What is Ethereum 2.0 ‘staking’?

Ethereum is the second largest crypto asset by market capitalisation. The Ethereum chain runs many of the top digital assets (e.g. the Dai stable coin, by MakerDAO), Decentralised Finance (DeFi) platforms, and almost single handedly powered Initial Coin Offerings (ICOs). Thus it captures the vast majority of developer attention.

Ethereum 2 represents a series of major improvements over Ethereum’s initial concept launched in 2015. These are all geared towards achieving Ethereum’s goal – a global, open-source platform for decentralised applications (dApps). These improvements are to be released in a carefully controlled manner following an agreed roadmap, enabling developers all over the world to review, and test that the infrastructure is fit for purpose. The first release on the roadmap is called Phase 0.

Why is the Beacon Chain important?

Ethereum 2 Phase 0 (The Beacon Chain) is due to be released in the third quarter of this year. It has various features that make it interesting, but one that is generating the most attention is its upgrade to Proof of Stake as a consensus mechanism.

What is a consensus mechanism?

All blockchains need a consensus mechanism, which is the process that leads to finality. Finality is the property of a blockchain that allows all parties to agree that an event happened, for example a financial transfer. The consensus mechanism that most people have heard about is called Proof of Work, and is used by many blockchains including Bitcoin and Ethereum, currently.

What is Proof of Work consensus?

Very briefly, transactions are grouped into blocks and a cryptographic hash is worked out to provide a unique number representing a digital fingerprint of all those transactions, plus the hash of the previous block. Any change to the contents of the blocks will create a completely different digital fingerprint (using the Ethash algorithm) and the fraud will be immediately obvious to everyone concerned.

In order to introduce some time and energy (work) into the system the hash must reach a certain threshold value of difficulty. Think of it as a number of leading zeroes on the hash. The more zeroes required the harder it will be to discover the digital fingerprint. There are a few numbers in the block header, outside of the transactions, that can be adjusted to create different hash values but the outcome is completely unpredictable. Thus it takes provable work to find an acceptable hash value.

The result of this Proof of Work is that the block of transactions gains finality and everyone can build on the next batch of transactions safely because everyone is in consensus that they are correct.

OK, but isn’t Proof of Work wasteful?

Yes and no. At small scales it’s an acceptable use of time and energy, but for larger scale systems it rapidly spirals out of control. As everyone piles in the difficulty level soars and soon only those with enormous computing resources are able to secure the network. This leads to centralisation, which is bad for a decentralised system as it can introduce censorship and control.

Is Proof of Stake better?

Ethereum 2 uses Proof of Stake consensus instead of Proof of Work. Ether is staked by the validators that secure the blocks and these validators are rewarded for their honest behaviour, and they carry a risk of loss for poor participation or subversive behaviour.

By forcing validators to put “skin in the game” they are encouraged to behave honestly. Therefore it is possible to construct a Proof of Stake system where stakers are incentivised to work honestly with a reward for good behaviour that benefits the security of the network, and a stiff penalty for attempting to subvert it.

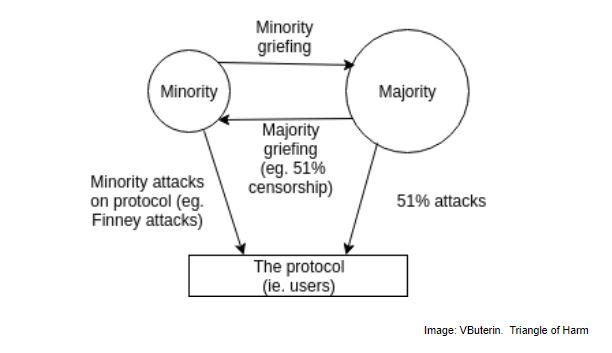

So is it better? Well better is subjective, the end goal of consensus is to have a secure chain that is resistant to malicious attacks. Proof of Work requires an attacker to buy enough computational power control 51% of the chain hashrate.

Proof of Stake requires an attacker to control the staked asset, put those assets at risk and write fictitious blocks. If the blocks are spotted to be false, the attacker’s stake could be reduced (“slashed”) and they will need to acquire further assets to make subsequent attacks. After an attack, the staked assets are a scarcer resource and as such a second attack would require a greater commitment than the first. Significant efforts have been committed to minimising both the Ethereum 2 attack surface and the prevention of censorship.

So the Beacon Chain is a working Proof of Stake consensus mechanism?

Exactly. The structure of Ethereum 2 can be thought of as a hub and spoke. The hub is the Beacon Chain and the spokes will be the shards and execution environments (more about those another time) which will come along in Phases 1 and 2 scheduled for 2021.

You mentioned rewards for good behaviour?

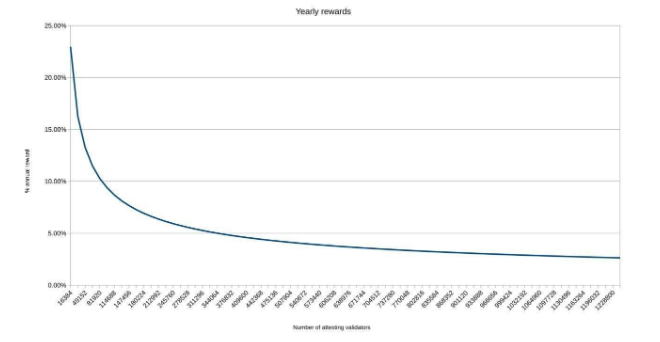

Yes. Validators participating in the Beacon Chain are eligible to be rewarded for staking assets. The amount of reward is shared, and so varies depending on the number of participants. There is a balance to be drawn between the amount of funds set aside to secure the network in validators and that which is available to pay for transaction and smart contract processing (not available in Phase 0) to get work done.

In addition, anyone who is validating transactions for the Beacon Chain must be running infrastructure that is always available when called upon by the network. Failure to be available to do the work required at the time required is punishable by slashing.

Imagine if all the validators were all running on the same operating system and a virus caused a denial of service event. Nobody would be available to secure the Ethereum 2 network. The slashing risk ensures that there is a strong incentive to put validators on a wide variety of operating systems, machines and geolocated data centres.

Remember all that game theory that had to be worked out? This is the kind of behaviour that needed deep analysis to get right.

Yes, yes, but the rewards – how much are we talking here?

Being part of a Proof of Stake system contains an element of risk, and will be more risky in the beginning as bugs and flaws are uncovered and fixed. Various analyses have shown that rewards vary with the number of validators present and can range from 25% to 3% paid in Ether over the course of each year of operation as can be seen below.

Where can I learn more?

A good introduction to Ethereum can be found on the official Ethereum Foundation website.

This article was written by Attestant.io. We have designed and developed a non-custodial, institutional-grade, managed staking service for individuals or entities with >32 Ether.

For more information, please read our technical posts on Ethereum 2 staking.

Attestant Limited is registered in England and Wales under company number 12540798 at 7 Albert Buildings, 49 Queen Victoria Street, City of London, EC4N 4SA, Great Britain.