Staying and Beyond

Softer Touch

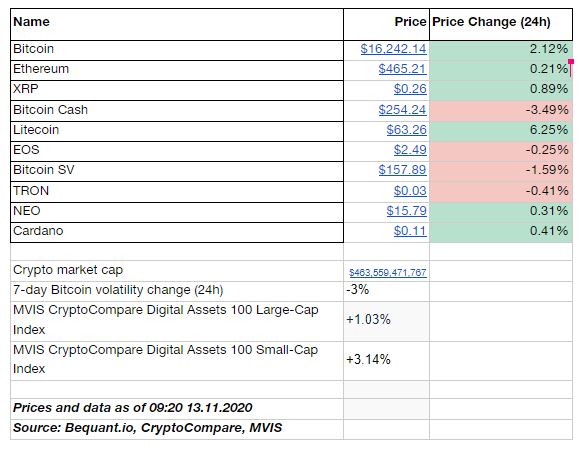

Bitcoin traded a touch softer over the weekend but well within the recent highs and the price action early doors Monday pointed to another attempt to test higher levels. Similarly, Ethereum also dipped over the weekend just ahead of the key $500 mark, with the $477 zone showing some resistance.

As noted recently, the aggregate open interest (OI) continues to rise and there are several key factors to point out. The OI on the regulated venue, the CME, is not lagging its peers and this is a very important factor to consider.

In the Markets

Margining Ahead

In addition, the outperformance is led by venues that provide stablecoin margined futures as opposed to Bitcoin margined products. As a result, the market is in a much healthier condition than it would have been if the said movement into stablecoin margin products did not happen. This leads to belief that higher levels will be achieved with much less strain on the market.

Something to bear in mind is that a similar trend can easily emerge across alts that are offered through derivatives structures by various venues. This will bring more stability and avoid amplification of downside movement.

Bitcoin Cash Bursts

Of note, the Bitcoin Cash network, a result of a hard fork from Bitcoin, has split into two new blockchains.

Based on data from Coin.Dance, Bitcoin Cash ABC (BCH ABC) has received no hashpower, meaning that it is possible Bitcoin Cash Node (BCHN) will become the dominant software of the Bitcoin Cash network.

Crypto AM Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Inside Blockchain with Troy Norcross

Crypto AM: Definitively DeFi

Crypto AM shines its Spotlight on CyberFi