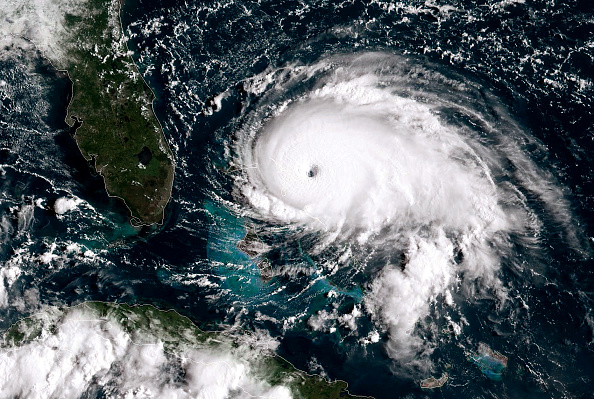

Profit at Hiscox blown away by hurricanes and typhoons

Insurer Hiscox said today its 2019 profit was hit hard by large catastrophes such as Hurricane Dorian and Typhoons Faxai and Hagibis.

The Ftse 250 company’s profit before tax fell 60 per cent to $53.1m (£41.3m) for the 2019 calendar year.

Earnings per share fell from 31.2p to 13.5p and net asset value per share fell from 627p to 580p.

The group’s combined ratio climbed to 105.7 per cent, from 94.9 per cent. A combined ratio over 100 per cent indicates that an insurer is not making an underwriting profit.

Gross written premiums increased to $4.03bn, from $3.77bn the previous year,

The company said it set aside $165m for Hurricane Dorian and Typhoons Faxai and Hagibis, in addition to $25m of reduced fees and profit commissions.

Investment return jumped to $223m from $38.1m the previous year.

The company upped its full year dividend 3.5 per cent to 29.6 cents.

Chief executive Bronek Masojada said: “Our strategy of balance, between big-ticket lines and our more steady retail earnings, provides resilience and opportunity. Our growing retail profits and strong investment return has enabled us to weather a third consecutive year of storms. We are investing for growth as we look to capture the many opportunities we see ahead.”

Hiscox said it was too early to estimate the impact of the coronavirus. It said its main areas of potential exposure are event cancellation, travel and personal accident cover. It said it had received notifications of small claims to date.

Masojada said: “We have had a few small claims so far. Only 10 per cent of our events customers buy pandemic exposure and that is only triggered when the government or World Health Authorities declares it a pandemic.”

The insurer said: “Pandemic is only covered in a very small part of the portfolio where we have very controlled net exposure.”

Masojada said the broader concern about coronavirus was the impact on economic growth, but said the nature of the business meant Hiscox was well-placed to weather a slowdown.

“We are a very defensive sector; I am not worried. You have to carry on buying your insurance for your car, house or business, even in a slowing economy,” he said.

Analysts at Jefferies said: “Though 2019 earnings were undoubtedly disappointing, Hiscox remains focused on protecting the balance sheet, with high reserve buffers, cautious loss picks and moderate risk exposure. While this prudence limits near-term earnings (and upside), it also limits downside risk at a time when investors question the reserving of peers.”

Hiscox said it had received 112 claims after recent UK flooding, of which 50 per cent are reinsured with government government backstop Flood Re. The insurer said its UK flood and storm claims would be capped at £10m.

Hiscox shares rose 4.4 per cent to 1,280p this afternoon.