£62bn of spending cuts needed to balance books, IFS forecasts

Liz Truss and Kwasi Kwarteng will need to slim the size of the state by £62bn to put the UK’s public finances on a stable footing, a top economic think tank said today.

The prime minister and chancellor could be forced to reduce education and transport spending, which suffered deep cuts during the David Cameron and George Osborne austerity years after the financial crisis, to balance the books, according to the Institute for Fiscal Studies (IFS).

Truss and Kwarteng have banked on a sweeping set of supply-side reforms to the economy and lower taxes boosting growth to pay for their fiscal strategy.

The plans in their current form rely on a short term borrowing splurge to pay for £43bn of tax cuts and capping household and businesses’ energy bills.

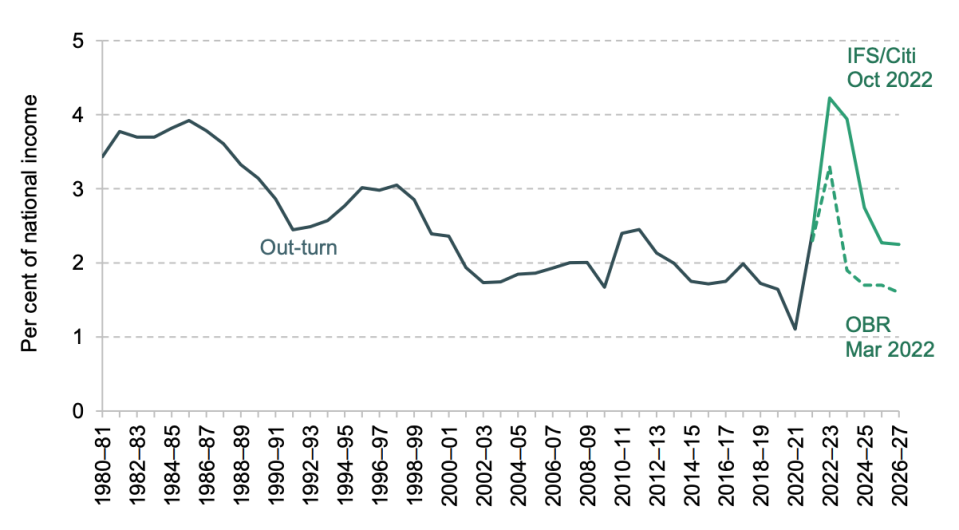

As a result, the IFS said Truss and Kwarteng will heap £194bn of debt onto the UK’s public finances, £94bn more than forecast by the Office for Budget Responsibility (OBR) last March.

Borrowing is set to hover around £100bn per year until 2026.

Kwarteng will outline his plans to get debt on a sustainable path in a bid to soothe market jitters on 31 October. The OBR will publish fresh forecasts the same day.

The chancellor and prime minister believe scaling back the size of the state, slashing red tape on businesses and allowing Brits to keep more of their money by slashing taxes will lift growth in the long-run, easing the burden on the public finances.

But, according to forecasts from investment bank Citi – which the IFS based its calculations on and account for the government’s mini budget – the UK economy will expand 0.8 per cent each year over the next five years, far below Truss and Kwarteng’s 2.5 per cent self-imposed target.

Paul Johnson, director at the IFS, took aim at the government’s decision to announce billions of pounds of unfunded tax cuts last month without an independent assessment from the OBR, which prompted investors to ditch the pound and UK debt.

“The specifics of the UK government’s fiscal strategy are under more scrutiny by financial markets than at any point in the recent past,” he said.

“The chancellor should not rely on over-optimistic growth forecasts or promises of unspecified spending cuts. To do so would risk his plans lacking the credibility which recent events have shown to be so important,” Johnson added.

The IFS and Citi’s projections of the scale spending cuts required to balance the books comes as councils and local authorities are already struggling to deliver effective public services due to high inflation.

The report said Truss and Kwarteng would need to inject a further £37bn into public services to protect their generosity.

Inflation is on course to peak at 12 per cent, Citi projected, despite the government freezing typical household energy bills £2,500 for two years.

The Bank of England will hike interest to 4.5 per cent in response to the price surge, the report said. The central bank has already done so seven times in a row to 2.25 per cent, including two back-to-back 50 basis point rises.

Analysts warned the investors are being spooked by Truss and Kwarteng pulling in an opposite direction to Bank governor Andrew Bailey.

“Monetary policy is now in acute conflict with looser fiscal policy,” Citi said

“This is destabilising and could well make recovery more painful and more delayed. Given the level of uncertainty, the monetary policy committee may effectively be forced to ‘overcompensate’ for any short-term fiscal support – driving weaker outcomes in the medium term,” the investment bank added.

A combination of higher prices and borrowing will swell the UK’s debt interest bill to £103bn this year and keep it above £60bn by 2026.

A large chunk of the UK’s debt stock is linked to an old measure of inflation, meaning the amount of money the government pays back to investors rises when prices increase.

UK debt interest bill is on course to balloon

A treasury spokesperson told City A.M.: “Through tax cuts and ambitious supply-side reforms, our growth plan will drive sustainable long-term growth, which will lead to higher wages, greater opportunities and sustainable funding for public services.”

“The government is committed to fiscal responsibility and getting debt falling as a share of GDP in the medium term. The chancellor will set out further details in the medium term fiscal plan on 31 October, alongside a full OBR forecast.”