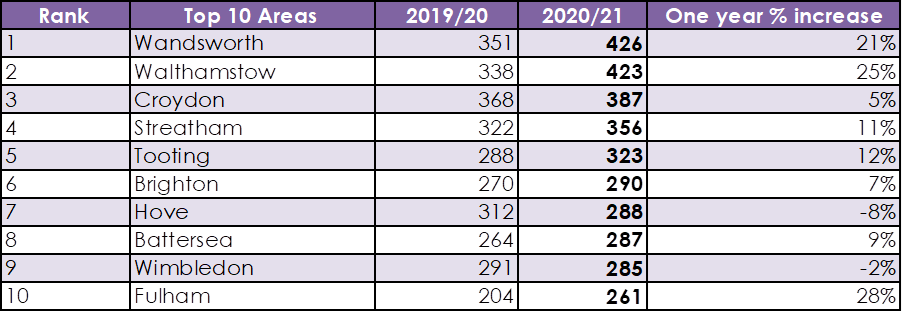

4.5x borrower’s earnings: ‘Risky mortgages’ rising fast, mostly in Wandsworth, Walthamstow and Croydon

South London is the UK’s hotspot for high-risk mortgages – with more than 6,300 mortgages written at 4.5 times the borrower’s earnings or higher in the last year, according to new research shared with City A.M. this morning.

Bank of England guidance says mortgages are considered ‘high-risk’ if they are lent at 4.5 times the applicant’s salary or above. Those with high-risk mortgages may be more likely to be unable to keep up with payments – and perhaps even default – during times of financial difficulty.

Traditionally South West London has been home to the highest concentration of risky mortgages.

Now that risk is expanding to South East London as more young professionals look to buy homes in ‘up and coming’ areas that are rapidly gentrifying, such as Croydon (387) and Streatham (356), according to research from tax firm Mazars.

Wandsworth

Wandsworth was the area with the most risky mortgages – with 426 written at 4.5 times the borrower’s earnings in the past year, a 21 per cent increase on last year. This places it first out of 2,763 areas of the UK for risky mortgages.

Wandsworth is joined in the top ten by five other South London areas, Croydon, Streatham, Tooting, Battersea and Wimbledon.

The number of high-risk mortgages in South London has risen as the area continues to see money pumped in to redevelopment projects such as the Northern line extension and the £9bn Battersea Power Station redevelopment and the redevelopment of Nine Elms including Embassy Gardens.

As developments continue, lenders expect an increasing demand for housing and are comfortable offering higher-risk mortgages to those they see as stable earners.

As a whole the UK has seen a rise in the total number of high-risk mortgages given out with 97221 written in 2020/21 – up from 96720 in 2019/20.* In the first quarter of 2021 high-risk mortgages made up 12.6 per cent of all mortgages up from 11 per cent five years ago.

“South London has long been a favourite area for mortgage lenders. The Stamp Duty holiday and the boom in house purchases has led to some lenders writing more lending than ever before in the area,” said Paul Rouse, partner at Mazars.

“However the PRA has a limit on how much risky-mortgage lending banks can do in total for a reason,” he said.

“But with interest rates expected to remain steady some lenders continue to feel comfortable offering mortgages at high earning multiples,” Rouse concluded.