European bank share prices bounce – but report warns negative rates could make the sector’s woes even worse

European banks looked more positive today, as markets continued Friday's rally.

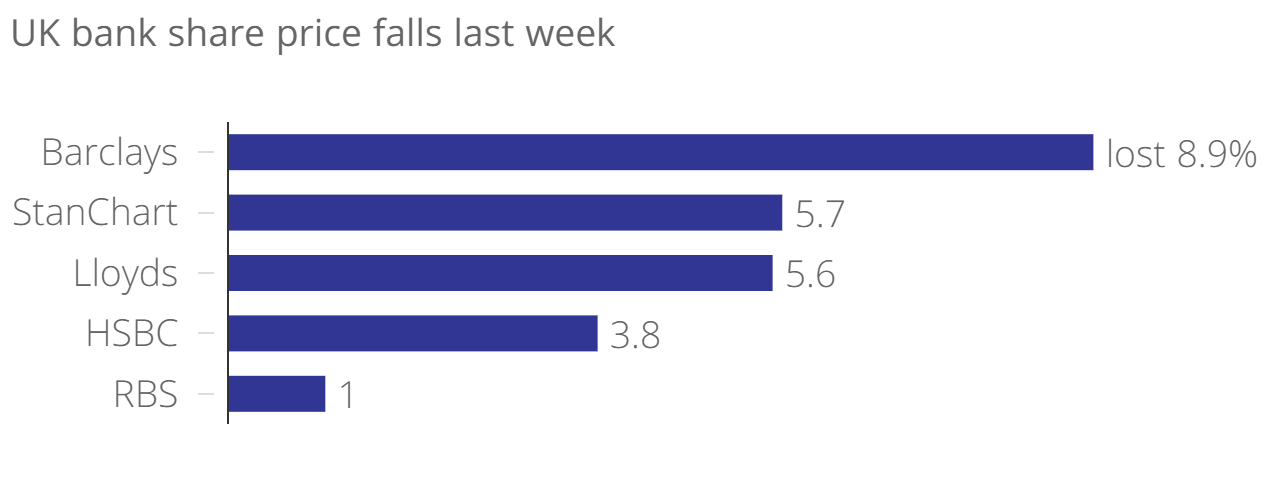

In the UK, HSBC was up 0.76 per cent to 443.75p, while Barclays was up 2.5 per cent to 161p. Lloyds was up 1.5 per cent to 59.39p, while Royal Bank of Scotland group rose 1.7 per cent to 244.3p.

That came after HSBC confirmed last night it will stay in the UK, rather than moving to Hong Kong. In a statement last night it said it had become clear the "combination of our strategic focus on Asia and maintaining our hub in one of the world's leading international financial centres, London, was not only compatible, but offered the best outcome for our customers and shareholders".

Other European banks were also pushed up, with Deutsche Bank – which was hit hard by uncertainties last week – rising 1.6 per cent to €15.55, while Commerzbank rose 3.1 per cent to €7.77 and Credit Suisse rose 4.9 per cent to €13.74.

But a report from CMC Markets published this morning suggested the move towards negative rates could undermine the banking sector.

Michael Hewson, chief market analyst at CMC, said the sector's woes were "set to get much worse given the direction of travel for interest rates over the next few years".

"The implementation by the European Central Bank of lower negative rates has been followed by the Bank of Japan, and if, as expected, the People’s Bank of China follows suit and cuts rates further this could well result in further downward pressure on profit margins for European banks already struggling with falling revenues and increasingly onerous regulation," he said.

"While the woes of Germany’s Deutsche Bank have grabbed the headlines in recent days the problem facing it and the wider banking sector aren’t unique. The only difference is that UK and US banks addressed a number of these problems earlier than European banks."