What the data tells us about the shape of the US economic recovery

Looking at high-frequency data in the US, the key question is whether momentum in consumer spending can be sustained.

Some signs of the much hoped-for V-shaped recovery have started to emerge for the US economy. While consumption collapsed in March and April due to lockdown measures and a jump in unemployment, stimulus cheques provided an immediate support to the US consumer as showed by the recent strength in retail sales.

What shape recovery?

While the debate between a U or a V-shaped recovery for the US economy will likely continue, the key question now has become whether that momentum in consumer spending is likely to be sustained.

Markets always move ahead and they had already moved up in anticipation of a V-shaped recovery back in April. As the Covid-19 pandemic is moving quickly in the US, looking at high-frequency indicators has become extremely important.

This data can give us an idea of what is happening in the economy more swiftly than government reports as they usually lag by at least a month.

Discover more from Schroders:

Read: Investors expect even higher returns from the stock market in years ahead – despite coronavirus shock

Learn: Forecasting the US election: should investors prepare for a new president?

Watch: Why do markets rise when economies slump?

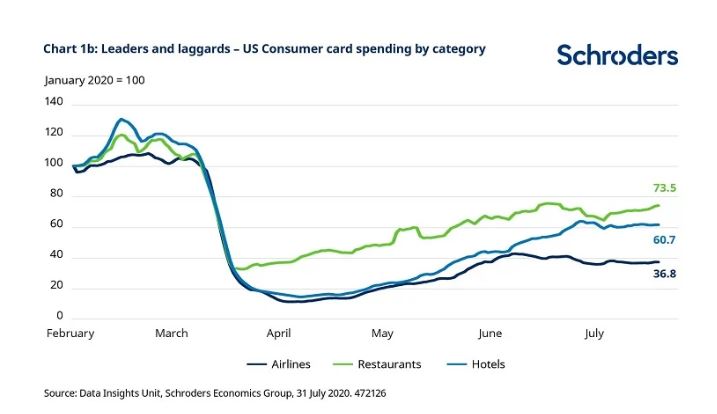

In particular, we look at daily data on US consumers’ credit and debit card transactions to find that only some parts of consumer spending are back to their pre-Covid-19 activity levels. We find evidence for a V-shaped recovery only for goods spending, not so for services.

After the initial March drop, as the reopening of the economy accelerated in May, spending at department, electronics and furniture stores has quickly started to recover. This is largely thanks to a surge in disposable income, boosted by government transfers. Latest data suggest that, despite the recent jump in the number of infections in the US, activity for the goods sector has not deteriorated in July.

What is the outlook for the service sector?

However, the picture for the US services sector looks quite different. In particular, activity for airline companies is only back to 38% of the level seen before Covid19 and it remains quite depressed for hotels and restaurants too.

Prospects for a quicker bounce back in service sector activity are likely to remain dim. Until a vaccine or effective treatment for the infection is developed, the recovery in these important parts of the US economy will continue to be subdued.

Finally, we think it is worth highlighting that the sustainability of the recovery in the goods sector is also at risk. US employment is still well below its level before Covid-19 and sales could start to collapse if the stimulus cheques do not continue to come through.

The US Congress will need to decide in the next few days if it is to head off a fiscal cliff at the end of July when enhanced unemployment benefits are due to expire.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.