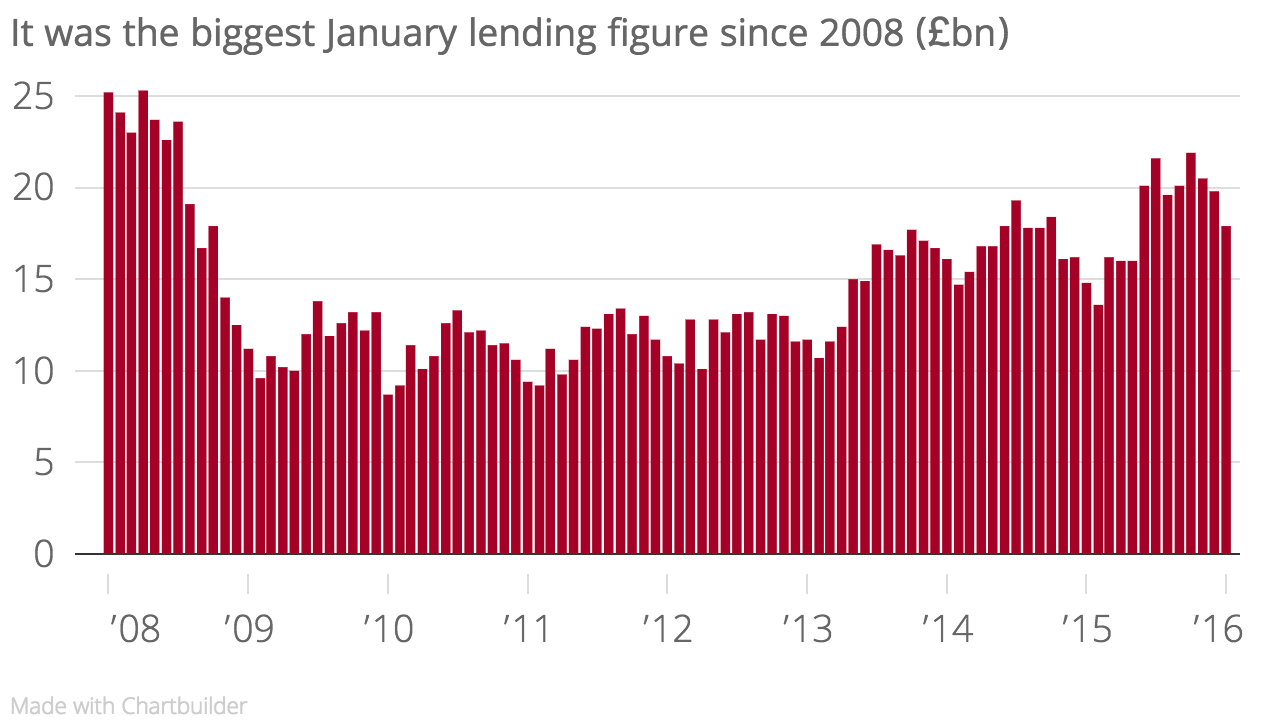

UK house prices: Mortgage lending has strongest start to the year since 2008

Mortgage lending had its strongest start to the year for eight years, according to figures released this morning.

Gross mortgage lending hit £17.9bn in January, 21 per cent higher than the same month last year, the Council of Mortgage Lenders said. It is the largest amount of mortgage lending conducted in January since 2008 when £25.2bn was loaned out.

"January saw a significant increase in lending compared to previous years as the growth in house price inflation drove lending beyond what we would normally see at the beginning of the year. It is therefore crucial to note that the annual rise in gross mortgage lending largely reflects an increase in the size of loans rather than the number secured," said Jeremy Duncombe, director at Legal & General Mortgage Club.

CML economist Mohammad Jamei said:

Lending started the year on a positive note. Our monthly estimate is 21 per cent higher than a year ago, with the current growth rate in lending similar to the closing months of 2015.

UK market fundamentals are helping to underpin this recovery, with real wage growth, an improving labour market, competitive mortgage deals, and government schemes all supporting household demand.