3i starts to enjoy fruits of Simon Borrows’ turnaround plan

The UK’S oldest private equity group 3i topped the FTSE 100 yesterday after revealing another set of thumping results, bringing the curtain down on a dramatic turnaround which has transformed the once-underperforming company.

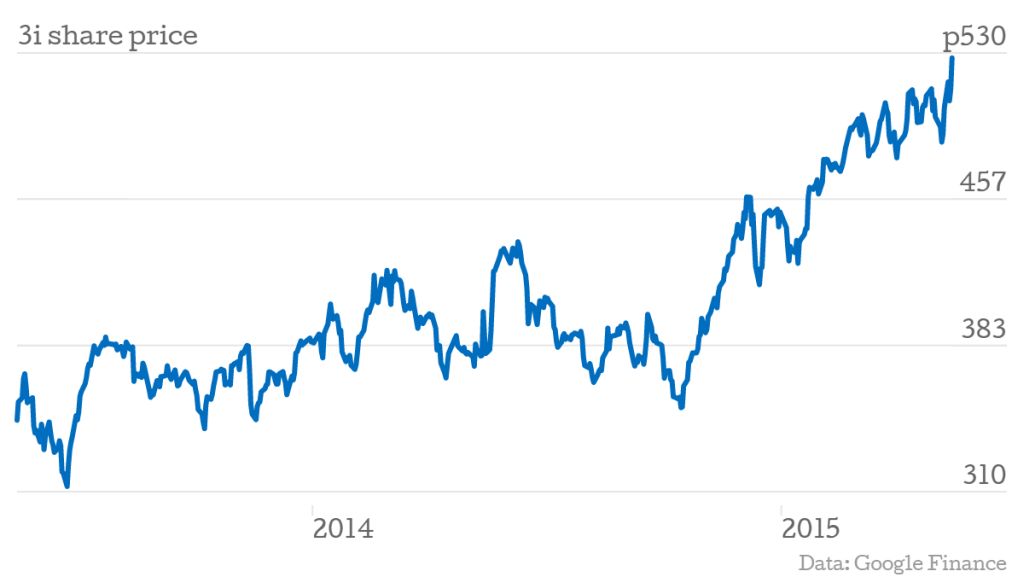

Investors applauded the end of the three-year initiative to streamline the firm by chief executive Simon Borrows by sending shares 15.5p higher to £5.27 a share.

3i, once known as Investors in Industry (III), made nearly £720m in investment returns last year, while the value of its asset portfolio also rose 14 per cent. This was despite currency fluctuations cutting the value of the portfolio by £114m.

The feel-good factor stands in stark contrast to a dark period three years ago when investor unrest and the departure of former chief executive Michael Queen left the firm reeling. Negative total returns totalling half a billion pounds and a share price slide put the company in a precarious place.

“The group economics were not working,” Borrows told City A.M. yesterday. “There were too many people in too many offices doing too many things. I have tried to focus the business back to its core.”

Borrows, a former investment banker at 0 who acted as a trusted adviser to 3i for many years and knew the firm inside out, made three key decisions: he closed offices, introduced closer scrutiny of portfolio companies, and expanded 3i’s interests away from its core private equity activities.

Underperforming bosses at portfolio companies were removed, monthly grillings of management were introduced and Borrows took over as chairman of the firm’s investment committee, giving the chief executive more oversight of investments.

“We were much more active in the management of portfolio companies. We really held the feet of the investment teams to the fire against a set of key performance indicators,” he said.

Yesterday’s results seem to show the strategy paid off, with portfolio performance earnings up 19 per cent this year, compared to 9 per cent in 2012.

But what’s next for Borrows after the turnaround? “There’s still a lot more to do,” he said. “I’m not looking to put my feet up.