Insurer Lancashire sounds losses warning after natural catastrophes

Lancashire Holdings has warned it is exposed to net losses of up to $75m (£57.41m) after damaging events within its marine portfolio, and damage from a series of natural catastrophes.

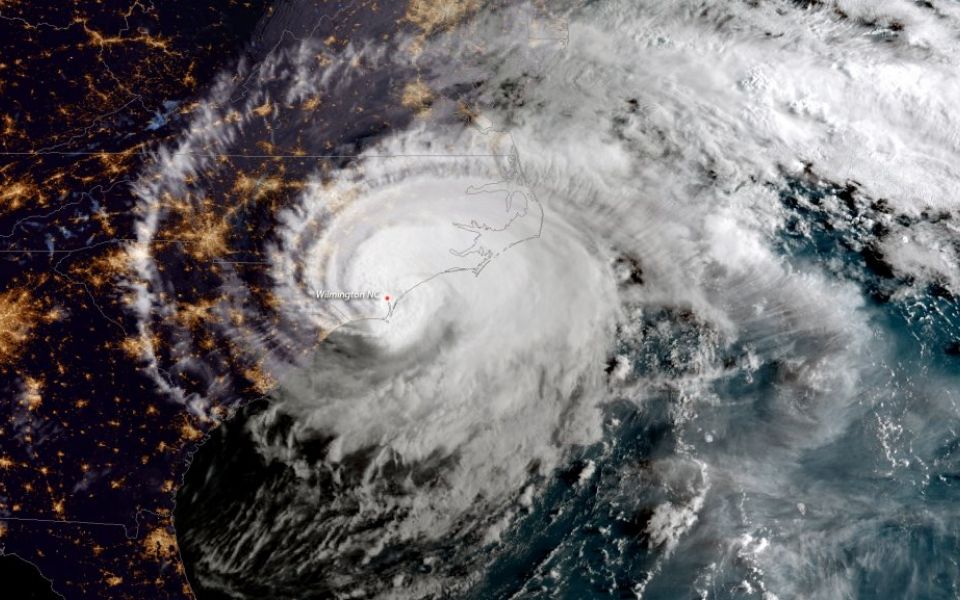

The insurer expects net losses of $30m from marine events, and of $25m to $45m from exposure to several recent weather events, including hurricane Florence, and typhoons Jebi, Mangkhut and Trami.

Read more: RSA Insurance shares drop as firm warns torrid weather will hit profits

Lancashire said the losses incurred would cause it to post a negative return on equity for the third quarter of 2018, adding that it would have been profitable had they not occurred.

“As additional information emerges, the company’s actual ultimate loss may vary from the preliminary estimates announced. The final settlement of all claims is likely to take place over a considerable period of time,” the company said in a statement.

The insurer’s shares dipped by up to eight per cent in early trading on the news.

Read more: Lloyds Bank reportedly plans to set up insurance subsidiary in Luxembourg

According to analysis by Munich Re, a German reinsurer, the first half of the year saw fewer severe natural disasters than the average, resulting in lower overall losses. The drop followed the impact of three major hurricanes – Harvey, Irma and Maria – during 2017. Over the summer, a series of natural catastrophes reversed that trend.

Hurricane Florence, which hit the East Coast of the US last month, is anticipated to cost insurance companies between $1.7bn and $4.6bn, according to modelling by Air Worldwide – lower than had been feared before it made landfall.