Eight things investors need to know about energy storage

With renewable energy growing in importance, effective storage will be vital. And as costs continue to decline, the potential to achieve growth could be huge.

Why is the roll out of energy storage so important for achieving the Paris Agreement targets?

Decarbonising the electricity supply will require a huge expansion of renewables to replace thermal generation. Doing this raises the problem of renewables’ intermittency: how do we cope when the wind isn’t blowing and the sun isn’t shining? In addition, the variability in generation that results from adding renewables into the energy mix can put an enormous strain on the grid.

Storing renewable energy with lithium-ion batteries can play a key role in solving this issue. Adding as little as four hours’ worth of storage to renewable projects can enable them to better match supply with demand. Adding storage effectively ‘firms up’ the supply of electricity and goes some way to giving it the reliability characteristics of fossil fuels, as well as being able to ease pressure points on the grid.

Why is growth taking off now?

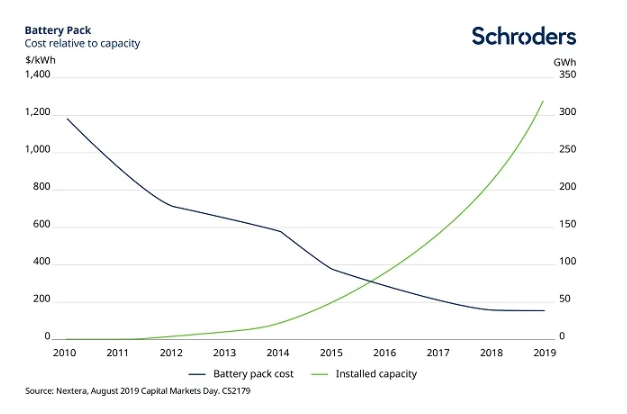

The key reason is cost: battery pack costs have fallen from more than $1,000/kWh (kilowatt hour) in 2010 to less than $200/kWh today.

On the demand side, certain geographies are already feeling the strain of having a high percentage of renewables in their energy mixes. This is exemplified by the ‘duck curve’ which shows the imbalance between renewable generation and peak demand in California.

Some utilities are already stipulating that responses to renewable generation tenders must include a provision for storage. NextEra Energy, the leading developer of renewables in the US, said in March 2019 that 40% of the contracts it signed in 2018 included storage.

What is the expected cost trajectory for li-ion energy storage?

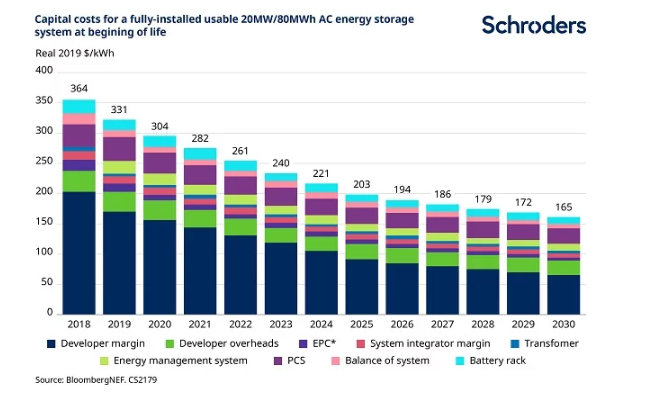

Costs per kWh are expected to continue to decline over the next decade driven by technology advances, scaling up of manufacturing and competition.

The energy storage industry benefits from using similar lithium-ion technology to the electric vehicle (EV) battery industry. As the supply chain and manufacturing capacity scales up for the (much larger) EV battery industry, the energy storage market shares in the cost reductions.

How cheap does storage have to be?

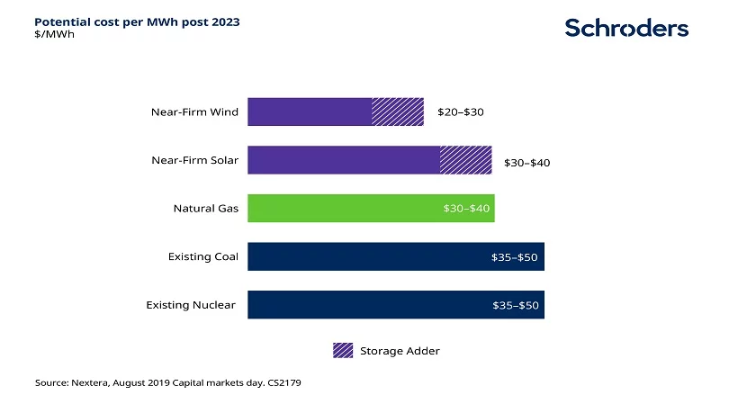

The crucial benchmark for the ‘renewables plus storage’ cost trajectory is the cost of fossil fuel alternatives. Within the next five years, unsubsidised ‘renewables plus storage’ are forecast to be on a par or cheaper than new gas, coal and nuclear in the US.

Incorporating the additional impact of ‘demand side management’ (the adoption of incentive measures to solve the mismatch between energy supply and demand) in the analysis implies that we have already reached that tipping point.

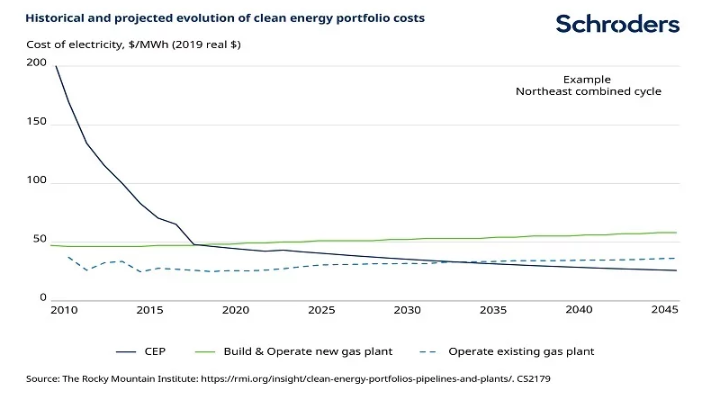

The Rocky Mountain Institute said that ‘Clean Energy Portfolios’ (renewables, storage and demand side management combined) are already cheaper than new gas plants, and that by the early-2030s they will be cheaper than operating existing gas plants. As both of these milestones are crossed we would expect to see positive inflections in growth for the industry.

How has the installed base of energy storage grown?

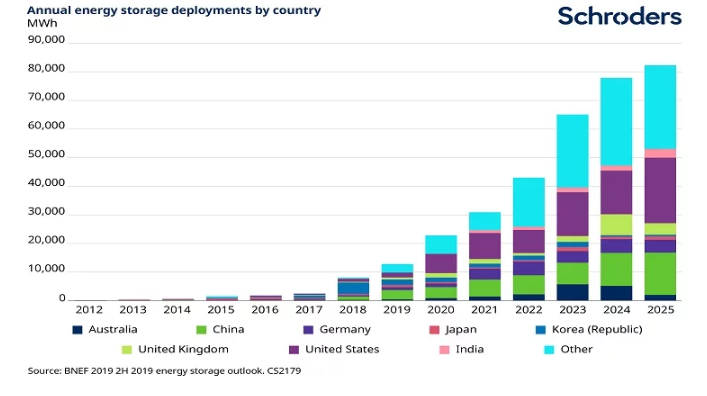

The installed base has grown from 600 megawatt hours (MWh) in 2012 to 15,900MWh at the end of 2018. By the end of 2019 it is expected to reach 28,800MWh and by 2025 the installed base is forecast to jump to 352,800MWh, representing a 39 per cent compound annual growth rate in annual installations between 2018 and 2025 (Bloomberg New Energy Finance estimates). A megawatt hour is equivalent to a steady power of one megawatt running for one hour.

Which countries are leading the way?

South Korea was the largest energy storage market in terms of annual installations in 2018, but China and the US are expected to be the largest single markets in 2020 and beyond.

Which companies are exposed to this trend?

LG Chem, Samsung SDI and Panasonic are producers of li-ion battery cells. Chinese EV battery producer CATL also has an energy storage business. In these upstream parts of the battery value chain, however, it is the EV market which will likely dictate fortunes: the energy storage market can provide a boost but will not be the whole story.

Further down the value chain, US utility Nextera is an installer of utility-scale energy storage in the US and we expect other utilities to build up pipelines of energy storage projects.

Discover more:

– Two lessons from the underperformance of alternative energy

– Is Bill Gates right about the “zero” climate impact of fossil fuel divestment?

– Can we avoid an energy crunch?

At the consumer level, solar inverter companies, such as SolarEdge and Enphase, have broadened their product portfolios to include storage, in an attempt to target the growth of the flourishing home ‘solar plus storage’ markets.

US residential solar installers such as Sunnova, SunRun and Tesla are also in a position to try to capture part of this market. Companies which supply grid equipment, such as Schneider Electric, ABB and Alfen may benefit from the investment required to integrate energy storage into the grid.

Investors in climate change have many trends to watch, how important is this one?

This is an industry approaching an exciting inflection point in growth and is a key part of the decarbonisation puzzle. As investors, we are particularly interested in these moments as the non-linear uptick in growth is typically underappreciated by the market, creating scope for positive surprises.

On the flipside, the growth of this market raises investment risks in the gas industry which has typically been viewed as a bridge to decarbonising the energy supply. More than $70 billion of investment into new US gas capacity is forecast between 2020 and 2025, according to a 2019 report by the Rocky Mountain Institute. And the idea that ‘renewables plus storage’ could start to outcompete operating gas plants by the early 2030s raises questions about the longevity of these assets and the returns on these investments.

In short, the spectre of stranded assets in the gas industry may become a reality sooner than investors think.

- Discover more content from Schroders at Schroders.com/insights and follow them on twitter.

Important information:

As with all investing, the value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Reference to stocks is for illustrative purposes only and should not be viewed as a recommendation to buy and/or sell.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.