28 months later: are European equities back on investors’ radar?

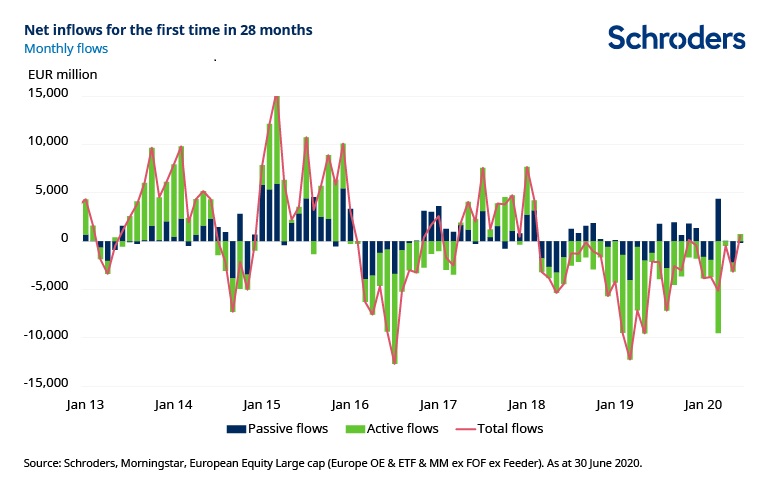

European equity flows turned positive in June for the first time in 28 months – we look at what might be reviving investor interest in the asset class.

It’s been a tough couple of years for pan-European equities. A combination of political worries, including Brexit, and weak economic growth means many investors have shunned the asset class. Equity investors have tended to favour the US instead.

However, there are tentative signs of renewed interest in Europe from investors. The chart below, which uses data from Morningstar, shows that there were positive flows into actively managed European equities in June. This comes after 28 consecutive months of flows out of active funds in the asset class.

What could be sparking this renewed interest? Firstly, Europe has had relative success in containing the coronavirus. While a number of countries – notably Italy – were badly affected in the early months of the pandemic, the strict lockdown measures ordered by governments have been successful in slowing the spread of the virus. Economic activity, including international tourism, has restarted in many countries.

Discover more:

Read: Sustainability: six ways the corporate world will have to change

Learn: Move over, US: time for a new stock market leader?

Watch: Why do markets rise when economies slump?

Perhaps more significantly, the response of the EU has helped build confidence. Individual countries supported households and businesses via various methods, but the €750 billion EU recovery fund is an important breakthrough. It will see the European Commission borrow on capital markets and a €390 billion programme of grants to member states who were economically weakened by Covid-19.

The scale of the recovery fund was a boost to markets when it was first proposed. The fact it has now been agreed, albeit after protracted negotiations, shows how the European authorities are capable of a credible and co-ordinated response. This is a positive step that may have surprised some observers and asset allocators.

Clearly, the outlook is uncertain, particularly as regards the spread of the virus. Clusters continue to emerge and the prospect of a second wave cannot be ruled out.

However, Europe’s response to the virus so far may be a factor in attracting investors to the region’s equities, both in terms of containment and collective action on the recovery fund. By contrast, the US faces new lockdowns in some states and an uncertain presidential election this autumn.

At the same time, valuations in Europe remain attractive compared to the US. As of the end of June, the cyclically-adjusted price-to-earnings ratio for Europe ex UK was 18.2x and 12.7x for the UK, compared to the US on 27.7x.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.