Who’s buying UK shares and what does it tell us?

High demand for UK-quoted companies from large and experienced buyers suggests other investors may be overlooking an opportunity.

Will a UK general election on 12 December help break the Brexit stalemate? Possibly, possibly not. The ongoing uncertainty means investors of almost every stripe remain cautious about buying UK equities (shares).

I stress ‘almost’ because some overseas buyers of UK-quoted companies have not lost their appetite. Overseas private equity (PE) or PE-backed buyers are particularly hungry. These are investors who target private companies (i.e. those not publicly-quoted on stock markets) or publicly-quoted companies that they subsequently take private.

Since the middle of this year, PE targets have included cyber security specialist Sophos, aerospace and defence group Cobham, theme park operator Merlin Entertainments and UK pubs business Greene King, with the latter two transactions having already completed.

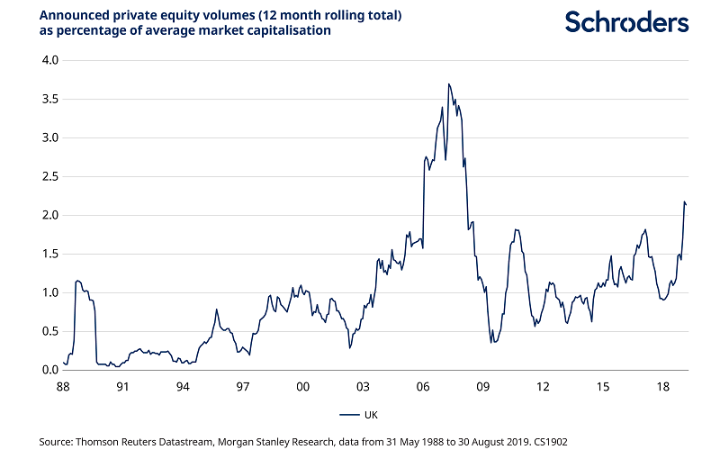

Such deals have contributed to a sharp pick-up in announced UK PE activity, which is now at 10-year relative highs (see chart, below). In addition, we’ve seen overseas companies bid for mass media group Entertainment One as well as the London Stock Exchange and food delivery platform Just Eat.

Plans by Just Eat to merge with Netherlands-based Takeaway.com have been gatecrashed by South African technology conglomerate Naspers.

So, what is driving this interest when other investors in UK publically-quoted shares remain highly circumspect?

UK shares could be at an important juncture

To my mind, this overseas corporate and PE interest is further evidence of the opportunity offered by UK shares. It comes at a time when they are trading at a 30 per cent valuation discount to global peers, close to a 30-year low. For a detailed explanation of the valuation metrics which are used to calculate this discount please see Three reasons why the UK stock market looks compelling.

While UK shares look compelling, many investors crave certainty in order to back them. Such certainty is unlikely until we know the shape of the next government, and a path towards resolving Brexit becomes clear. It is by no means guaranteed the UK will achieve a smooth departure from the EU by 31 January – the new Brexit deadline – followed by an orderly transition period.

At what could be an important juncture, we suggest investors carefully review their UK exposures.

The current hiatus ahead of polling day is perhaps a good opportunity to assess your state of readiness for the possible market, economic, monetary and fiscal policy impacts ahead.

Both fiscal and monetary policy attempt to reduce economic fluctuations. Monetary policy regulates the supply of money in an economy using interest rates and other methods, and is controlled by a central bank. Governments set fiscal policy by adjusting spending and taxes.

The sharp pick-up in UK PE deals has led a European-wide recovery in such activity this year. But it is only the latest expression of a buoyant market for UK “inward” mergers and acquisitions (M&A) (the buying, selling or combining of companies).

Overseas acquirers spent more than £70 billion on UK-registered companies in 2018, according to the Office for National Statistics, based on completed deals. This includes the acquisition of Sky by Comcast of the US, which paid more than £30 billion for the broadcaster during a frenzied period of consolidation within the global media sector.

For more views on the UK stock market and economy:

– How might the UK economy react to different Brexit scenarios?

– What Thomas Cook’s collapse tells us about the power of disruption

– How damaging are the latest interest rate cuts for European banks?

Broadly speaking, the values, when stripping out very big deals, were in line with other post-global financial crisis years. However, considering the veritable tidal wave of UK fund outflows since the EU referendum, such resilient appetite for UK enterprise is eye-catching.

This enduring enthusiasm has come at a time when UK equities are in the doldrums. They have underperformed their global counterparts since 2016 following the UK’s vote to leave the EU.

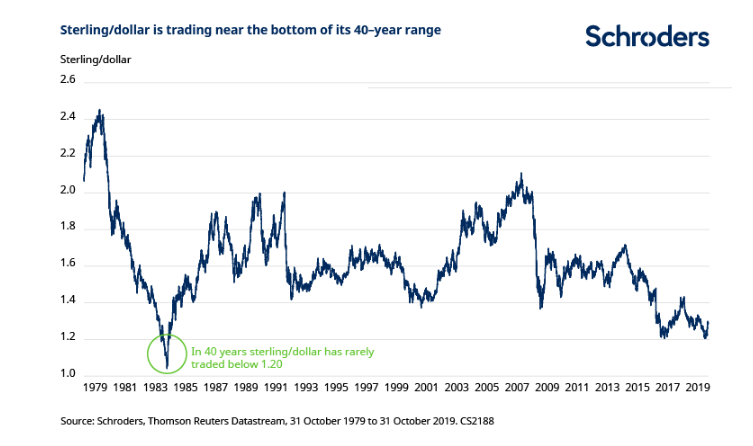

The situation has resulted in appealing valuations relative to other markets. Readily-available cheap debt financing due to low interest rates, and, from the perspective of those based overseas, sterling weakness (see chart, below), have also played their parts in sparking interest among buyers.

What the recent rebound shows us

We found it instructive to see the speed with which domestically focussed UK shares rebounded last month as the risk of a no-deal Brexit on 31 October receded.

The share price recoveries of certain publically quoted investment trusts invested in UK equities was particularly pronounced.

Domestically focussed UK shares have significantly lagged UK overseas earners since 2016 (for background, see Why as an investor I’m looking through Brexit fears). And the recent “Brexit bounce” has only really scratched the surface of redressing this.

Negativity towards the UK equity market is entrenched, and the positioning of investors remains extreme. Global fund managers have been “underweight” the UK for three years, according to the Bank of America Merrill Lynch. That means they have been holding a lower amount of UK equities than they would normally.

UK domestically focussed shares have suffered more than others and in the event that sentiment were to turn for the better, they could recover at speed, which is why we’ve been building meaningful positions while prices are low. Markets have previously recovered from periods of uncertainty and I see no reason why this won’t occur again.

It’s always worth bearing in mind though that the UK equity market is global in nature. International developments often set the tone, and in this regard the ongoing US-China trade discussions and the state of the world economy are important considerations.

Step back and survey

It is a challenge to step back and take a dispassionate measure of markets. In this regard the enduring M&A interest in UK-quoted companies is important.

We are always very interested in how the corporate and PE sectors behave since we share their long-term mentality. Like them, we are focussed on ascertaining the value of companies based on fundamentals, such as earnings or sales and the sustainability of business models.

Our job is to use all this information to find shares that the market has mispriced. The rewards of such an approach should be higher today as the time horizon of the average equity investor has shortened. This is partly due to the rise of short-term and “passive” strategies which replicate the performance of a specific benchmark or standard, such as an index or a market average.

As a result, investors seem more susceptible to herd behaviour, a tendency which can result in extremes, and certain areas of the UK equity market look extremely unloved to me at the present time.

Many of the companies being targeted in this wave of M&A are high quality businesses whose prospective new owners likely see an opportunity to foster growth. Technology platforms such as Just Eat and BCA Marketplace (owner of the WeBuyAnyCar.com portal, whose acquisition by a PE buyer completed this month) look to be doing the disrupting and are in expansion mode.

Meanwhile, speciality pharmaceutical company BTG, whose acquisition by Boston Scientific recently closed, had independent designs to become a world-leader in interventional medicine.

We continue to find quality companies to invest in at reasonable prices and take a highly selective approach when choosing between investment opportunities. We are focussed on companies with sustainable and robust business models, with a strong emphasis on balance sheets and accounting. A weak balance sheet can hamper the ability of a company to invest in its operations or respond to changing market conditions.

In the event UK shares were to come under renewed pressure, as long-term investors we will remain squarely focused on any resulting new opportunities.

Important Information:

Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. This is not a recommendation to buy or sell any financial instrument/stock or to adopt any investment strategy.

Investments concentrated in a limited number of geographical regions can be subjected to large changes in value which may adversely impact the performance of an investment

Equity [company] prices fluctuate daily, based on many factors including general, economic, industry or company news.

Please be aware the value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Past performance is not a guide to future performance and may not be repeated.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.