Crypto AM shines its Spotlight on AgAu

AgAu – The Peer-to-peer, Electronic, Money System.

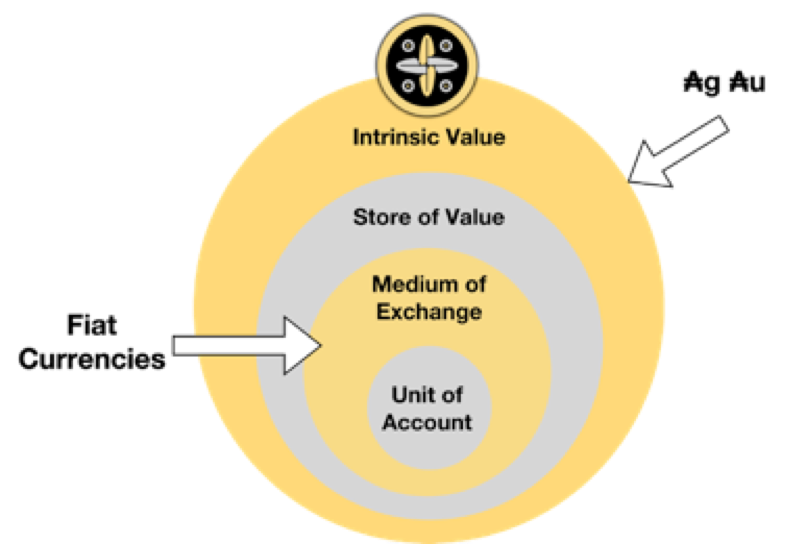

Referencing Satoshi Nakamoto’s white paper: Bitcoin, a peer-to-peer, electronic, cash system, AgAu makes a distinction between cash/currency and money.

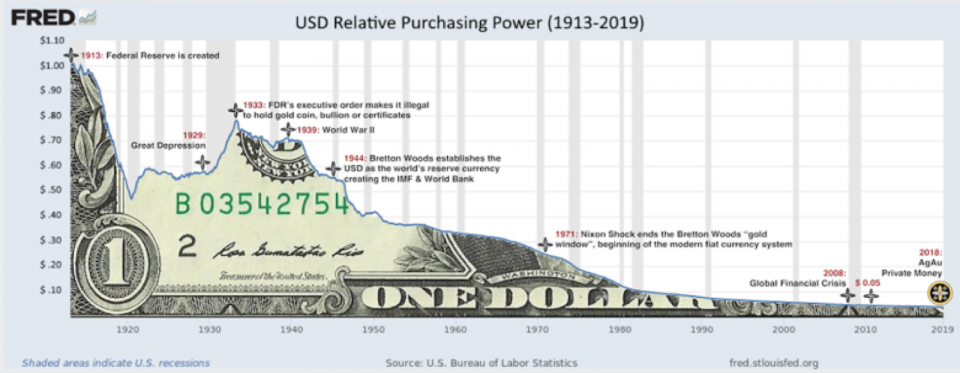

“Cash or currency is fiat. Gold on the other hand, is money. Currency can be a medium of exchange; gold is a store of value. Over the long term the historical evidence is crystal clear, fiat money always disappears or goes to zero… If there was to be a Monetary Reset, the most likely consensus across the world would most probably be gold.” said Thierry ARYS RUIZ, Executive Chairman of AgAu.

The company AgAu AG was founded in 2018 and borrowed its name from the merger of the two atomic symbols “Ag” (for Silver) and “Au” (for Gold). AgAu plans to issue digital tokens corresponding to the direct ownership of allocated silver and gold bullions in Switzerland. AgAu aims to be the easiest way to transact the direct ownership of allocated and redeemable physical LBMA quality gold and silver. The precious metal shall be audited and secured in regulated private vaults outside the banking system.

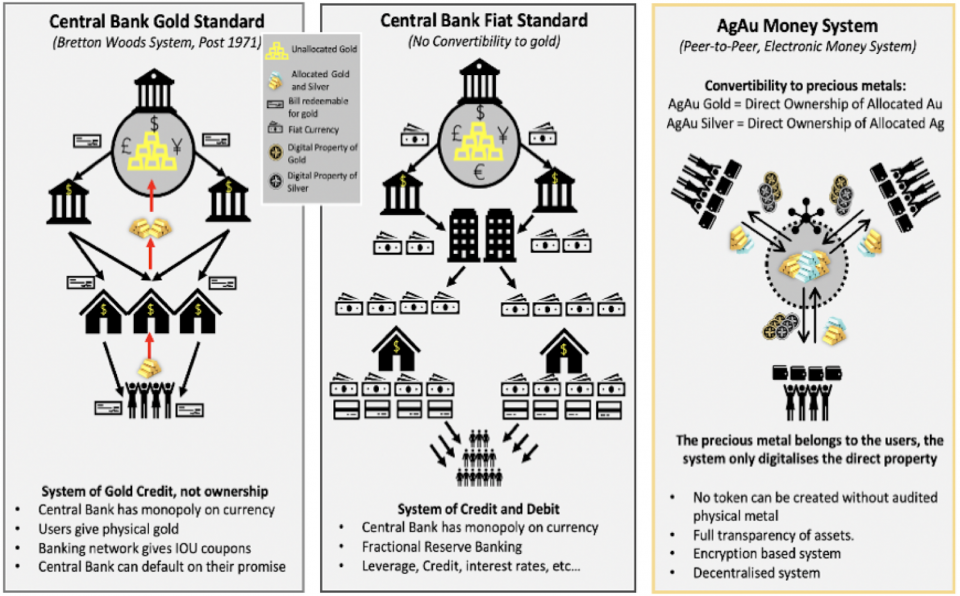

In fact, humanity has only departed from the gold standard for a little less than 50 years. In 1971, Nixon “temporarily” suspended the convertibility of US dollars into gold. The Swiss based commodity trading and technology company AgAu AG aims to “end the fiat system” and bring back a gold standard at the time where there is an increasing lack of trust in centralised institutions and many financial market observers fear a systemic financial collapse.

“Switzerland has a historic relation with gold, the country has long been considered the safest jurisdiction in the world for privacy and private property laws. We aim to merge the best of Switzerland: Commodity Trading (Gold & Silver), Banking and FinTech/Blockchain in one powerful idea: AgAu” – said Thierry ARYS RUIZ

AgAu is based in Zug, Switzerland; a known hub for commodity traders such as Glencore (LON:GLEN) but more recently the epicenter of Blockchain and Distributed Ledger Technology focused companies with the area now known as “The Crypto Valley”.

Building a Decentralised Private Central Bank (Hayek Bank) In Secret

Alongside Mr. Arys, is top Swiss banker Nicolas Chikhani, former CEO of Arab Bank Switzerland which recently engaged in crypto custody activities. Nicolas renewed his entrepreneurial spirit by joining AgAu’s board shortly after leaving the Geneva based bank.

«I see an asymmetric risk/return by investing in AgAu, if we are successful in this venture, the impact and potential is huge.» said Mr. Chikhani. The pair are planning to announce soon more top profiles joining the advisory board with experts ranging from international bank directors, commodity trading experts and top strategy consultants.

AgAu recently closed an angel investment round at a strong valuation with industry leaders signing on to be a part of the project. “The investment round concluded a preliminary step before the launch of the product in the second half of this year. We are very pleased to have received the trust of what I consider the best people to accomplish our task- this will be revealed in the coming months.” said Mr. Arys Ruiz.

Mark Valek, gold fund manager and partner of Incrementum is said to be joining AgAu according to people familiar with the matter. The specialist investment fund based in Liechtenstein is also recognized for its research report “In Gold We Trust”, sometimes referred as “the gold bible” among precious metal investors. Mr. Arys Ruiz declined to comment on the identity of the advisory board members to be announced later this year.

Direct Ownership of Swiss Gold and Silver

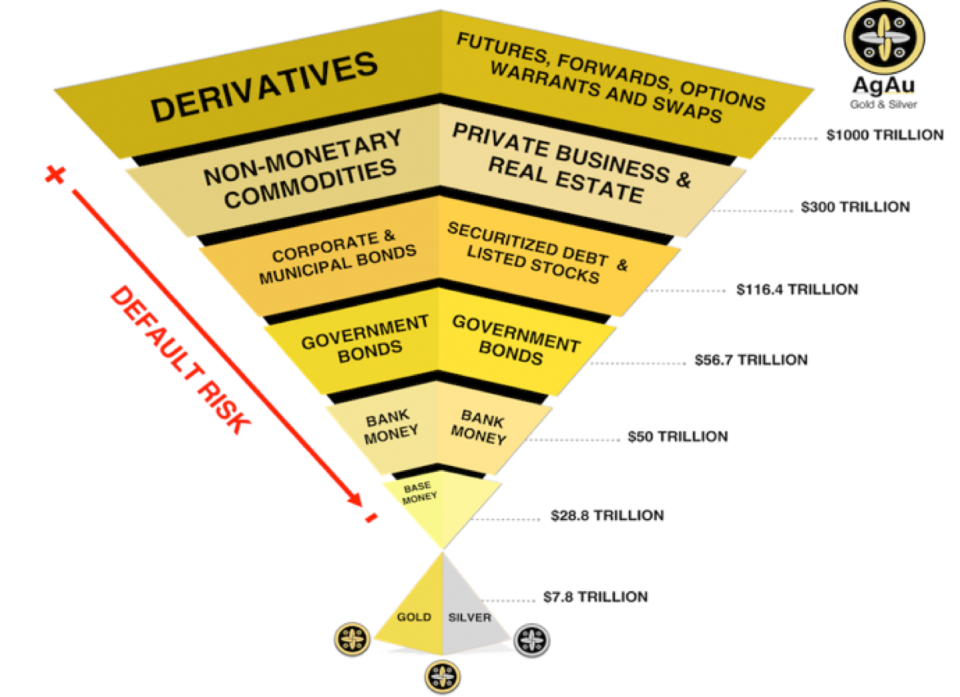

Unfortunately, most of today’s precious metals are transferred through centralised exchanges in the form of synthetic products, structured ownership or in a non- allocated form. Infusing Blockchain and Smart Contract technology, AgAu has overcome the impracticality of owning LBMA quality physical precious metals and disintermediate points of failure.

Unlike other solutions, AgAu has purposely avoided the use of a multitude of ownership layers via trusts, funds, traditional venues, other forms of custody or centralized protocols. This unique model allows for electronic direct ownership and transfer of physical and allocated LBMA Good Delivery quality gold and silver.

“We decided to give the token holder the choice on how to keep AgAu tokens, be it in their “primitive form” (allocated, in self-custody) or using other forms of custody layers or protocols.” Mr. Ruiz. AgAu will not make the choice on behalf of the user and therefore provides less counterparty risk and gives more direct ownership, security and optionality. Also, AgAu is not inflationary, the value of a token will always be 1 gram of precious metal further proving the reliability of this new form of money.

AgAu as Payment Token

The Swiss Financial Market Supervisory Authority (FINMA) has classified AgAu tokens as an asset token not being a security but being validated as a payment token as per the latest FINMA ‘stable coin’ guidelines.

“This is a great milestone for us. In our view, it is validating our ambition to be an alternative form of payment” said Mr. Arys Ruiz. AgAu strives to be the easiest way to transact the direct ownership of allocated and redeemable physical, LBMA quality gold and silver. The precious metal is audited and secured in private vaults outside the banking system in Switzerland representing a politically neutral alternative to fiat.

AgAu has recently published its white paper: “AgAu: The Peer-to-Peer, Electronic Money System”. As stated in the white paper, AgAu’s mission is to increase the freedom of exchange of goods, values and ideas by establishing a superior form of money enabling everyone to preserve and enjoy the fruits of their labour.

To learn more read the official white paper, visit AgAu.io