Financial markets 2018: the year in review

After two years of steady growth in asset prices, 2018 proved more of a challenge for investors, particularly in the last three months of the year.

US president Donald Trump’s tax cuts had provided an added boost for investors heading into 2018, and US GDP growth accelerated to 4.2 per cent on an annualised quarterly basis in Q2. However, economic growth elsewhere, notably in the eurozone, decelerated and global growth became less synchronised.

Meanwhile the prospect of fading US policy support in 2019, together with escalation in the US-China trade conflict, reduced monetary stimulus and global growth concerns eventually took their toll on investor confidence.

Stock markets in particular have suffered in 2018. Stocks have been a major beneficiary of the low interest rate and loose monetary policy environment since the global financial crisis. Companies have been able to borrow money cheaply to strengthen their balance sheets while also benefiting from a pick-up in demand as the global economy recovered.

Low interest rates have also driven down the yield on other asset classes such as bonds, creating even greater demand for stocks which have a higher yield. For instance, UK government bonds yield around 1.3 per cent compared with the FTSE All Share Index which yields around 4 per cent.

Now that interest rates have started to rise and monetary policy is beginning to tighten, investors have begun to speculate how company profits will be impacted. As a result volatility has picked up.

During the last three months of the year the Chicago Board Options Exchange Volatility Index (VIX), otherwise known as the “fear gauge”, hit its highest level (25.2 per cent) since February 2018, when concerns over economic growth in China caused stock markets to retreat. The higher the level of the VIX the more likely it is that investors see a market-moving event happening in the next six months.

Stock markets suffer in Q4 2018

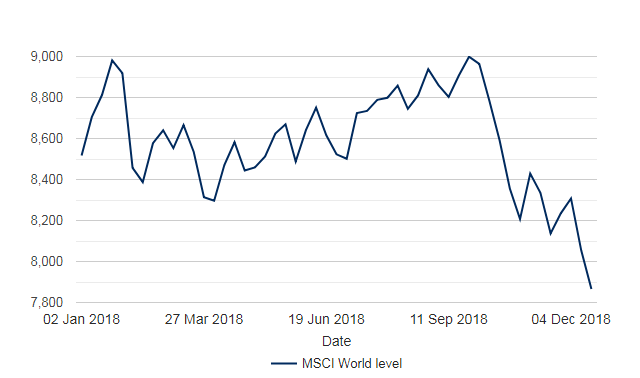

Global stocks have fallen 7.1 per cent in 2018, according to the MSCI World Index as at 18 December. Gains in the first nine months of the year were erased and then some in the final three months. Global stocks gained 6.1 per cent in the first three quarters of 2018, but stocks fell more than 12.0% in the third-quarter of 2018.

The MSCI World Index in 2018: stocks fall sharply in Q4

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv data for The MSCI World Index in US dollars as at 19 December 2018.

Worst quarterly performance in seven years

The fall in the MSCI World Index in the last three months of 2018 means global stocks are on course for their worst quarterly performance in seven years, as at 18 December 2018.

Regionally, for the whole of 2018, US and Japanese stocks are the laggards, among the five major stock markets we examined.

The US S&P 500 and Japan’s Nikkei 225 both fell 12.9 per cent. The best performing stock market was the FTSE 100, but that was still down 10.6 per cent. The Stoxx 600 in Europe was down 11.0 per cent and the MSCI Emerging Markets Index was down 12.8 per cent.

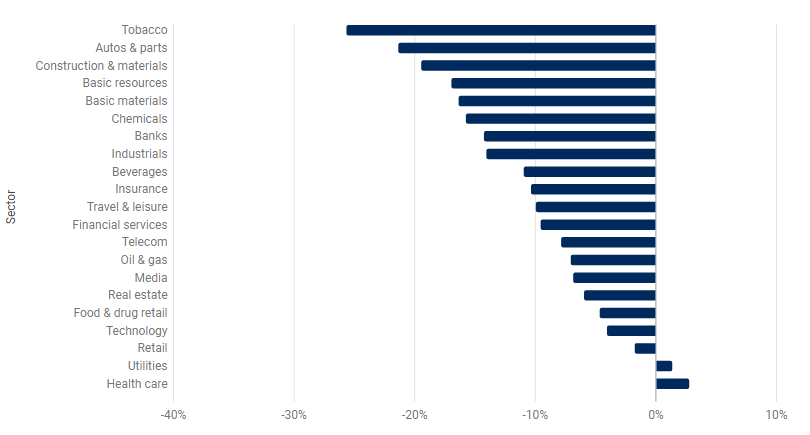

The best (and worst) performing sectors in 2018

Utilities and health care are the only two sectors in positive territory approaching the end of 2018. They are traditionally referred to as “defensive” sectors because the goods and services they supply should remain in demand even if the economic outlook isn’t great.

Among the worst performing sectors are basic resources and materials, which are used in construction, as well as banks and autos. These are traditionally referred to as “cyclical” sectors because demand for the goods and services they supply is typically dependent on the health of the economy: the better the outlook, the better they should perform.

The main outlier was the tobacco sector, which is usually considered defensive. However, it was the worst performing sector this year due to concerns that US regulators are planning to ban menthol cigarettes.

The sectors that performed the best (and worst) in 2018

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv data for Thomson Reuters World Index of sectors in US dollars as at 19 December 2018.

Bonds yields rising

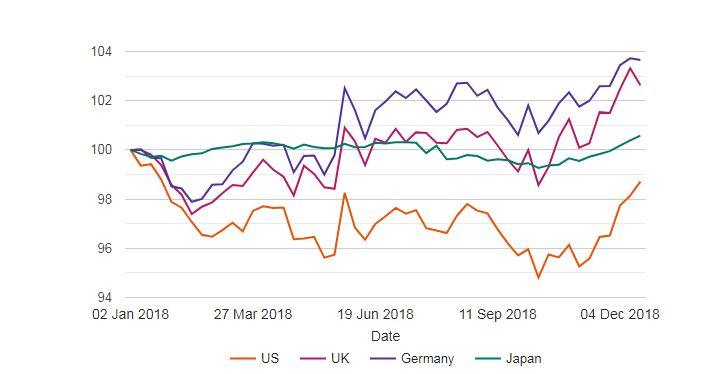

The story of government bonds through 2018 has largely been a story of strengthening economic growth and rising rates in the US versus country specific, often political factors, elsewhere.

The negative total returns of US 10-year Treasuries reflects the increase in the benchmark yield, which rose from 2.41 per cent to 3.01 per cent between the start of the year and the end of November. Bond bond yields rise when bond prices fall.

Strong growth, wage inflation, rate hikes and a seemingly more hawkish Federal Reserve chair all contributed to persistent upward pressure on yields. The significant 3 per cent yield level was broken in September. It remained above that level until early-December when risk aversion returned.

In Europe, the key stories were the slowdown in economic growth and the victory for populist parties in Italy, who subsequently formed a coalition government. This resulted in 10-year Bund yields falling from 0.42 per cent to 0.31 per cent, even as the European Central Bank announced the end of monetary stimulus. Italian 10-year bond yields rose from 2.00 per cent to 3.21 per cent when the coalition government announced a proposed budget which led to friction with the EU. Italy has now reached agreement with the EU which keeps it out of the “excessive deficit procedure”, where the EU monitors a country’s debt. Italian bond yields haven fallen to 2.75 per cent since, but still remain elevated.

UK gilt yields rose from 1.19 per cent to 1.37 per cent. The overall driver was continued above-target inflation, a consequence of weak sterling following the Brexit referendum, and expectations of interest rate hikes. The Bank of England increased rates in August. The relationship between bond yields and Brexit news has not always been clear; however, the 10-year yield declined immediately following the announcement of the draft Brexit withdrawal agreement on 14 November.

The total return of government bonds in 2018

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv total return data for 10-year UK, US, German and Japanese government bonds correct at 19 December 2018. Data rebased to 100 to provide a better comparison.

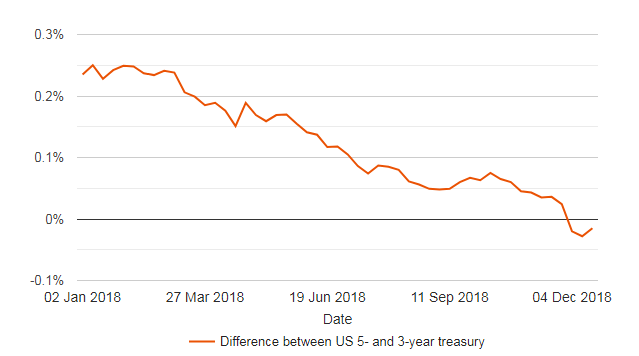

Is the US yield curve signalling a recession?

Over the last 60 years the US yield curve has been a good indicator of recessions to come, usually within the following 18 months. In particular, investors look at the timing of when the yield curve inverts.

Put simply, the yield curve is difference between the yields of two bonds, one long dated and one short dated. The theory being that if it costs less to borrow money in the short-term than it does in the long-term then that is an indication that investors expect the economy to grow.

Typically, it should cost more to borrow money now than in the future. That’s because if the economy is expected to grow, over time prices should rise.

Inflation, which is the rising costs of goods and services, erodes the fixed returns of a bond and investors tend to want compensation for taking on that risk and therefore demand a higher yield for longer dated bonds.

But when long term yields fall below short term yields, known as an inversion, the curve may indicate a recession is on the horizon.

The yield curve inverted very recently. As the chart below shows, in the first week of December, the yield on the three-year US Treasury fell below the yield on the five-year Treasury. While it is an indicator, it does not necessarily signal a recession. Usually, economists look at when the yield inverts over a full quarter, because that’s how long growth takes to be reported, along with other indicators.

The yield curve inversion: three versus five year US Treasuries

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv data for the three and five-year US Treasury correct at 19 December 2018.

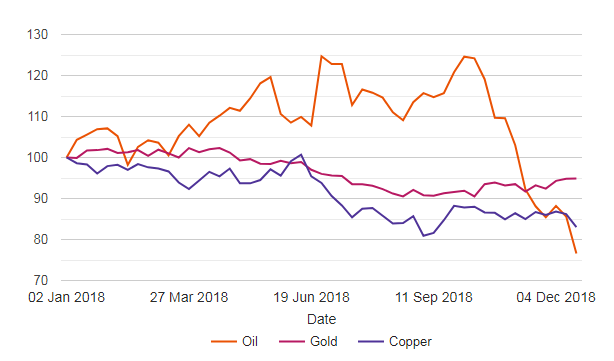

What’s happened in commodities?

Commodities are often seen as a bellwether for the global economy. If the prices of commodities such as oil and copper are rising, then it could be taken that investors see a more robust economic outlook. However, if they are falling and gold is rising, then investors are seen to be more cautious.

Commodities such as oil and copper are fundamental to a thriving economy. Oil is used in the production of goods and services, while copper is used throughout the construction of buildings and houses. If the demand for construction is strong, so too should be the demand for oil and copper. If the reverse is true then investors tend to put their money into gold because gold is a physical asset, more easily converted into cash and seen as protection against inflation.

As the chart below shows, while oil and copper have fallen, gold has largely retained its value.

How oil, gold and copper performed in 2018

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv data for the Crude-Oil WTI, Gold Bullion and LME-Copper correct at 19 December 2018.

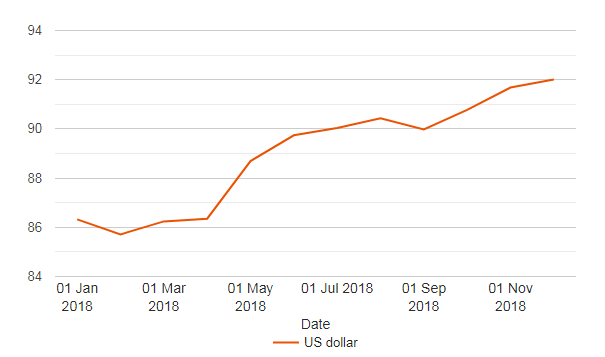

The continued strength of the US dollar

Part of the problem facing global markets and commodities is the continued strength of the US dollar. It hurts commodities in particular because they are priced in dollars. A strong US dollar means commodities become more expensive because of the exchange rate.

Another issue is that a lot of the world’s debt, both company and government, is borrowed in US dollars. Again, a strong US dollar means that for foreign borrowers, debt becomes more expensive to repay, which hurts company profits and increases government deficits. This is because in local terms they will owe more money as a result.

As the chart below shows, the rise in the value of the US dollar shows no sign of halting in the short-term. However, the inversion of the yield curve suggests that investors are speculating that the pace of US growth and the rise in interest rates could slow, which could affect the value of the dollar.

The rise of the US dollar

This material is not intended to provide advice of any kind. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Past performance is not a guide to future returns and may not be repeated.

Source: Schroders. Refinitiv data for price of US dollar against a basket of major currencies as at 19 December 2018.

Peter Harrison, Group Chief Executive at Schroders, offered his view of the market in 2018 and the outlook for 2019. He said: “2018 was the year in which the long term sustainability of business models started to influence how the market prices companies.

“We have seen criticism of some practices of large technology companies leading to falls in their stock prices, and increasing physical damage caused by climate change; inequality between generations has led to political turmoil in several European countries. Across our investment decision-making an eye on sustainability is becoming more and more critical.

“We recently published a 10-year outlook for markets, Inescapable investment truths for the decade ahead.

“This highlighted the modest return prospects from public markets, given lower rates of economic growth than in the past and the low level of bond yields.

“2019 will fit that pattern, with positive returns likely, but investors having to work hard – both through asset allocation and security selection – to augment low headline market returns.”

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.