What is ‘fake’ and what is ‘real’ in financial markets?

I re-watched the Orson Welles docudrama ‘F for Fake’ the other day. The 1973 film is an exploration of what is fake and what is real in the art world.

I was curious to see how it held up in the age of fake news.

Well, the movie doesn’t have much to say about fake news, but it does reveal quite a lot about financial markets, bubbles and our interest-rate environment.

One of the concepts the film examines is how a forged piece of art can be passed off as authentic. What the forgers need is an expert to authenticate the forgery and then an art dealer to sell it as real to unsuspecting investors and collectors.

See where this is going? The financial industry has true entrepreneurs who create products and services that improve lives and progress society. Then there are fake entrepreneurs (or managers) who increase the market value of the companies they work for — and their personal financial wealth through higher share prices — without creating anything new. They tend to accomplish this by cost-cutting and M&A.

What these fake entrepreneurs need are experts (or analysts) to certify that their actions constitute authentic added value. And they need stockbrokers to sell fake progress as the real thing to unsuspecting investors. If the stockbrokers are successful enough in pushing up the share price or of the market as a whole, it will become so detached from reality that some analysts will call it a bubble. Which is another important concept ‘F for Fake’ explores.

When is a fake a fake?

When is a bubble a bubble?

In the art world, a fake is a fake when the consensus opinion of experts declares it as such. As Oja Kodar asks in the movie: “If there weren’t any experts, would there be any fakes?”. Without experts, all art would be real.

A friend told me he is trying to find a way to classify bubbles before they burst. What if bubbles can only be identified based on their bursting? No bursting, no bubble. In today’s financial markets, we live in constant fear of the low interest-rate bubble bursting. Wary of extremely low or even negative interest rates, many analysts and economists expect a massive devaluation of assets once interest rates normalise.

But more than 10 years after the financial crisis, interest rates have yet to normalise in the US or Europe. And in Japan, 30 years after the bubble burst, interest rates haven’t normalised either.

How long do low or negative interest rates have to hang before they become real? What if this isn’t a bubble or historic aberration but a permanent reality?

According to the currently accepted wisdom on financial markets:real and nominal interest rates cannot stay this low forever; real interest rates remain stable in the long run and fluctuate around a level of 1%; the difference between the real rate of interest and the real rate of growth is constant over time and fuels rising inequality between owners of capital and workers.

What if all these assumptions are wrong? In a fascinating must-read, Bank of England visiting scholar Paul Schmelzing challenges each of these doctrines. He compiles data on global real interest rates and the difference between real economic growth and real interest rates spanning more than 700 years. His extended timeframe and reliance on primary data paints a very different picture of the above assumptions.

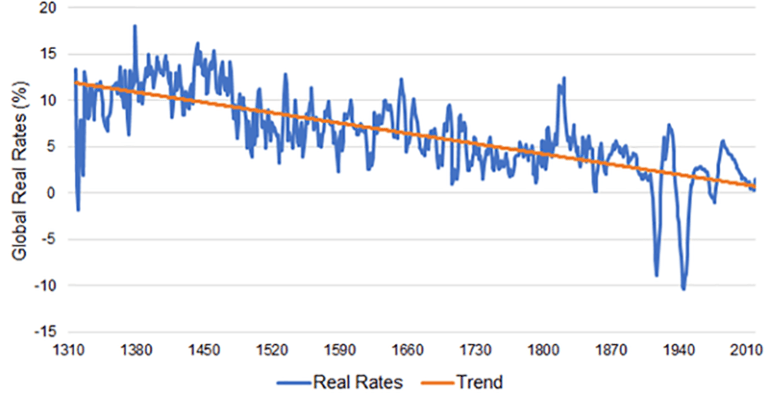

The long-term declining trend in real interest rates

Data underlying Bank of England SWP 845, ‘Eight centuries of global real rates, R-G, and the ‘suprasecular’ decline, 1311-2018’.

If his data is correct — and the results are so revolutionary, we ought to be cautious about assuming as much — then real interest rates are in a long-term decline, with a slope of about 1 to 2 basis points (bps) per year. This means that today’s low real interest rates aren’t an anomaly. Rather they represent a return to a long-term secular trend that was interrupted by rising real interest rates from 1950 to 1990.

Again, if Schmelzing is correct, ‘normal’ real interest rates are not coming back. Instead, they will eventually turn negative on a global scale. And they will stay there for a long time — with only occasional cyclical upward swings.

Hints towards critical future trends

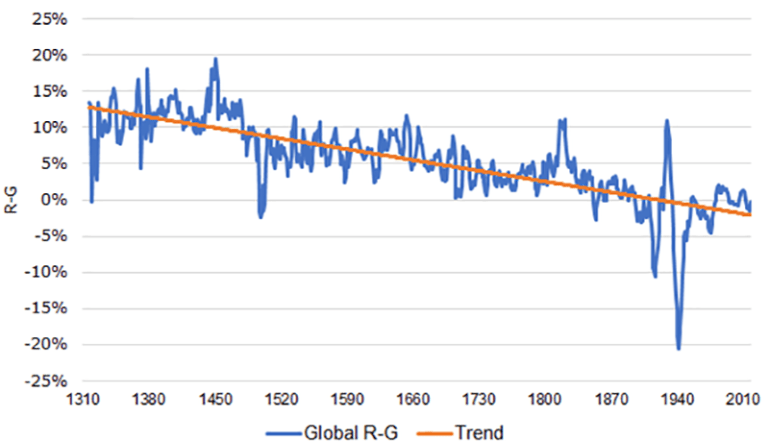

In a finding that may be even more consequential for investors, Schmelzing also demonstrates that the difference between real interest rates and real economic growth (R-G) is not constant at all, but also steadily declines. The current level of R-G is effectively a little high, which suggests that it will continue to fall in the years ahead.

Global trends in real rates minus real growth

Data underlying Bank of England SWP 845, ‘Eight centuries of global real rates, R-G, and the ‘suprasecular’ decline, 1311-2018’.

This is of immense importance because it hints at several critical trends:

- Sustaining high volumes of sovereign debt without defaulting grows easier over time. So Japan’s debt-to-GDP ratio might not be an outlier but a harbinger of what is to come in Europe and the US.

- Risk premia for risky assets such as equities are largely determined by R-G. If R-G remains low for the foreseeable future, these risk premia should remain low too — barring the usual spikes in risk premia during recessions, etc. This means that equity returns and excess returns over bonds and bills will remain low and continue to decline in the coming decades.

- Declining risk premia imply a sustained increase in valuations so such long-term valuation metrics as the cyclically adjusted PE (CAPE) ratio may never fully revert to their historical means.

These are all big ‘what ifs…?’. But should Schmelzing’s analysis be right, we might have to fundamentally reconsider what is real and what is fake in financial markets.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

By Joachim Klement, CFA, trustee of the CFA Institute Research Foundation.

Image credit: Getty Images / sorbetto