Building business resilience for a better future

The standout figure from EY’s latest profit warning analysis is the 34% of companies that have issued a profit warning in the first nine months of 2020. That’s over a third of companies that have materially downgraded their earnings forecasts at least once, compared with 23% in the whole of 2001 and 18% in 2008.

Many of 2020’s profit warnings were unavoidable. Being unable to operate due to a sudden pandemic-driven lockdown isn’t a forecasting or operational failure. It isn’t something that companies could have easily predicted or mitigated against. But companies can and must act now to reshape their business to these new realities. Businesses with resilience and agility will be in the best position to survive short-term shocks and thrive during long periods of uncertainty.

The pandemic is an exceptional event, but it’s not a short-term or isolated challenge. If we look back at 2019, companies were already issuing profit warnings at 2008-like levels. The economy was growing, but companies were struggling to adapt to challenges on multiple horizons. As well as Brexit and wider geopolitical uncertainty, deep structural changes were occurring across many sectors, driven by technology and changing attitudes and behaviour.

Read more: COVID-19 has changed investors’ priorities but UK attractiveness remains resilient

These pressures haven’t disappeared. In many cases the pandemic has accelerated trends and its challenges have converged with existing issues. Changing COVID-19 restrictions, Brexit uncertainty and changing patterns of consumer demand are combining to present an immense planning and forecasting challenge. Many companies are facing cashflow pressures from increased operating costs and the unwinding of government support whilst also facing the need to build inventory ahead of Brexit.

Read more: Brexit: No-regrets actions before the end of the transition period

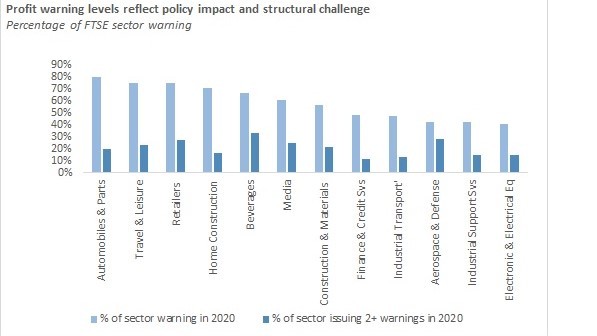

If we look at the sectors with the highest number of warnings – and the highest level of multiple profit warnings – we see that they include sectors hit hardest by the pandemic and COVID-19 restrictions, but also those sectors that were already struggling with high fixed costs, overcapacity and disruptive entrants.

It would be a mistake, however, to just focus on the most distressed companies or sectors. Even companies that were essentially sound just before the pandemic have been forced to rethink their business models and make tough choices. Moreover, as many CEOs have noted in recent months, their companies are also only as strong as the weakest supply chain link.

Which is why I feel there has never been a greater imperative for companies to build resilience to shocks and the agility to meet the growing challenges of uncertainty and rapid change. To do this, they need the information and ability to take and enact decisions at speed. Many companies will need to rethink their operating models and cost bases and take difficult decisions around where and how to deploy their capital.

Read more: COVID-19, the perfect storm for women: Work, trade and immigration

As economies and societies reshape, so must business, whilst keeping a clear understanding of their core purpose and their position in society. The UK economy was increasingly policy-driven before the pandemic, but COVID-19 has significantly amplified government influence and policy is often the difference between the companies that thrive, survive or muddle through – something we’ll be exploring in more detail in the coming weeks.

To find out more about our profit warning data and 20 years of EY analysis, visit: ey.com/warnings