Hostelworld shares fall as it warns of £3.5m coronavirus blow

Hostelworld warned the coronavirus outbreak has hurt 2020 bookings today as the virus ravages the travel sector, after slashing its 2019 dividend to invest in expansion.

The Covid-19 outbreak prompted Hostelworld to warn it will take a €3m (£2.6m) to €4m (£3.5m) hit to earnings before interest, tax, depreciation and amortisation (Ebitda) in the first quarter of the year.

The budget hostel booking site warned the coronavirus outbreak has “challenged” trading since late January as the outbreak spreads across the world.

Bookings have faltered to a “significant” extent and more customers are cancelling trips in the wake of the coronavirus spreading across Europe, Hostelworld warned.

“Given that the depth and duration of the virus outbreak is impossible to forecast at this time, we are unable to calibrate its effect for the balance of the year,” Hostelworld said today.

“However, if near term trends were to persist to the end of March we estimate the impact to Ebitda to be in the range €3m to €4m for the first quarter.

“With continued tight cost control and our strong cash generative characteristics, the Group remains resilient in volatile market conditions.”

That sent Hostelworld’s share price down 11.5 per cent to 92.9p in early trading.

The figures

Hostelworld’s warning came as it revealed profit before tax more than halved in 2019, from €6.7m in 2018 to just €3.01m. Revenue also slipped 1.7 per cent to €80.7m.

While earnings per share jumped from €0.595 a year ago to €0.878, the company also halved its dividend. It did so to pursue “both organic and inorganic investment opportunities”, it told investors. It will pay shareholders just €6.3 per share compared to 2018’s €13.8 payout.

Why it’s interesting

Hostelworld admitted its business is suffering as the coronavirus outbreak continues to devastate world travel. Countries have imposed restrictions on international flights and a slump in demand has forced airlines to cancel flights to destinations like China and Italy.

That has had a knock-on effect on the hostel booker, which said its Asian market and European market have suffered as a result.

Europe revenue slipped 4.2 per cent year on year to €46.9m in 2019. While Asia, Africa and Oceania revenue rose marginally to €18m, overall revenue dipped to €80.7m, from €82m in 2018.

And Hostelworld warned: “Trading since late January has been challenged by the outbreak of the Covid-19 virus, which is having a significant impact on global travel demand, within Asian markets and more recently within the European market.”

Marketing costs have also risen as a percentage of net revenue as bookings fell, it said.

What Hostelworld said

Chief executive Gary Morrison said:

Overall, the group sees significant potential for the further deployment of capital to enhance future growth through both organic and inorganic investment opportunities. As a result, the Board has taken the decision to rebase the dividend policy.

A rebased progressive dividend with a pay-out of between 20 and 40 per cent of adjusted profit after tax will enable investment in organic and inorganic opportunities, which should see shareholder return increase in the medium to long term.

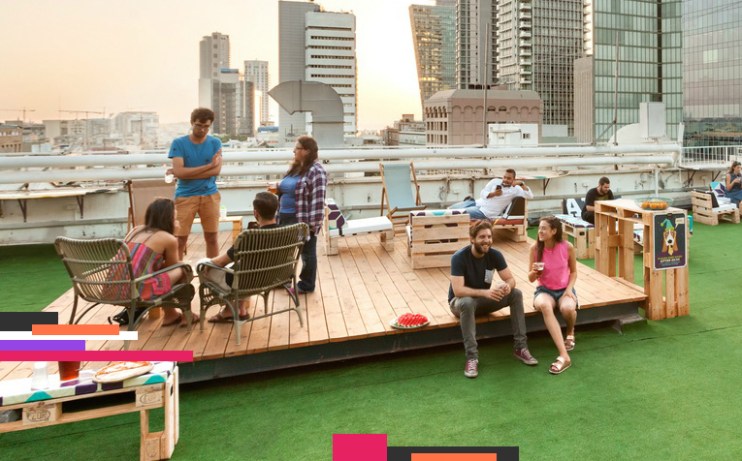

Main image credit: Hostelworld