Private equity firm KKR raises record €5.8bn European fund

US buyout firm Kohlberg Kravis Roberts (KKR) has raised its largest ever European fund at €5.8bn (£5bn), as investors look to the region for higher returns.

The flagship fund, which launched in February with an initial target of €5bn, will focus on private equity deals in Western Europe.

Read more: European private equity buyouts climb to 12-year high

“Europe’s complex dynamics create significant opportunities to deploy capital and continue delivering value and outperformance for our investors,” said KKR head of EMEA Johannes Huth.

KKR had already committed over a quarter (28 per cent) of the fund before the fundraising closed on Tuesday.

Deals already struck by the fund include the buyout of German payments group Heidelpay for over €600m, a stake in German publisher Axel Springer, and a 50 per cent stake in Nordic pension adviser and non-life insurance broker Soderberg & Partners.

“We will invest our fifth European fund by maintaining the differentiated approach that has served us so well to date, combining our local country knowledge with the skill and insights of our sector teams to source and execute investments,” said Huth.

Read more: Venture capitalist firm Draper Esprit has managerial reshuffle

The fundraising surpassed KKR’s previous European fund, which closed at €3.4bn in 2015. The firm’s entire private equity platform is currently investing a combined $11.6bn (£9bn).

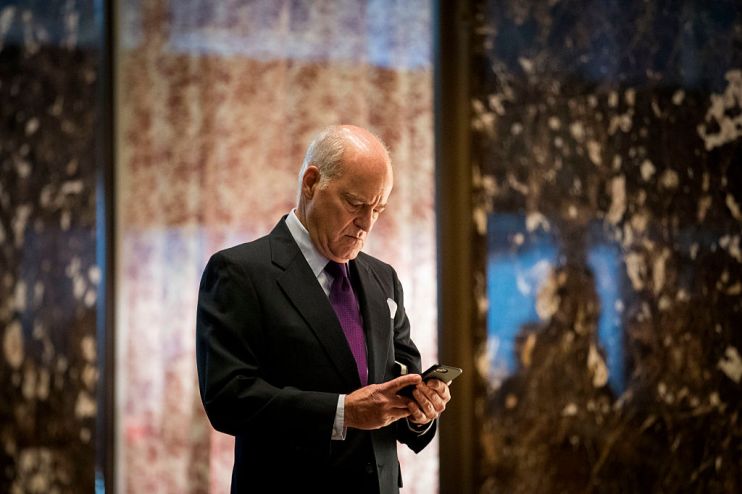

Main image: KKR co-founder Henry Kravis. Credit: Getty