Equinor unveils $5bn share buyback and starts production from massive oil field early

Norwegian state oil giant Equinor today launched a $5bn (£4bn) share buyback as it also promised to bring a massive new oil field online earlier than expected.

The firm said that it would immediately start repurchasing $1.5bn in shares, and will complete that first tranche before the end of February.

Shares bounced on the news, closing the day up 9.15 per cent to €16.70.

“We have over the last years built a strong financial position with solid credit ratings and a net debt ratio around 20 per cent,” said chief executive Eldar Saetre.

The company’s main shareholder, Norway, will keep its 67 per cent stake undiluted.

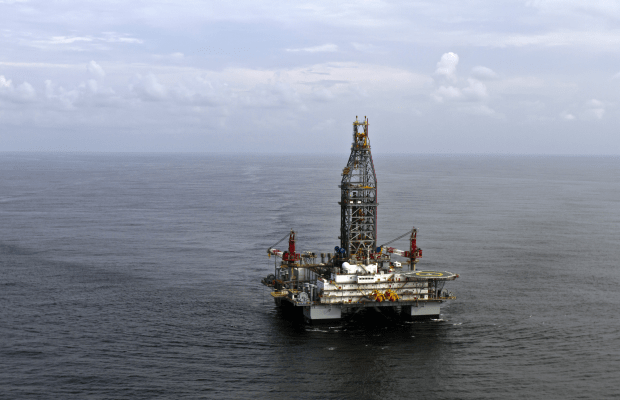

Meanwhile Equinor said it would start pulling oil from the Johan Sverdrup in the North Sea in October, a month ahead of what it had expected.

In a note, UBS analysts said the progress on the field and the buyback “signals positive progress from the board.”

“We believe sector shares are cheap,” they said, pointing to the fact that the company’s shares have fallen 21 per cent so far this year when measured in US dollars.

The Johan Sverdrup, which was the biggest discovery in the North Sea for three decades, will produce cheap energy for the company.

It comes as other firms, especially US majors, scale back from the dwindling basin.

Earlier Reuters revealed that US giant Exxon Mobil has agreed to sell all its assets in Norway for $4bn. Exxon did not confirm the reports.

The news would mark the end of Exxon’s business in the country after more than a century there.

It comes after the firm in June said it was looking to sell the portfolio, including stakes in several fields run by Equinor and Shell.

Its parts of the 20 fields produced around 170,000 barrels of oil equivalent per day in 2017.

Read more: Exxon Mobil prepares exit from the British North Sea

Sources told Reuters that the company has held talks with Equinor and a handful of other potential buyers. The sources did not reveal which of the potential bidders has won the race for the fields.

Exxon is reportedly also looking to sell its British North Sea stakes.