Can international tourism ever recover?

We look at what might reignite demand for overseas travel and whether the downturn could profoundly change some countries’ economies.

Travel restrictions are slowly being lifted, but most people are more likely to be jumping into their cars to go on holiday than onto an aircraft.

So, can international tourism ever recover? And might the slump force some countries to reorder their economic priorities?

Lessons from previous crises

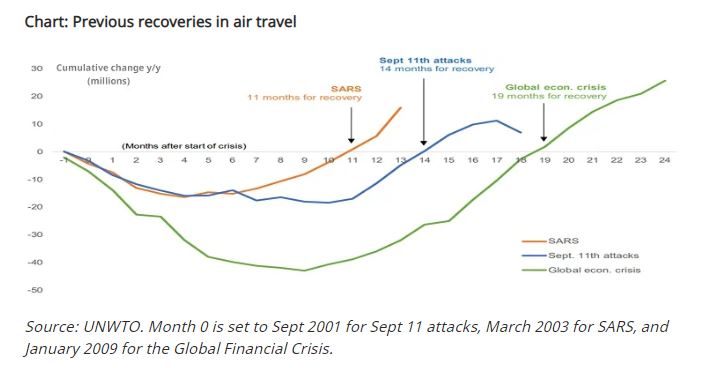

The UNWTO (United Nations World Tourism Organization) has looked at three periods which weighed on international travel over recent years: SARS, the Global Financial Crisis (GFC) and 9/11. The subsequent recoveries are shown in the chart below.

The current coronavirus crisis appears to be a rather potent cocktail of all three of these events: a viral epidemic more widespread than SARS, an economic downturn sharper than the GFC, and a fear of flying comparable to the aftermath of 9/11.

This points to a trough far greater than the 45% downturn in international travel seen nine months into the GFC. Indeed, data from the International Air Transport Association (IATA) showed global demand in April, measured in revenue passenger kilometres or ‘RPKs’, as having plunged 94.3%.

The length of the recovery is likely to come down to which of the three factors – the virus, the economic recession or the fear of flying – lasts longest. The limited evidence above suggests that an improvement in economic conditions will be what reignites demand for travel.

Read more:

– Brexit: No-deal “a drop in the ocean” for economy compared to Covid-19

– WFH: Is it the death knell for offices?

– How Covid-19 will impact UK employment

Are ‘staycations’ here for the long haul?

In many ways it seems intuitive for there to be a sustained increase in demand for domestic holidays. A wariness of squeezing into planes and an increase in red-tape at airports adds to existing concerns around the environmental impact of overseas holidays.

The move towards “staycations” might also be encouraged by a long-term rise in air travel costs. In the near term, prices are forecast to remain low. The International Air Transport Association (IATA) said it expects “significant discounting…to stimulate demand”. However, prices may rise in the long term because of the heavy hit to supply.

Data from travel analytics firm ForwardKeys shows airline seat capacity down 77% year-on-year globally at the start of April. This is largely down to a number of airlines having gone bankrupt, and others retiring large swathes of their fleet. At least some of this hit will be permanent. This may result in a greater degree of monopoly power for those remaining airlines, particular along less-travelled routes.

The reduction in planes flying is compounded by a decline in seats per plane. If airlines are forced to keep the middle seat empty for social distancing purposes, capacity would fall to around 67% (though this figure will vary depending on the seat configuration).

Given that the IATA forecasts breakeven capacity rate to be 73% in 2020, it seems likely that airlines will need to raise prices for those passengers who do get a seat.

That said, the path for air fares remains highly uncertain. It is also doubtful whether domestic tourism is a particularly strong substitute for international tourism over the longer-term. Few nations can boast the range of climates and experiences available to international travellers; Blackpool – despite its charms – is no Barbados.

In addition, this is more than just a viral pandemic – the sharp recession and resulting unemployment will almost certainly induce a rise in precautionary savings that will weigh on tourism of any type. As outlined previously, these economic effects will likely linger longer than the fear of travelling itself.

Consequently, faith in domestic tourism providing anything more than a gentle buffer through this crisis seems optimistic.

Could Covid-19 cure ‘Dutch Disease’?

One other consequence of the crisis may be a move to diversify economies which have an unhealthy reliance on the tourism sector. The coronavirus crisis has been described by many as a reallocation shock, and it would be no surprise to see some economies move to reduce their dependence on tourism.

With growth in tourism outstripping GDP for each of the past nine years on a global level, many governments have been content to ignore this underlying fragility. They may now be regretting this.

The alternatives to tourism may not be obvious, but opportunity might knock as nations free themselves from a form of tourism-induced ‘Dutch disease’ (which is when the rapid development of one sector of the economy precipitates a decline in other sectors).

A fall in international arrivals would ease upwards pressure on local currencies, enabling struggling producers to better compete on the international stage.

With the number of jobs in the labour-intensive tourism sector dwindling, these same producers may also see wage burdens ease as the pool of available workers swells.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.