Chipmaker revenue slips amid global oversupply and smartphone slowdown

Global semiconductor firms suffered a decline in revenue last year as a huge oversupply in the market and a slowdown in smartphone sales took their toll.

Semiconductor revenue totalled $418.3bn (£322bn) in 2019, down almost 12 per cent on the previous year, according to figures from research firm Gartner.

This was driven by a huge oversupply in the memory market caused by slowing demand from so-called hyperscale computing, as tech giants such as Google, Amazon and Alibaba slowed investment in their data centres.

This was coupled with a slowdown in smartphone sales in recent months, with consumers holding on to their devices for longer and demand for the latest gadgets waning.

The decline took its toll on many of the top chipmakers including Samsung Electronics, which lost its position as world’s leading semiconductor vendor by revenue.

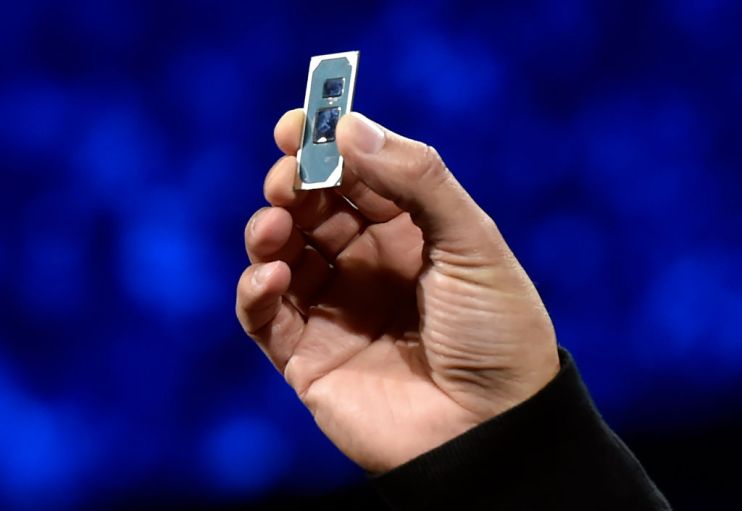

Intel, which last year sold its smartphone chip business to Apple for $1bn, reclaimed its position as the world’s top semiconductor firm with revenue of almost $66m.

Andrew Norwood, research vice president at Gartner, said the oversupply was a normal trend in the memory chip market, which he described as a “boom and bust industry”.

Semiconductor revenue is expected to rise again in the coming year thanks to a rebalancing of supply and demand.

Norwood added that while the trade war between the US and China appeared to be dying down, the market could be affected by President Donald Trump’s decision to add Chinese firms such as Huawei to a trade blacklist last year.

“The immediate impact was to push Huawei into looking outside the US for alternative silicon suppliers, with wholly-owned Hi Silicon at the top of the list as well as alternative suppliers based in Japan, Taiwan, South Korea and China,” he said. “This will be an area to watch in 2020.”