Investors crave knowledge – but where do they find it?

A majority of investors want enough knowledge to make their own decisions – or to challenge the decisions made by their financial adviser. But they differ on where they look for this information.

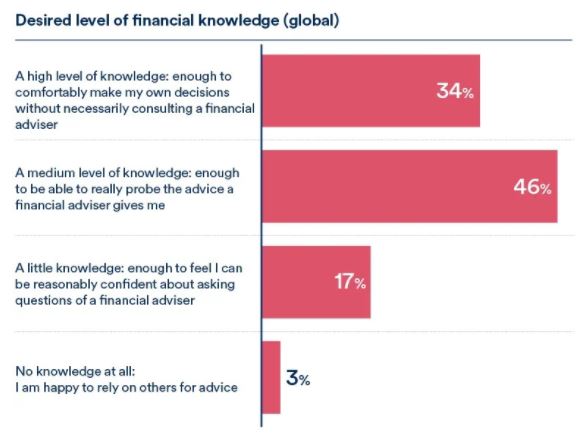

An overwhelming 97% of investors want some level of personal finance knowledge, according to the latest issue of Schroders’ Global Investor Study, a landmark annual survey of more than 23,000 investors from around the world.

One third want significant knowledge – enough knowledge to be able to invest without necessarily seeking professional help. A further half want at least enough knowledge to verify or “probe” the advice they’re given. Just 3% say they are happy with no knowledge whatever, and are prepared to trust fully to others’ guidance.

These latest findings come at a time of extreme market turbulence brought on by Covid-19 and its aftermath. The survey was conducted across 32 worldwide locations between 30 April and 15 June 2020, a period following steep falls in global markets. The crisis appeared to focus investors’ minds on their personal finances, with almost half (49%) saying they thought about their investments at least weekly (up from 35% before the crisis).

Discover more:

– Learn: Market shock: how did investors react to the impact of Covid-19?

– Read: Investors expect even higher returns from the stock market in years ahead – despite coronavirus shock

– Visit: Schroders’ Global Investor Study home page to find out more

Desired level of financial knowledge?

Sheila Nicoll, Head of Public Policy at Schroders, says: “What we’re seeing is a snapshot of the high value that investors place on knowledge about money. They want the information not necessarily to be able to manage their investments themselves, but to make them feel more comfortable when they talk to advisers and providers. That’s very revealing.”

Sheila, whose background includes many years’ work in the field of financial consumer protection, says confidence is the key. “Financial headlines are often alarming, that’s the nature of news,” she says. “But what many people find is that they don’t have enough knowledge to feel confident asking questions. This survey tells us investors want to be asking the right questions.”

Who should provide financial education?

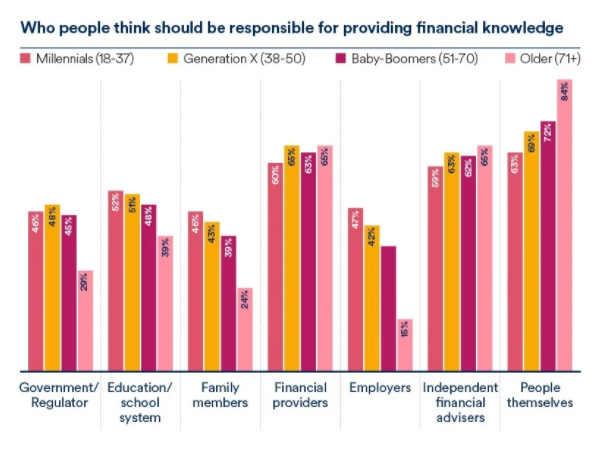

Overall, the biggest source of information for investors is their own work and research, with 72% of respondents citing this. Financial providers, independent advisers and family members are the next biggest sources of knowledge in that order.

The government (through a regulator, for example), employers and the schooling system come bottom in terms of educating investors.

Interestingly, there is a disconnect with these last three sources: although they are the least likely to provide knowledge, investors think they should be playing a greater role in doing so. Hence 51% say schools should be responsible for developing financial knowledge, compared to just 40% saying that they do.

Where are investors gleaning their knowhow?

Sheila Nicoll says investors are right to point to schools and governments and demand more – but says that these can play only a part. “It’s vital that schools educate people about money and investing, but it’s not the sole answer. Investors’ knowledge needs to be topped up throughout their lives. In particular, it is important to catch them at moments in life when they want to engage”.

Should schools and governments be responsible?

There is a clear divide between generations when it comes to opinions about who should be providing financial knowhow. Older investors (aged 51 and over) are happy that they source their own knowledge.

Millennials and Generation X investors – these two categories cover everyone under 50 – are more likely to think the job should be done by schools, governments and employers.

“This divergence could be down to a number of factors,” Sheila says. “It may be that older investors have gained confidence through their longer history of investing, or it could be that they have more access to advisers. But the fact that younger investors are looking for help from other sources – schools, governments, providers, employers – suggests to me a real hunger for more knowledge.

“It also suggests an understanding that, compared to previous generations who were able to rely on the state and defined benefit pensions, they are likely to need to take more responsibility for their own future financial wellbeing. Having that increased financial understanding and confidence is a huge step toward better outcomes for these people.”

Millennials need more information

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.