Investors expect to take ‘10.3%’ a year from retirement savings

Investors believe they can make aggressive withdrawals from their retirement savings and not run out of money, according to the Schroders Global Investor Study 2019.

Investors believe they will be able to withdraw, on average, 10.3 per cent a year from their retirement savings without running out of money, according to a new global study.

The figure is far higher than long established guidance on how much to take each year to pay an income. In the US, for example, the “4 per cent rule” has been the basis for financial planning in recent decades, although some experts now deem a 4 per cent withdrawal rate to be too high.

The finding was part of the Schroders Global Investor Study 2019, which gauged the views of more than 25,000 investors in 32 locations around the world.

Sangita Chawla, Head of Retirement Savings at Schroders, said: “To see such a high average figure for withdrawals in this market environment was alarming.

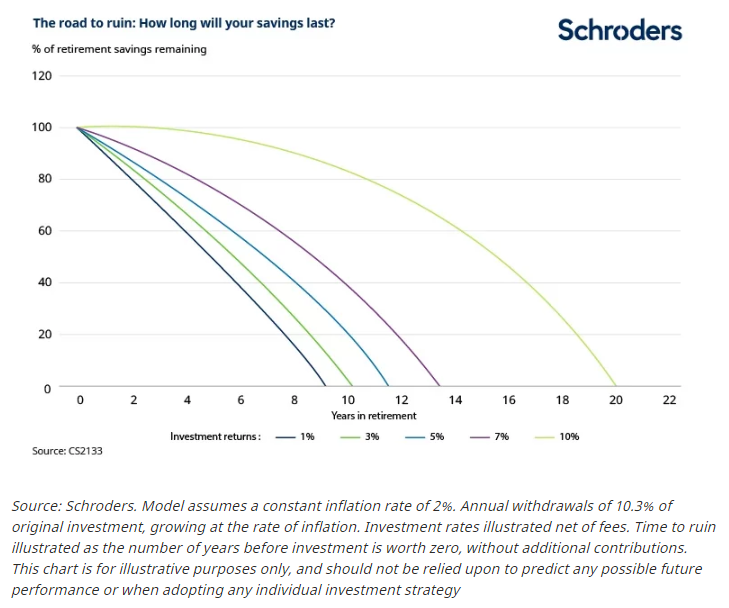

“Our calculations [see below] show that a 10.3 per cent withdrawal rate could deplete a retiree’s savings in a decade.

“So why are investors being so bullish? It could be that too many people are underestimating how long they might live. Consider that global average life expectancy for 65-year-olds has risen from 80 to 82 in the past decade, according to United Nations data.

“Although this differs from men to women, and is likely to increase further in the future, it’s the less developed countries that are ageing most rapidly.

“It’s also possible that people are being more bullish about the amounts they plan to withdraw because they have other sources of income or wealth to rely on.

“These factors aside, it’s fair to say to calculate how long savings can last is not an easy calculation, particularly as you need to factor in inflation, fees and the variability of investment returns. We would always recommend seeking professional help from a financial planner or adviser.”

How long will my savings last in retirement?

The “4 per cent rule” emerged in the early 1990s. From retirement savings of $100,000, an investor would draw $4,000 a year, with the withdrawal rate rising with inflation each year. Taking more than this runs the risk of the money running dry within 30 years, according to the rule.

The chart below, based on Schroders analysis, shows the effects of a withdrawal rate of 10.3 per cent on a portfolio.

Consider investing in a portfolio that aims to generate a real return (after inflation) of 4 per cent per year. After allowing for fees of 1 per cent per year, a retiree would run out of savings in ten years.

For the average retiree living twenty years and wishing to withdraw 10 per cent per year, the same $100,000 would need to be invested in assets that returned 10 per cent per year (after fees and inflation).

It is not only highly unlikely that the retiree would want to take this level of risk, it is also difficult to find portfolios that can deliver this level over a twenty-year period.

To cover a more realistic length retirement of around 20 years, an annual return of 10 per cent, after costs and inflation, would be needed.

The road to ruin: How long will your savings last?

Read more: What is a safe amount to take from a pension?

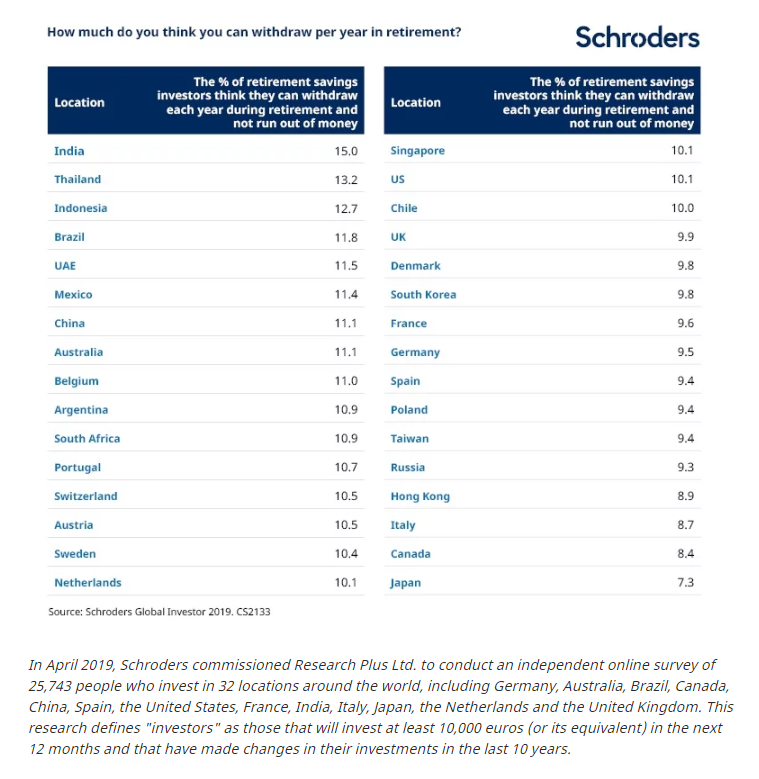

A geographical breakdown

The 2019 Schroders Global Investor Study also highlighted geographical disparities, concerning the average proportion investors feel they can take out of their retirement savings each year and not run out of money. Investors in India had the highest average (15.0 per cent); Japanese investors had the lowest (7.3 per cent).

Regionally, Asian investors (10.8 per cent) had the highest average. Europe (9.8 per cent) was the lowest, while it was 10.4 per cent in the Americas.

A table with the full list of locations and the amounts they think they will be able to withdraw in retirement can be found below.

Schroders’ Sangita Chawla said: “It should be considered that interest rates are higher in some countries, such as India, and that investors might expect better returns.

“But the withdrawal rates look very high around the globe, especially when you consider the lowest rate of withdrawal was a little over 7 per cent.

“That should really set the alarm bells ringing, particularly when real interest rates are negative in developed markets. And while real rates have been higher in some emerging economies, these rates have been falling as well.”

How much do you think you can withdraw per year in retirement?

To read more stories from Schroders Global Investor Study visit schroders.com/GIS

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.