Twitter hack promoting Bitcoin scam draws headlines, but price remains ‘boring’

This week the price of Bitcoin (BTC) started trading around $9,300 but over time traded downward to a low testing the $9,000 support, before moving up to trade close to $9,200. Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week close to $245 and traded within its range throughout it.

Bitcoin made headlines across the world this week as hackers managed to breach Twitter’s security and gain access to its internal systems and tools. Using it, they hijacked dozens of high-profile accounts to promote a fake bitcoin giveaway, asking users to send BTC to an address, promising they would return twice as much as they received

The attack, according to Twitter, targeted 130 different accounts. These included the accounts of Tesla CEO Elon Musk, President Barack Bama, Amazon CEO Jeff Bezos, Presidential Candidate Joe Biden, Microsoft co-founder Bill Gates, and of cryptocurrency exchange Binance, Coinbase, and Gemini. Some of the impacted accounts saw hackers download their Twitter history, which may include valuable data.

Security experts have warned the fake bitcoin giveaway could have been a cover for “other malicious activity,” as access to high-profile accounts’ direct messages and other sensitive information could be worth a lot on underground markets.

The security breach is being investigated by the U.S. Federal Bureau of Investigations (FBI), and the UK’s National Cyber Security Centre has revealed it reached out to the microblogging platform over the security incident.

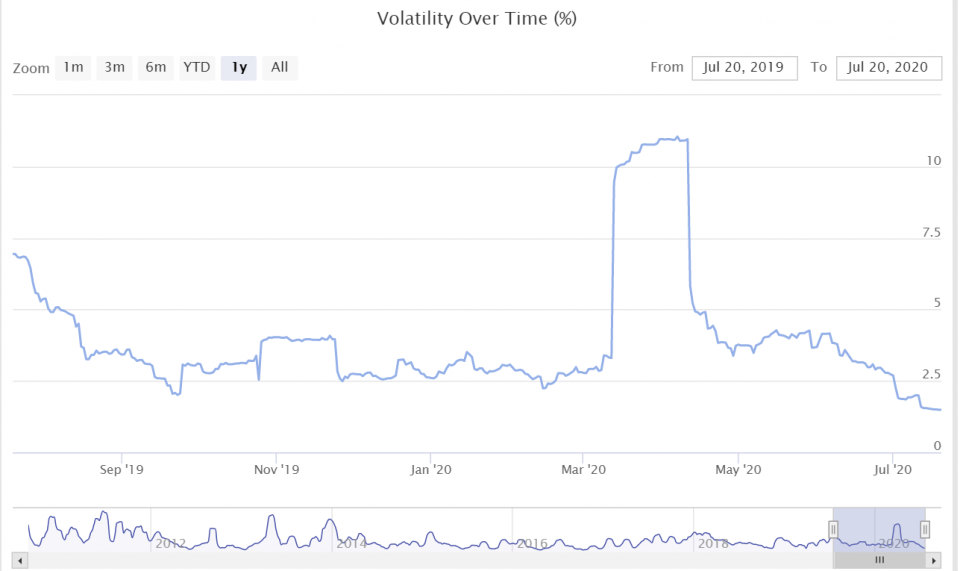

The incident made headlines throughout the world, with various prominent news outlets explaining what bitcoin is to their audiences. Despite widespread coverage, bitcoin’s price remained “boring” according to its own historical volatility, as BTC’s 30-day volatility index is now below 1.5%.

It’s worth noting that the last two times it dropped below 1.5% the flagship cryptocurrency’s price made significant price movements, which suggests the low volatility could be an accumulation period. Indeed, multi-billion dollar crypto asset manager Grayscale Investments reported its largest quarterly inflows to date, bringing in $905.8 million in Q2 2020, up from its previous record of $503.7 million in Q1 2020.

Potentially adding to the demand in the near future, PayPal has revealed in a letter sent to the European Commission that it plans on developing cryptocurrency “capabilities,” at a time the firm was “assessing” the need for a European framework for cryptoassets. It adds PayPal is interested in how cryptocurrency technology could be used to promote transparency and compliance efforts.

High-Quality Crypto Exchanges Gain Market Share

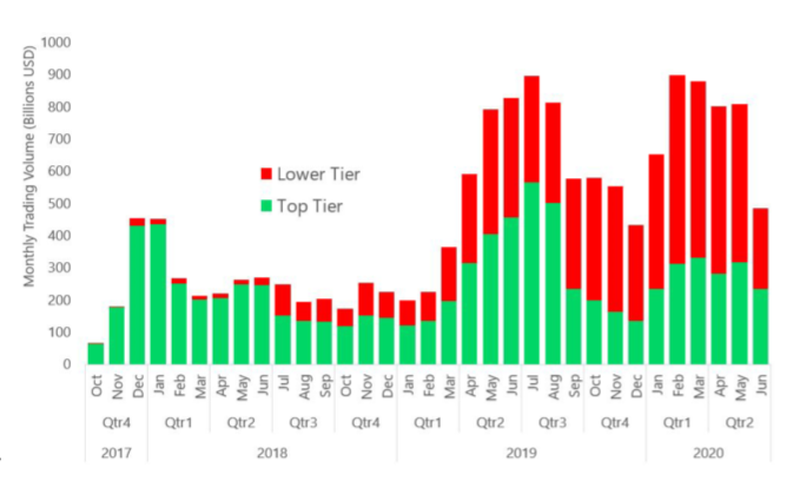

CryptoCompare’s updated Exchange Benchmark report revealed that the so-called Top-Tier cryptocurrency exchanges, those graded AA-B on the report, have been gaining market share over riskier, Lower-Tier exchanges, those graded C-E.

The report details Top-Tier exchanges account for 32% of global trading volumes in Q4 2019, and 36% in Q1 2020. In the second quarter, these accounted for 40% of global trading volumes, while in June they were up to 46%.

Despite the growing market share of Top-Tier exchanges, the report noted that 38% of cryptoasset trading platforms interact with entities deemed high-risk in over 25% of their transactions. High-risk entities include scammers, Ponzi schemes, addresses associated with crimes, darknet markets, and OFAC sanctions addresses.

Binance, one of the Top-Tier exchanges, rolled out its crypto debit card, the Binance Card, in Europe this week. The card will allow cryptocurrency holders to pay with crypto in millions of locations worldwide. The card is set to be launched after Binance acquired Swipe, a crypto debit card issuer it acquired earlier this year for an undisclosed sum.