How might stocks react to a Biden win?

Our analysis suggests such an assumption would be premature.

It’s not just Covid-19 and the economic slump it has caused that are on investors’ minds. They’re also beginning to worry about the risks surrounding the 2020 US presidential election.

The latest polls show that the presumptive Democratic nominee, Joe Biden, is poised to win and the prevailing view is that this would have a negative impact on the stock market.

However, our analysis suggests this assumption is premature. Historically, no political party has been exclusively good or bad for markets.

So why do investors view Democratic presidents as cause to be bearish? Well, one reason is that they tend to enact more business-unfriendly policies, such as tax increases and regulation, which can weigh on corporate profitability.

Although this is a reasonable expectation, the reality is far more complicated. Presidential policies matter more than just party affiliation. Some markets and industries may emerge as relative losers, while others may be more insulated.

Discover more:

- Learn: What could a Biden presidency mean for climate change?

- Read: Investors crave knowledge – but where do they find it?

- Watch: Is Big Tech under threat?

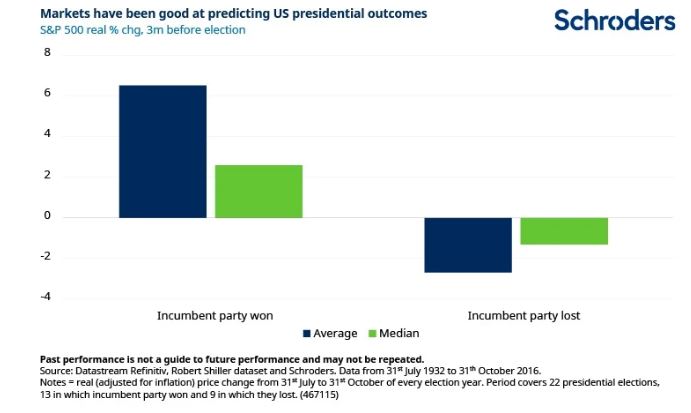

US stock market performance ahead of previous elections

Stock prices have on average fallen in the final three months leading up to an election whenever the incumbent political party lost, but rallied if the incumbent party won. This is irrespective of whether the president was a Republican or Democrat.

So, if investors believe Trump will lose in November, history would suggest that markets are more at risk of selling off than rallying in the upcoming months.

Republicans or Democrats: which is better for investors?

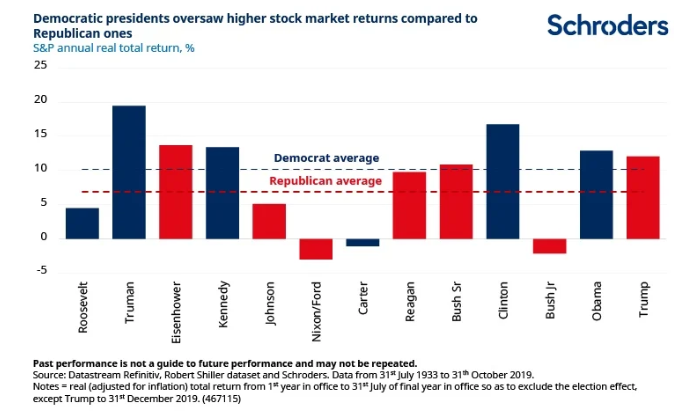

A longer-term analysis, however, suggests that things are not so clear cut. Although you might think Democratic presidents are worse for equity markets, the evidence suggests the contrary.

Since 1933, Democratic presidents have on average overseen higher stock market returns than Republican ones. For example, the average real (adjusted for inflation) total return for the S&P 500 Index under Democratic presidents was 10.2%, versus 6.9% under Republicans.

The problem is that nearly all of this average outperformance advantage can be explained by the boom years under Bill Clinton and the subsequent dotcom bust and Global Financial Crisis under George W. Bush. Excluding these two presidencies, the difference in returns is practically zero.

Neither political party is exclusively good or bad for markets. Instead, what matters more is the policies presidents choose to enact and their net impact. For example, although Trump’s tax cuts were widely seen as a positive development for markets, his handling of foreign policy and trade issues had the opposite effect.

Biden’s polices and how they might affect stocks?

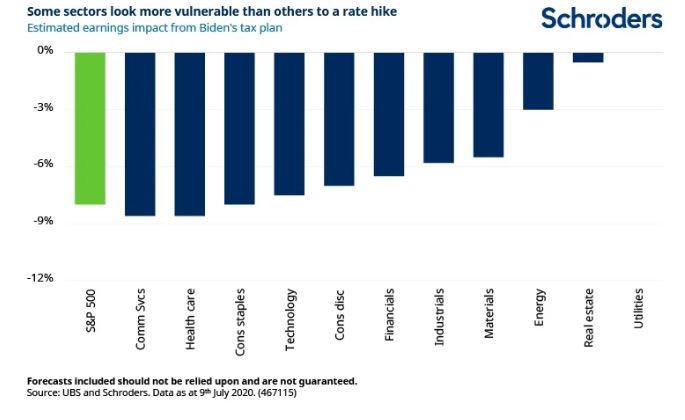

Taxes: The largest risk facing equity markets is the potential for US corporate tax rates to increase. In 2017, Trump lowered the tax rate from 35% to 21%, delivering a major boost to US earnings per share (EPS) and stock prices. However, Biden has said he would like to partially reverse this policy in early 2021, which could have significant consequences for equity investors.

For example, UBS estimates that raising the tax rate to 28%, alongside other proposed tax changes, would lower S&P 500 profits by 8%. On top of this, Biden has proposed to raise the minimum wage, which would also weigh on corporate profits. Together, such moves could potentially increase the appeal of non-US equities, after years of the US outperforming the rest of the world.

At the sector level, communication services, health care and consumer staples would see their earnings impacted the most. Meanwhile, energy, real estate and utilities would not be materially affected.

All of this, of course, is conditional on the Democratic party securing a majority of seats in the upper chamber of Congress (the US Senate), without which they are unlikely to pass major tax legislation.

Besides, there is a high chance corporate tax reform would take a back seat in Biden’s first year in office while economic rescue packages are prioritised.

Healthcare: The pandemic has disproportionately affected lower-income families and exposed the inequality in access to health care in the US. As a result, Biden is expected to double down on drug pricing control and create a public health insurance option to compete with private companies.

Both policies are negative for pharmaceutical companies and health insurers, but would still require congressional approval and in any case have a milder market impact compared to more far-reaching alternatives such as the “Medicare for All” scenario championed by Bernie Sanders.

Tech: We have already highlighted the immense concentration of the US equity market in the five largest technology companies – Microsoft, Amazon, Apple, Google and Facebook – which account for 20% of the total US market value.

For many months, the prevailing concern was that the Democratic nominee would usher in new anti-trust rules against these tech giants and at worst break them up into smaller businesses.

However, Biden’s general stance on tech has remained relatively unclear. At the same time, the coronavirus has dampened the anti-tech momentum, not least because of our increasing reliance on their digital services, as millions of people are confined to their homes.

Despite this, the Democratic party has moved significantly to the left on this issue and can be expected to pressure Biden to ramp up regulatory scrutiny.

The low taxes paid by these firms is also likely to be a focus. For example, Biden has proposed to double the global minimum tax on offshore profits from 10.5% to 21%.

Foreign policy: With 66% of Americans having an unfavourable view on China, geopolitical tensions between the US and China are likely to continue under a Biden presidency, especially with regards to technology and trade practices.

On the other hand, there is a high chance Biden will restore economic cooperation with Europe and Asia, while also easing up on tariffs.

This would inject a degree of predictability and stability into global affairs, which would be a welcome relief for global markets after a volatile few years.

And if global trade activity picks up in response, this could be the catalyst for investors to return to some export-oriented emerging markets that were adversely affected by the US-China trade dispute.

The reaction to a Biden win?

The perception that a Biden win would be a bad outcome for markets is not substantiated by the historical record on Democratic presidents. Investors should focus on his policy agenda and its potential investment implications.

If there is a Democratic sweep of Congress, US share prices are likely to price in an increase in corporate tax rates. This would bolster the appeal of non-US equities, especially if coupled with reduced trade frictions.

On the other hand, if Republicans retain control of the Senate, tax reforms are unlikely to pass. But as most foreign policy decision-making resides with the president, we can still expect an improvement in international relations.

This combination of the tax status quo and a defrosting of international relations would be the best-case scenario for global markets.

Over the medium-term, sector-specific issues may arise that could weigh down on the valuations of US healthcare and tech stocks. Investors should remain on guard if they are overly exposed to such areas.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.