UK economy: Five charts that show we face a long road to recovery

The coronavirus pandemic has plunged the UK economy into an unprecedented crisis, with GDP shrinking by a record 20.4 per cent April as lockdown measures hammered businesses.

The Bank of England has warned that Britain could be heading for its deepest recession in three centuries this year. It is widely believed that April will mark the bottom of a huge crash before a lengthy recovery, but just how long that process will take is unclear.

Bank of England governor Andrew Bailey said earlier this week that some early signs of recovery were already apparent, but added that the downturn would leave some “scarring”.

But the V-shaped recovery Bailey initially predicted looks far from certain.

City A.M. has rounded up five charts showing that the UK’s economic recovery from Covid-19 is likely to be a long and slow process.

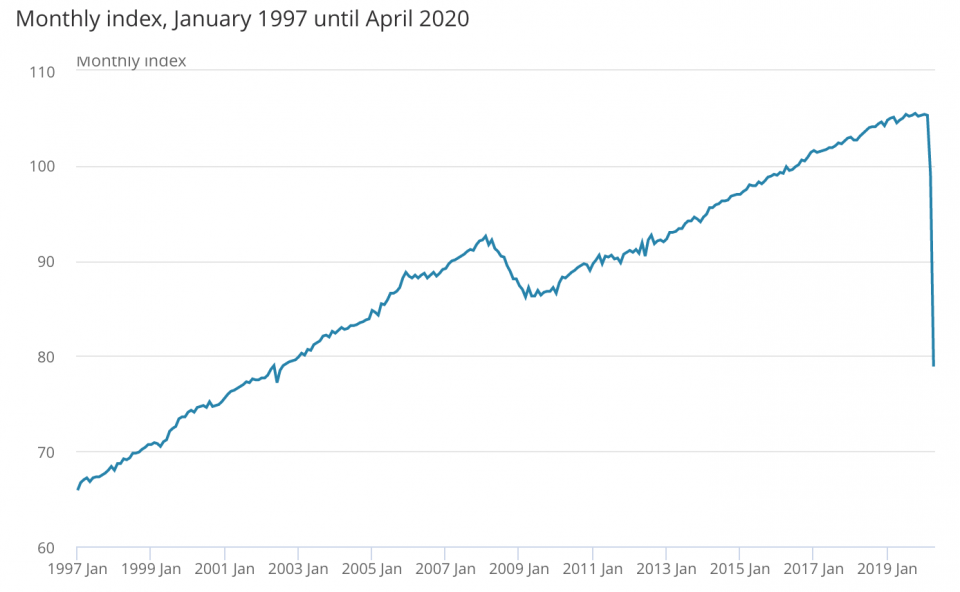

‘Catastrophic’ contraction for UK economy

The UK economy shrank 20.4 per cent in April – the steepest monthly decline since records began – as entire sectors were shuttered by the nationwide lockdown introduced in late March to curb the spread of the virus.

The dire GDP figures, released by the Office of National Statistics (ONS), was worse even than economists’ unprecedentedly weak forecasts. A consensus of estimates produced by Pantheon Macroeconomics had pointed to an 18.7 per cent plunge.

“”This is catastrophic, literally on a scale never seen before in history,” said Paul Johnson, director of the Institute for Fiscal Studies think tank. “The real issue is what happens next.”

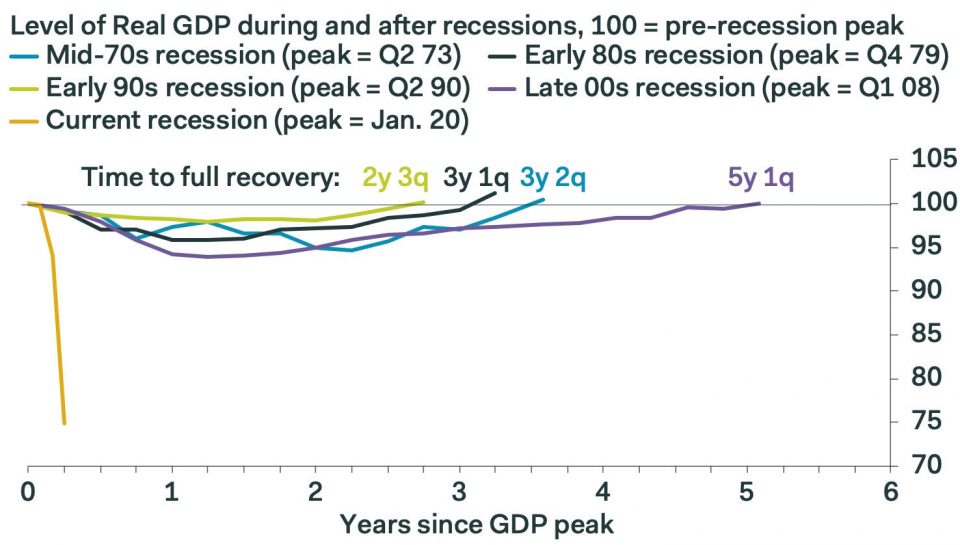

Coronavirus causes the worst of all UK recessions

Speaking of recovery from previous recessions, this chart from Pantheon Macroeconomics puts April’s GDP slump in the context of previous downturns.

A pretty grim sight, it shows that the Covid-19 recession has already been four times deeper than the 2008-2009 financial crisis, the previous deepest downturn in post-war history. For context, it usually takes the UK economy three to four years to return to its pre-recession peak.

However, PwC’s chief economist, Jonathan Gillham, said the unprecedented GDP contraction “underlines that the effectiveness of the response from both the government and the business community remains critical to limiting the longer term scarring to the economy through business failures and unemployment”.

“If this response is effective, we would expect a quicker economic recovery than we saw after the financial crisis, even though the short-term fall in output will be much steeper due to the lockdown,” Gillham added.

Before the Open newsletter: Start your day with the City View podcast and key market data

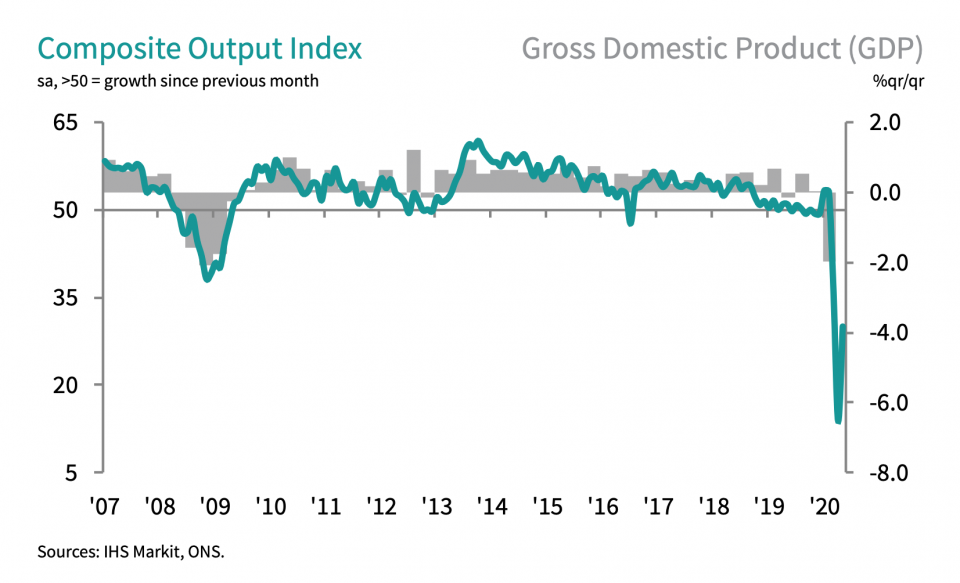

A sustained decline in private sector activity

Early indications suggest that while the downturn in the UK’s private sector persisted in May, the speed of decline slowed slightly as the government began to ease some restrictions.

IHS Markit/Cips purchasing managers’ index (PMI), which measures the health of the UK economy’s private sector. May data gave a reading of 30, compared to 13.8 for April. Any reading below 50 indicates a contraction.

But despite the uptick, May’s PMI figure remains far worse than anything recorded during the 2008-financial crisis. That shows just how far the private sector has to improve before it will return to pre-crisis levels.

UK likely to be worst hit major economy

Earlier this week, the Organisation for Economic Cooperation and Development (OECD) warned that the UK was likely to face the largest economic hit from the coronavirus pandemic of any developed nation.

The OECD set out two “equally possible” forecasts for all G20 economies: the so-called double hit in which there is a second major coronavirus outbreak later in 2020, and a single hit outcome in which the virus is kept under control.

Under the single hit scenario, the UK is predicted to be the hardest hit major economy with GDP shrinking 11.5 per cent. In the double hit scenario, the UK economy is expected to contract 14 per cent, just behind France at 14.1 per cent.

“The slow lifting of restrictions – pubs and cafes are still not open – means the UK may endure a wider bottom than many others, making recovery all the slower. All this before the jobs Armageddon this autumn when furlough support ends,” noted Markets.com chief analyst Neil Wilson.

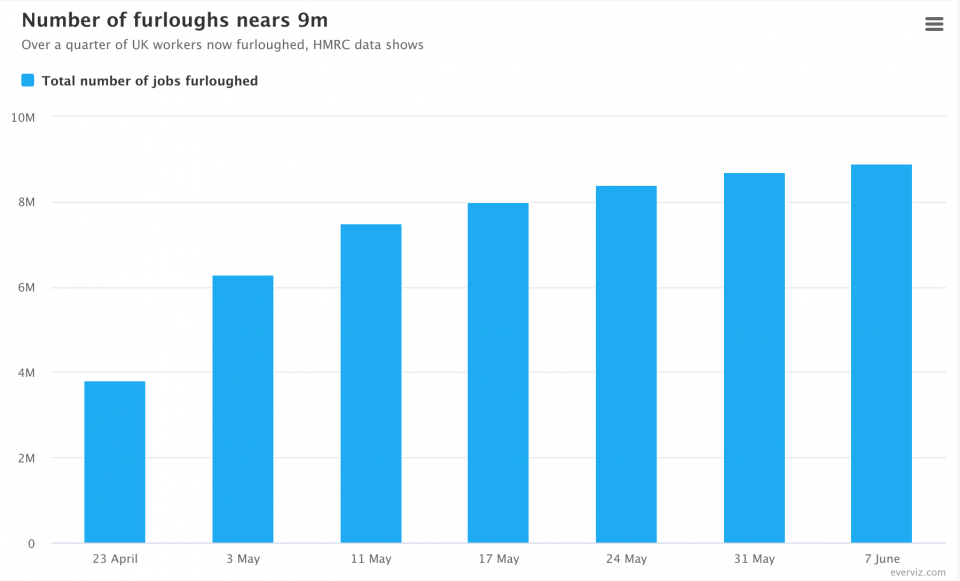

Over a quarter of UK workforce furloughed

And this chart showing the total number of workers currently furloughed under the government’s coronavirus job retention scheme gives some indication of how sharply unemployment could spike once the support comes to an end in October.

There are fears unemployment could spike above 4m when the UK job retention scheme ends in October. Currently the unemployment rate is 3.9 per cent but economists have warned it could hit nine per cent or more if small businesses fail to reopen when the scheme closes.

“An additional spike in unemployment after the lockdown also seems likely, once government support via the Job Retention Scheme ends,” KPMG chief economist Yael Selfin has warned.