Crypto ETP volumes plunge while demand for stablecoins keeps growing

This week CryptoCompare data shows the price of Bitcoin (BTC) moved from around $10,700 to a $10,250 low before moving sharply up to test the $11,000 mark. A breakout above $11,000 failed and BTC is currently trading around $10,850.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week around $360 and just like bitcoin dropped, to $320. Ether has since recovered to trade at around $357 at press time as the decentralized finance trend keeps growing.

The market capitalization of stablecoins in the cryptocurrency space has been growing rapidly. So much so that last week Tether’s USDT went past $15 billion, and now the total market cap of stablecoins in general – including the Centre Consortium’s USDC, Binance’s BUSD, Gemini’s GUSD, Paxos’ PAX, and Maker’s DAI – is now above $20 billion.

Demand for stablecoins has been on the rise thanks to the yield farming trend on the decentralized finance (DeFi) space. Yield farming – or liquidity mining – involves investors locking up tokens in DeFi protocols to earn rewards in the platforms’ governance tokens. Adding these to the APY from lending and borrowing, and often returns can be of over 100% per year. To combat volatility, stablecoins are used.

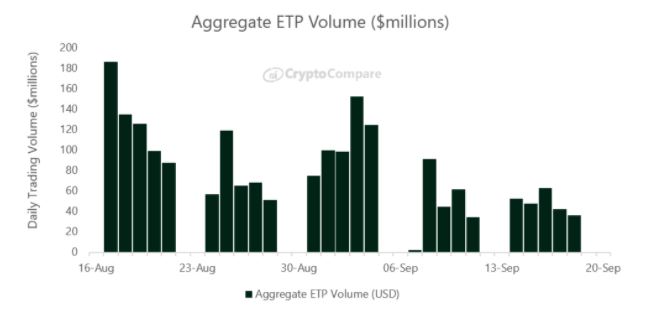

While demand for these cryptocurrencies, pegged 1:1 to the value of the U.S. dollar, is going up, cryptocurrency exchange-traded product (ETP) trading volumes have plunged over 74% in the last month, as the prices of these products have also been dropping.

According to data from cryptoasset data aggregator CryptoCompare in its Digital Asset Management Review, exchange-traded product volumes plunged from $186.5 million in mid-August to an average of $48 million in mid-September.

The document notes that Grayscale’s Bitcoin Trust product, GBTC, represented the “vast majority” of ETP volume and as such accounts for most of the decrease in trading activity. Excluding over-the-counter products, like GBTC, ETHE and ETCG – all Grayscale products – the largest crypto ETP by trading volume was ETCGroup’s Bitcoin ETP (BTCE), which traded on Deutsche Boerse XETRA.

Grayscale’s BTC and ETH products represented the largest average daily trading volumes at $49 million and $7.4 million respectively. These experienced significant losses, dropping 20.4% and 43.4% respectively.

This week it was also announced that regulated Brazilian fund manager Hashdex partnered with Nasdaq to launch the world’s first cryptocurrency exchange-traded fund (ETF) on the Bermuda Stock Exchange (BSX). The ETF, dubbed the Hashdex Nasdaq Crypto Index ETF, will track the prices of a crypto index developed by Nasdaq and Hashdex.

In other news, the number of Bitcoin ATMs throughout the world – physical machines that let people buy and sell cryptocurrencies – has surpassed 10,000. The first Bitcoin ATM was installed in Vancouver, Canada in 2013 and it took the industry 3.5 years to get to 1,000 ATMs, and another 3.5 years to get to 10,000 ATMs.

Crypto Exchange KuCoin Hacked for $150 Million

Singapore-based cryptocurrency exchange KuCoin suffered a major security breach over the weekend that saw hackers breach its hot wallet and steal over $150 million worth of cryptocurrencies, including bitcoin, ether, and various Ethereum network tokens.

In a live steam the CEO of KuCoin Global Johnny Lyu revealed the funds represented a small portion of the exchange’s total cryptoasset holdings, as its cold wallets – those not connected to the internet – were not affected in any way.

The exchange has reached out to numerous other cryptoasset trading platforms, including Binance, Huobi, OKEx, Bybit, and Upbit, for them to block the addresses associated with the theft to stop the hackers from laundering the funds. It’s also in contact with “international law enforcement,” and offering “rewards of up to $100,000 to those who can provide valid information to us regarding this incident.”

In other crypto exchange news, Russia’s telecom regulator Roskomnadozr blacklisted the website of leading cryptocurrency trading platform Binance. The website appears to have been blacklisted earlier this year, but access to it hasn’t been affected in any way. Russian users do not have to use A VPN or mirror websites to access the exchange.

In its announcement, Binance detailed it was not “previously notified of any claims by law enforcement agencies, civil government services, or courts” before being notified by the telecom regulator last week.

Crypto AM: Market View in association with Ziglu