Scrapping the VAT refund for tourists would be catastrophic for the UK economy

Retail, hospitality and tourism are three of the sectors that have been hardest hit by Covid-19 and the ongoing lockdown restrictions.

Employing close to six million people, job losses in these sectors are expected to be devastating.

The government should be doing all it can to support these businesses at this critical time. Instead, it appears to be doing the opposite.

In a short-sighted move to claw back tax revenue, the Treasury has announced it will remove the VAT Retail Export Scheme incentive for international visitors looking to shop in the UK. This tax break enabled tourists to either avoid or claim a rebate on UK VAT on goods purchased here.

The consequences of this move, for retail and for the wider UK tourism sector, could be devastating, risking millions of jobs across the country unnecessarily.

It might sound hyperbolic to connect the VAT incentive to Britain’s tourism offering, but the fact is the retail industry is a real draw for international visitors. Statistics from Visit Britain show that 54 per cent of visitors to the UK in 2017 went shopping while here — the second most popular activity for tourists behind dining in restaurants.

Indeed, HMRC itself acknowledged in 2013 that “the VAT Retail Export Scheme — otherwise known as Tax Free Shopping — plays a key part in the shopping experience for our visitors and positively influences their views on Britain as a value for money shopping destination”.

It is obvious that if the UK has a less competitive system than countries like Italy and France, that will inevitably be a factor when people decide where to shop on holiday. And there is evidence from recent history that those international shoppers are highly price sensitive. Following the depreciation of the pound by 15–18 per cent after the EU referendum, the value of tax-free shopping sales in the UK rose year-on-year by 36 per cent in July 2016, 28 per cent in August 2016 and 43 per cent in September 2016.

But we don’t need to rely on models or past examples — tourists are already adapting their plans and deciding against visiting the UK in 2021.

Tour companies are changing their bookings for next year in part because of the expected increase in tax. Companies with multiple European locations are seeing tour operators cancel London bookings and signing up for trips to Paris and Milan instead. Surely, we want London to be able to compete with those cities?

And it’s not just the capital that will be hit hard either — all the UK’s regions will be directly impacted by this change. In 2019 Edinburgh, Manchester, Liverpool and Leeds saw a combined £202m in direct retail sales using the incentive. Nor is this simply about where products are sold, but also where they are made: if sales of quintessentially British products fall away, regional manufacturing and production will be impacted on a colossal scale.

No wonder, then, that the tax change has received an overwhelmingly negative response from a wide range of businesses. All the available evidence from the private sector makes clear that this decision will cause a significant reduction in affluent international tourists to the UK, who contribute millions of pounds to the British economy every year.

This is not a case of businesses asking for a hand-out. Instead, we are simply asking the Treasury to reconsider — especially given the current economic landscape. The UK’s retail and hospitality sectors are already grappling with a perfect storm of Covid restrictions and Brexit uncertainty.

The decision to remove tax-free shopping has come at the worst possible time — and will have long-term and far-reaching consequences.

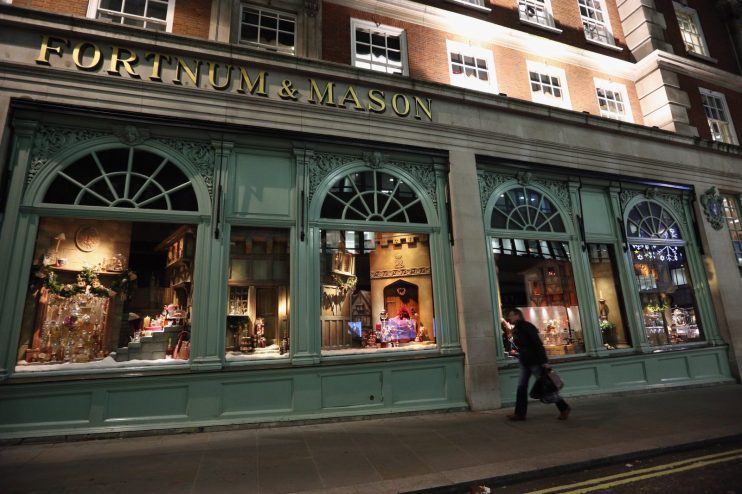

Main image credit: Getty