BIS warns market volatility was just the beginning as global credit binge stalls and investors lose faith in central banks

The volatile start to the year for financial markets may only mark the beginning of a realisation that the world economy has become more fragile, the Bank for International Settlements (BIS) warned today.

“The tension between the markets’ tranquillity and the underlying economic vulnerabilities had to be resolved at some point. In the recent quarter, we may have been witnessing the beginning of its resolution,” said Claudio Borio, head of the monetary and economic department at the Swiss-based global financial regulator.

Borio gave a stark warning that central banks were losing credibility, and that this had fuelled part of this year’s financial turbulence.

Read more: Negative interest rates have "insidious" effects

“Despite exceptionally easy monetary conditions, in key jurisdictions growth has been disappointing and inflation has remained stubbornly low. Market participants have taken notice. And their confidence in central banks’ healing powers has – probably for the first time – been faltering.”

Slowdowns in key emerging markets such as China and unintended consequences of central banks’ decisions to impose negative interest rates had also been a factor, the BIS said.

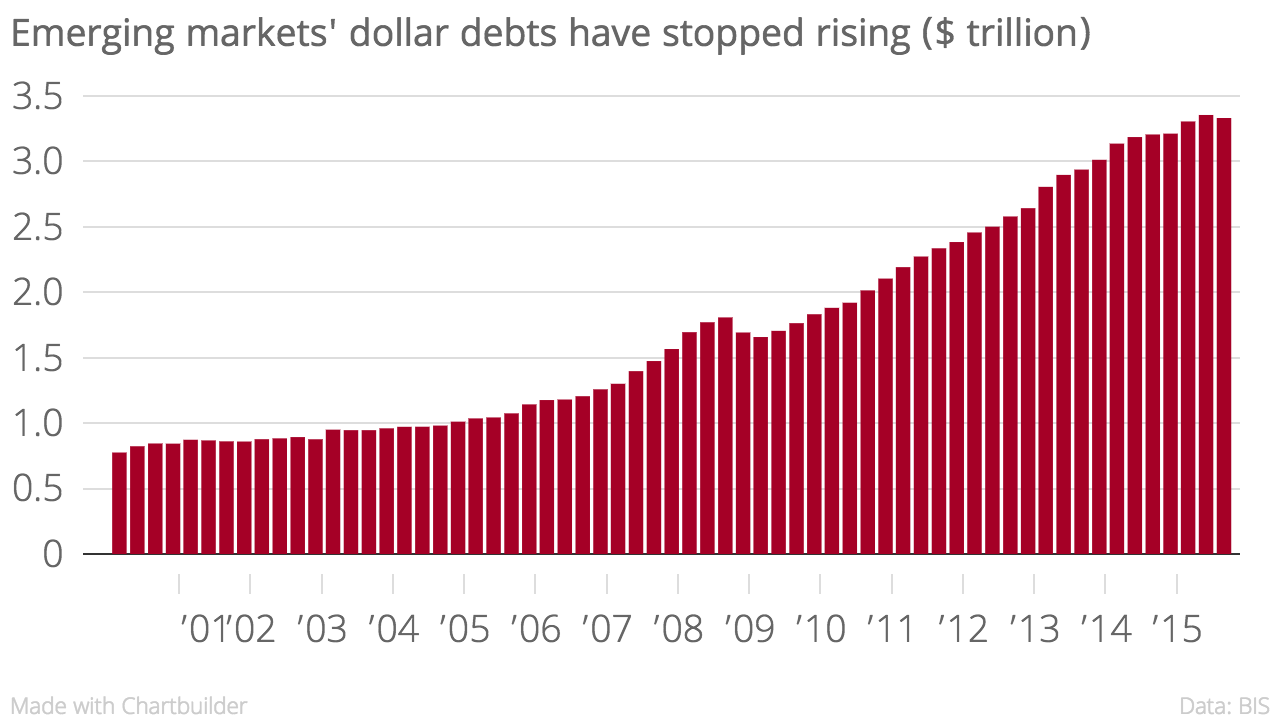

One long-held fear at the BIS has been the build up of dollar-based debts outside the US, especially in emerging markets. Dollar debts in emerging economies totalled $3.3 trillion (£2.3 trillion) in the three months to September, unchanged on the previous three months. It was the first time since 2009 the figure failed to grow.

Emerging market currencies have been falling against the dollar, making servicing external debts more expensive. And this has been occurring as domestic credit conditions have been turning.

Read more: What's helicopter money – and could it save the world?

“It is as if two waves with different frequencies came together to form a bigger and more destructive one,” Borio said.

“The most worrying development has been the steep rise in private sector debt elsewhere, especially in several emerging market economies including the largest – the main engines of global growth post-crisis. The increase has been strongest among corporates, whose profitability has been declining, and among commodity exporters.”

The BIS added: "If they persist, tighter global liquidity conditions may raise stability risks in some countries, especially those where other indicators already point to a heightened risk of financial stress."