoin’s price rise above $16,000 as the cryptocurrency gets closer to its all-time high near $20,000, seen in December 2017. As the price of the cryptocurrency rises, more and more BTC that had been dormant since 2010 has been moving.

This week a total of $30 million worth of BTC moved across a series of transactions, and their destination is unknown. The move marked the fourth time BTC from the so-called Satoshi-era moved. The funds were moved from wallets containing 50 BTC each, which means they came from a miner who found blocks back in 2010, as the reward for finding a BTC block back then was 50 coins per block.

While most of the BTC went to unknown wallets, in previous movements funds 9.99 BTC were donated to the Free Software Foundation (FSF), while another 9.,99 went to the American Institute for Economic Research (AIER).

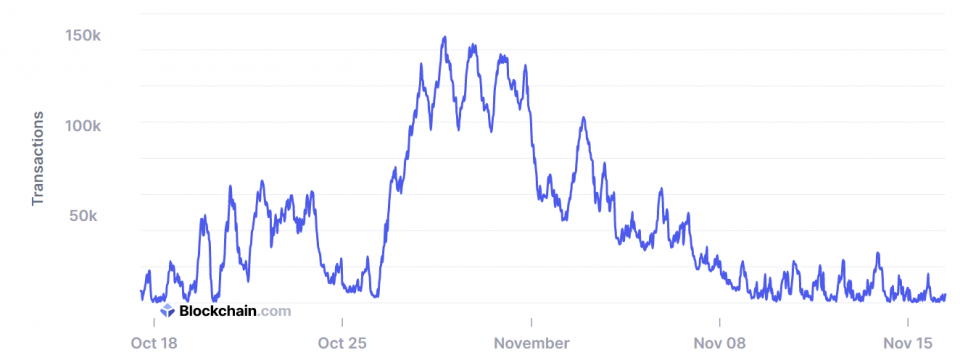

Despite the large movements and growing price, the number of unconfirmed transactions on the Bitcoin blockchain has essentially been cleared to little over 1,000 transactions this week, after the computing power on the flagship cryptocurrency’s network jumped by 19.6%.

The increased computing power – hashrate- helped reduce the time required to find blocks on the network, from the 10-minute average to 7.7 minutes. Each block on the BTC network has a limited amount of space in which BTC transactions are included, which means transactions that aren’t included remain unconfirmed.

Blockchain.com data shows that earlier this month 127,000 transactions were unconfirmed, while now there are less than 5,000 transactions waiting to be included in blocks.

Block times are expected to go back to their normal 10-minute average after bitcoin’s mining difficulty is adjusted in response to the growing computing power on the network, which likely came thanks to environmental factors in China, where most of the hashrate is located, and to the growing price of BTC, which likely made old mining machines profitable again.

As the price of BTC rises institutional investors may be eyeing it as an alternative to gold as Grayscale’s Bitcoin Trust (GBTC) saw cumulative inflows through October, while gold exchange-traded funds (ETFs) saw “most outflows” since mid-October.

According to analysts at JPMorgan, the contrast seen between GBTC’s inflows and gold ETF outflows “lends support to the idea that some investors that previously invested in gold ETFs such as family offices, may be looking at bitcoin as an alternative to gold.”

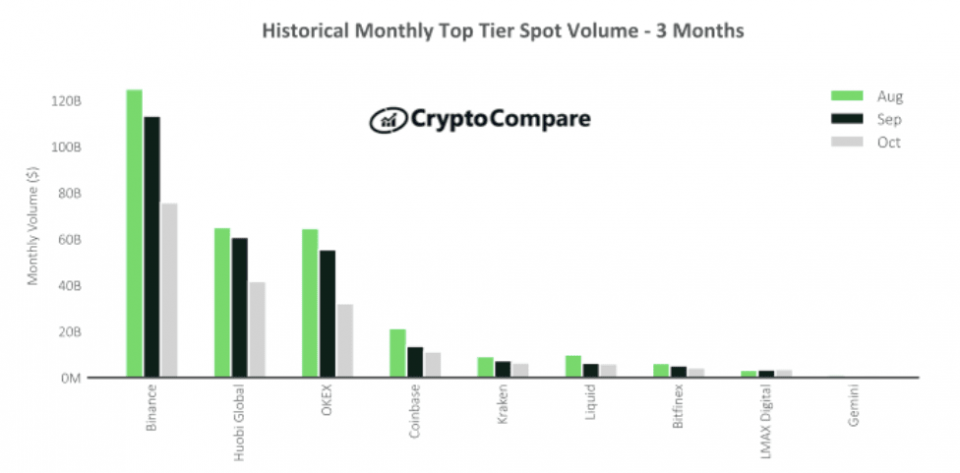

Despite the increasing interest from institutional investors, data shows top-tier cryptocurrency trading platforms saw their trading volumes plunge last month, even though they set a daily trading volume record for the year back in September.

According to CryptoCompare’s October 2020 Exchange Review, Top-Tier cryptocurrency exchanges, defined by the firm’s Exchange Benchmark, saw larges decreases in monthly spot trading volumes in October, with some top platform losing as much as 40% of their trading volume.

The top three Top-Tier exchanges, Binance, Huobi, and OKEx, out of the top 15 Top-Tier trading platforms they represented 77% of the volume last month, down from 82% in September.

Nearly 100,000 ETH Deposited Into ETH 2.0 Contract

Data from the Ethereum blockchain shows that over 95,200 ether has been deposited into the deposit contract of Phase 0 of Ethereum’s 2.0 upgrade, which developers claim will help scale the second-largest cryptocurrency’s blockchain and reduce energy consumption, by introducing shard chains and implementing a Proof-of-Stake (PoS) consensus algorithm.

The transition into ETH 2.0 is set to occur over a series of phases, with the first one starting early next month if enough ether is staked into the contract. Users have to move at least 32 ETH to run a validator node on the blockchain and earn rewards for securing it.

Ethereum co-founder Vitalik Buterin moved 3,2000 ETH to the contract. Per the Ethereum Foundation’s Danny Ryan, over 500,000 ETH is necessary to trigger the genesis of ERH 2.0, as “there must be at least 16,384 32 ETH validator deposits 7 days prior to December 1. If the threshold isn’t met, genesis “will be triggered 7 days after” it is met.

Crypto AM: Market View in association with Ziglu