Surprise: Lloyds Banking Group share price leaps as it hikes dividend – but profits are hit by PPI charges

Lloyds Banking Group shares leaped this morning as it hiked its dividend – but more PPI charges dented its pre-tax profits.

Read more: Lloyds cuts bonuses for 2015

The figures

Lloyds said underlying profits rose five per cent on last year to £8.1bn in 2015, while total income rose one per cent to £17.6bn.

Operating costs fell to £8.3bn, while impairment charges fell 48 per cent to £568m.

But statutory profit before tax fell to £1.6bn, from £1.8bn the year before, while earnings per share fell to 0.8p, from 1.7p in 2014. That was thanks to an additional £2.1bn PPI provision during the fourth quarter, which brought the 2015 total up to £4bn.

The bank nevertheless chose to hike its dividend to 2.25p per share, up from 0.75p in 2015.

Shares in the bank jumped 9.5 per cent as the market opened, to 68p.

| What you need to know about Lloyds' dividend |

|

Total ordinary share dividend for 2015 is 2.25p – that's £1.6bn in total Special dividend is 0.5p per share, or £400m in total Average individual retail shareholders with 6,000 shares will receive about £160 this year With a 10 per cent stake, the government will receive about £200m in 2015 – in addition to the £8bn it has made through share sales this year The lender's dividend yield for 2015 is circa four per cent |

Why it's interesting

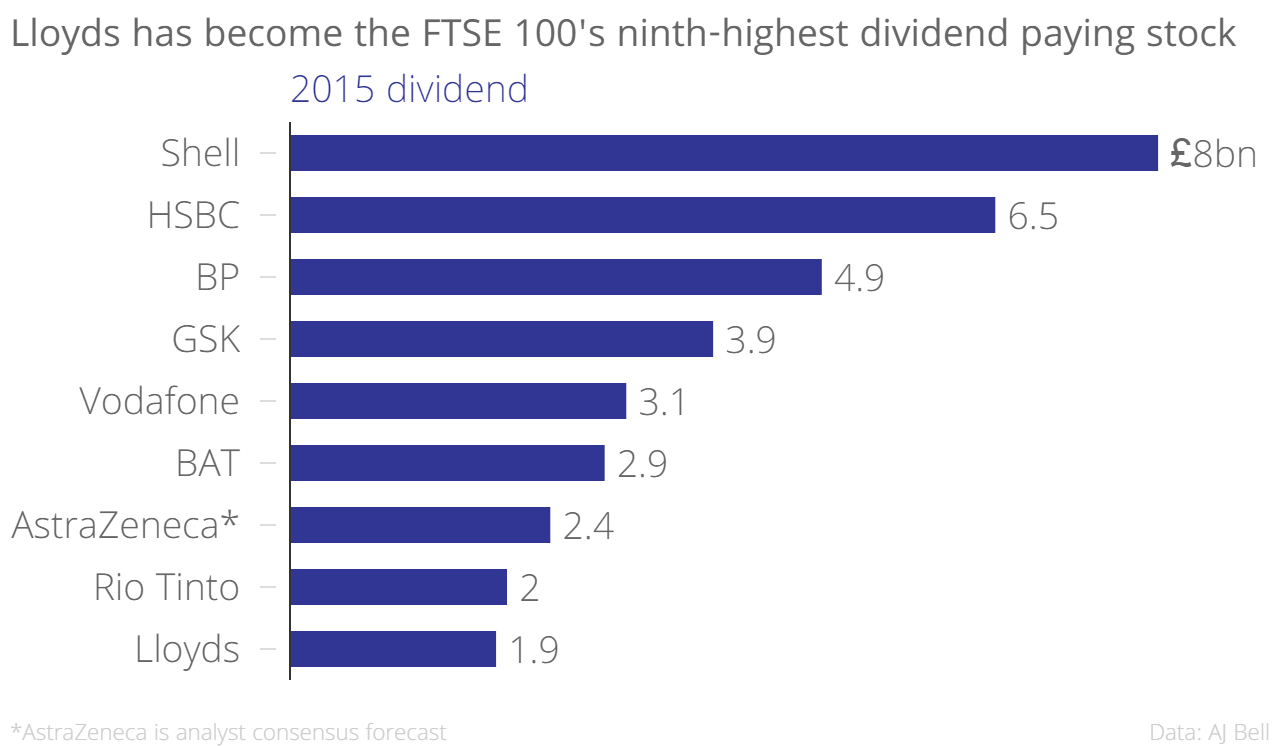

Like other lenders, Lloyds has been hit by heavy selloffs this year – but the fact it was able to hike its dividend to more than 2p per share may nonetheless help chief executive Antonio Horta-Osorio to convince George Osborne the bank, which is still partly owned by the government, is strong enough to fully privatise.

In January Osborne called a temporary halt to any further selloffs of Lloyds shares, saying the next tranche, which was expected to raise £2bn for the Treasury, will only be sold off "when turbulent markets have calmed down". And while Lloyds is looking strong, those PPI provisions may continue to be the albatross around Lloyds' neck.

Meanwhile, the bank said the UK's economic environment remains "resilient".

"This is reflected in strong employment levels, reduced levels of household and corporate indebtedness, and increased house prices, amongst other things, which provide a positive backdrop and underpin the group's future prospects," it added, hopefully.

What Lloyds said

Horta-Osorio said:

We made a strong start in 2015 to the next phase of our strategy and have delivered a robust financial performance, enabling increased dividend payments. Our differentiated, UK focused, retail and commercial business model continues to deliver, with our financial strength, cost leadership and lower risk focus positioning us well in the face of current market uncertainty. We remain confident in our ability to become the best bank for customers and shareholders, while continuing to support the economy and helping Britain prosper.

In short

It isn't an easy time to be a lender – and while Lloyds continues to show strength, PPI remains its albatross.

[charts-share-price id="104"]