Where Next for Stablecoins?

Tether, Paxos, Dai: welcome to the world of stablecoins, instruments that are designed to follow closely the price of the assets or currencies which they are pegged to. They are on the opposite end of the volatility spectrum, compared to Bitcoin or Ether, as they play a different role: they allow investors to move dollars across crypto exchanges and settle Bitcoin transaction with minimal interaction with banks. There is anecdotal evidence that stablecoins are beginning to be used outside the restricted circles of crypto markets; in recent years countries with volatile or hyper-inflated sovereign currencies, have started switching to stablecoin as a store of value, after the crash of bitcoin in early 2018.

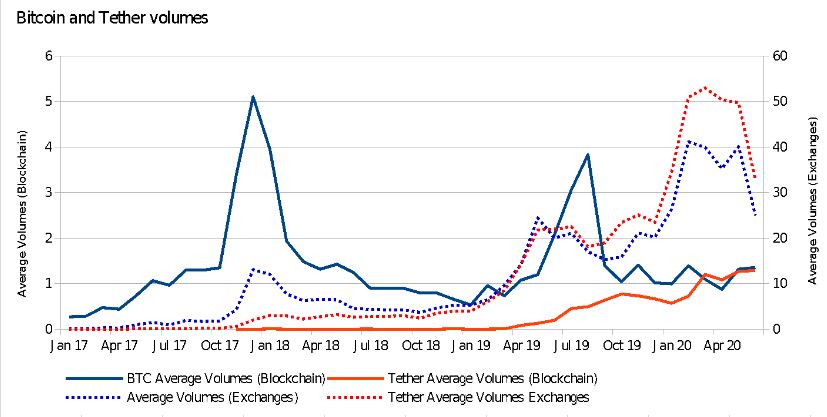

Stablecoins have proved successful – judging, for example, from the volumes of Tether dollars exchanged daily on blockchain and those reported by exchanges. Whether you believe data reported by exchanges or not, Tether volumes are starting to take over those of Bitcoin itself.

Libra, of course, is another important stablecoin: as the project launched in 2018, regulators around the world were vocal in their concerns on the project. A recent paper issued by the Financial Stability Board – an international body established by the G20 economies to coordinate the work of national financial authorities – proposed a Decalogue to address the regulatory, supervisory and

oversight challenges raised by stablecoins. Many saw this as a direct reaction to Libra but the recommendations also offered a mea culpa to those fostering the evolution of financial markets.

“Authorities should ensure that there is comprehensive regulation, supervision and oversight of stablecoins across borders and sectors”. Clearly, to cut across borders, such regulatory environment ought to be coordinated, to avoid inconsistencies in the treatment of instruments which by their very own nature transcend national borders and regulations.

Stablecoins come in different forms which in turn are interpreted by various regulators differently. Paxos dollars, for example, are issued by a US regulated company and backed by physical dollars kept in a bank; Dai dollars are issued by a smart contract, an algorithm governed by the holders of another token called Mkr. Dais are backed by crypto collateral, in excess of the dollars issued – to cater for the volatility of the price of the crypto pledged to “mint” dollars. Paxos Gold is a stablecoins that – as the name suggests – is backed by gold, kept at in bank volts. There is another stream of stablecoins – though with no successful incarnations yet – governed by an algorithmic central bank that mint or burn coins to maintain the peg with the desired assets, based on supply and demand forces.

Stable implies a fixed redemption value or a variable redemption value that is determined formulaically and not driven by market forces. Variances around parity (one token one unit of the currency it represents) may signal issues, for example, with perceived counterparty risk. Prices above parity are harder to explain: the premium may be driven, for example, by frictions and barriers of acquiring the stablecoin directly from the issuer. Perfect parity stablecoins would also appear to subvert the traditional notion of counterparty risk: a promise to pay a dollar made by a private company should be discounted for counterparty risk – as well controlled this may be, by contract or regulations. Yet most stable coins trade above parity more often than not.

Two elements probably explain this phenomenon: counterparty risk of liabilities is evaluated over a time horizon, days, months or years. Stablecoins can turn around very quickly: unlike Fiat money of advanced economies, where the velocity of circulation continues to decline (in the UK, for example this has dropped to below one over a year time horizon), stablecoins turn around several times in a single day, rendering the time horizon for the estimation of counterparty risk close to zero. As a self-fulfilling promise, the ability to quickly settle transactions makes investors oblivious of the counterparty risk of the issuer, in the face of the convenience, the benefit of which is such to overcome counterparty risk.

Stablecoins can be represented on a single blockchain or across multiple chains, providing “resident” tokens on each chain supported to facilitate settlement driven by algorithms or by intermediaries. The same technology that powers blockchain provides robust controls to ensure that multiple issuances on diverse blockchain are treated as a single one, preventing double spending of tokens and immediate conversion across blockchains. This may present additional challenges to the implementation of the “travel rule”. Additional, but not unsurmountable.

The structure of each stable coin may attract different regulatory regimes – payment regulations being the most obvious. A question in a recent consultation paper issued by the Singapore Monetary Authority does not leave much space for arguing :

“ If stablecoins fulfil the functions of money in the way e-money does, then do holders of stablecoins deserve the same regulatory protections as e-money?”

Some stablecoins may be structured as, or be considered in different jurisdictions, investments, and therefore regulated as securities. Some regulators may see them as banking products, requiring authorisation for deposit taking activities. Certain jurisdictions (Switzerland and Abu Dhabi, for example) have recently promulgated bespoke regulations for crypto assets, other like China and Russia have banned them outright. Money laundering regulations in Europe and US are united around the “travel rule”, the requirement for intermediaries to obtain, hold, and transmit originator and beneficiary information.

Central banks continue to look with interest at stablecoins, possibly as lab experiment in preparation of the launch of central bank issued digital currencies. These are digital assets are as stable as can be, given that the issuer is a central bank and their value from the same forces as traditional currencies. Individually, and collectively through the BIS, central banks have praised digital currencies for their ability to reduce the cost of payments, increase cash usage and, ultimately, promote balanced economic growth. The first central bank issued digital currencies are widely expected to be minted within a year or two: countries like China and Sweden, for example, are now piloting the digital equivalent of their national currencies. The US has just introduced the digital dollar project.

The dramatic shift in attitude and behaviours arising from the pandemic is likely to lead to an acceleration of the acceptance and use of retail stable coins and a slow a steady increase in institutional use, particularly for risk management.

Francesco Roda, Chief Risk Officer at Koine

francesco.roda@koine.com

Linkedin