Welcome to DeFI Kitchen – eating in or takeaway?

What is on the menu? All dishes are very tasty and come fresh straight from the Farm. You will have to choose depending on your flavour – we have delicious PorkChop (CHOP), Spaghetti (PASTA) is still on our menu, unfortunately we had to dump our last HOTDOG and PIZZA. Alternatively, you can swap to Asian menu and try our chef’s Justin’s new special grilled SALMON or enjoy our mouth-watering SUSHI, NOODLEs or tasty KIMCHI.

Ok great, do you have wifi? – Sure, we have regular YFI, alternative YFII, and YFIB for business. DeFi kitchen is doing everything to ensure 1,000,000 per cent of our guest satisfaction.

You might find yourself puzzled while reading – “What does this have to do with DeFi?”

The DeFi space is filling up with emoji meme yield farming hysteria. New projects are being ‘printed’ every single day, promising unseen and insane returns to those who are farming and becoming ‘vampires’ that are sucking out the liquidity from other well established protocols like Uniswap.

What is Yield Farming?

Yield farming in essence is a way to try to maximise the rate of return on capital by leveraging different DeFi protocols. Yield farmers are chasing the highest yield by switching multiple different strategies. The most profitable strategies usually involve a few DeFi protocols like Compound (COMP), Curve (CRV), Synthetix (SNX), Balancer (BAL) or Uniswap. If the initial strategy doesn’t work anymore or there is better ‘Farm’ around, farmers can move their funds around between protocols that are generating more yield. This is called ‘crop rotation’. The goal is to park your funds with the protocol that offers the highest Annualised Percentage Yield (APY). If you would go check APY for traditional savings accounts, typically you will see numbers anywhere between 0.01 per cent to 3 per cent APY (which is unheard of in traditional finance). Not in DeFi farmland. Yield farming returns can be as high as 100 per cent and some of the protocols claim to offer over a million percent APY. Yes, you’ve read that correctly – 1,000,000 per cent APY.

But how is this possible? There are three main components, and the first is liquidity mining. It is the process of distributing tokens to the users of the protocol and rewarding those who provide liquidity to the pool. This provides additional incentives to the farmers that is added on top of the yield that is already generated using specific protocols. These incentives sometimes are so strong that some farmers are willing to lose their initial capital just to harvest more distributed tokens. The catalyst for a wider spread of yield farming was the Compound (COMP) protocol, which offered higher rewards in COMP tokens for those who were borrowing assets with the highest APY.

The second component is leverage, which is using borrowed funds to increase the potential return on investment. In the yield farming world, farmers can deposit their coins as collateral and borrow other coins. Then they can use borrowed coins as further collateral and borrow even more coins. By repeating the cycle farmers can leverage their initial capital by several X and maximise the return on their capital.

Last but not least, the third component is risk. Farmers are often willing to take high risk just to harvest as much ‘crops’ as they can. If the collateralization level drops below a certain threshold, there is a risk of liquidation. A lot of farming protocols are often not audited, full of smart contract bugs, and often a target for attacks on draining liquidity pools that would lead to the loss of all of your capital.

Combining these three elements, farmers are able to harvest hundreds and thousands of dollars in just a matter of minutes or hours. The majority of new ‘vampire’ protocols are offering hard to grasp seven figure APYs by incentivising users to stake their liquidity provider tokens. They represent participation in a liquidity pool, so that they can provide ‘crops’ in their own native token.

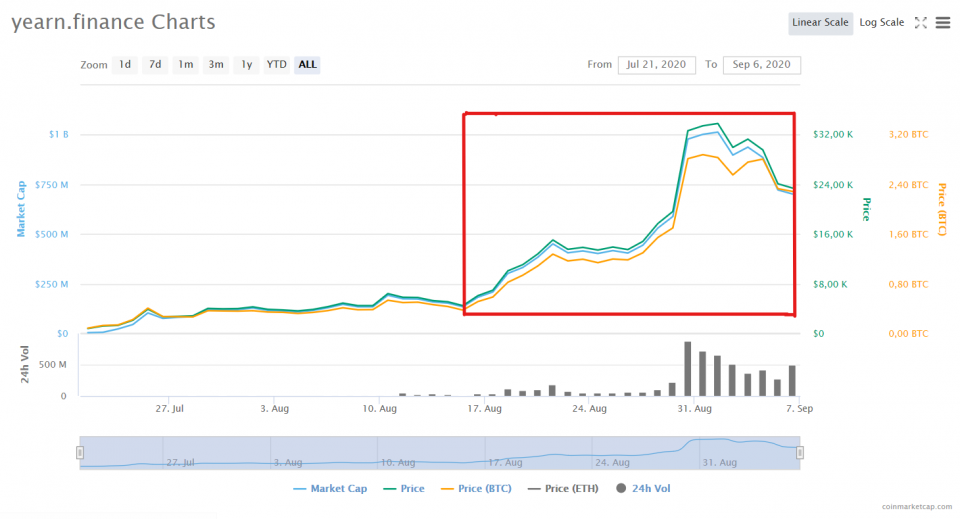

$30 to $30,000 YFI Craze

YFI is a governance token for yearn.finace created by a software developer Andre Cronje. Some say that he helped DeFi to grow into a multi-billion dollar industry. Andre spent his personal funds to bootstrap his yield maximizing protocol, the community has rallied around YFI, raising its valuation from nothing to $1 billion in less than 2 months. The price of the token grew to 4000 within a month and then skyrocketed to $35,000+ in just a matter of a few weeks surpassing the All Time High (ATH) price of Bitcoin.

After this unseen success, other similar protocols started to arise. For example yfibusiness.finance (YFIB). YFIB is a DeFi farmland that yields ‘crops’ on the capital that you stake. The returns, just like in other similar protocols, vary from one protocol to the next. Project is set to automate & optimize staking such that you can earn maximum return on your capital without having to worry about circumstances. With a scarce supply of minted 30,000 tokens, $YFIB is aiming to mirror the success of YFI. Who knows what the DeFi kitchen will serve as the next main course.

Back In July of 2007, the former CEO of Citigroup, Chuck Prince, said this about the subprime lending markets:

When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.

As always, remember that quality information is what will make you the most gains in this rapidly changing market. If you want to get into DeFi, invest your time, and you will get rewarded. And never forget, Do Your Own Research (DYOR) and take responsibility for your actions, then there will be nobody else to blame.

DeFi Insiders MSH are a group of experts working in the heart of the movement. This is a live reflection of what is happening on a day to day basis. Nothing written in this article constitutes financial advice and does not reflect either the views of City AM or those of Crypto AM.