Bank shares were smashed again today as investors lost confidence in the face of long term low interest rates

It’s been another day of carnage for European banks, as share prices continue to slide beyond lows recorded even at the height of the global financial crisis.

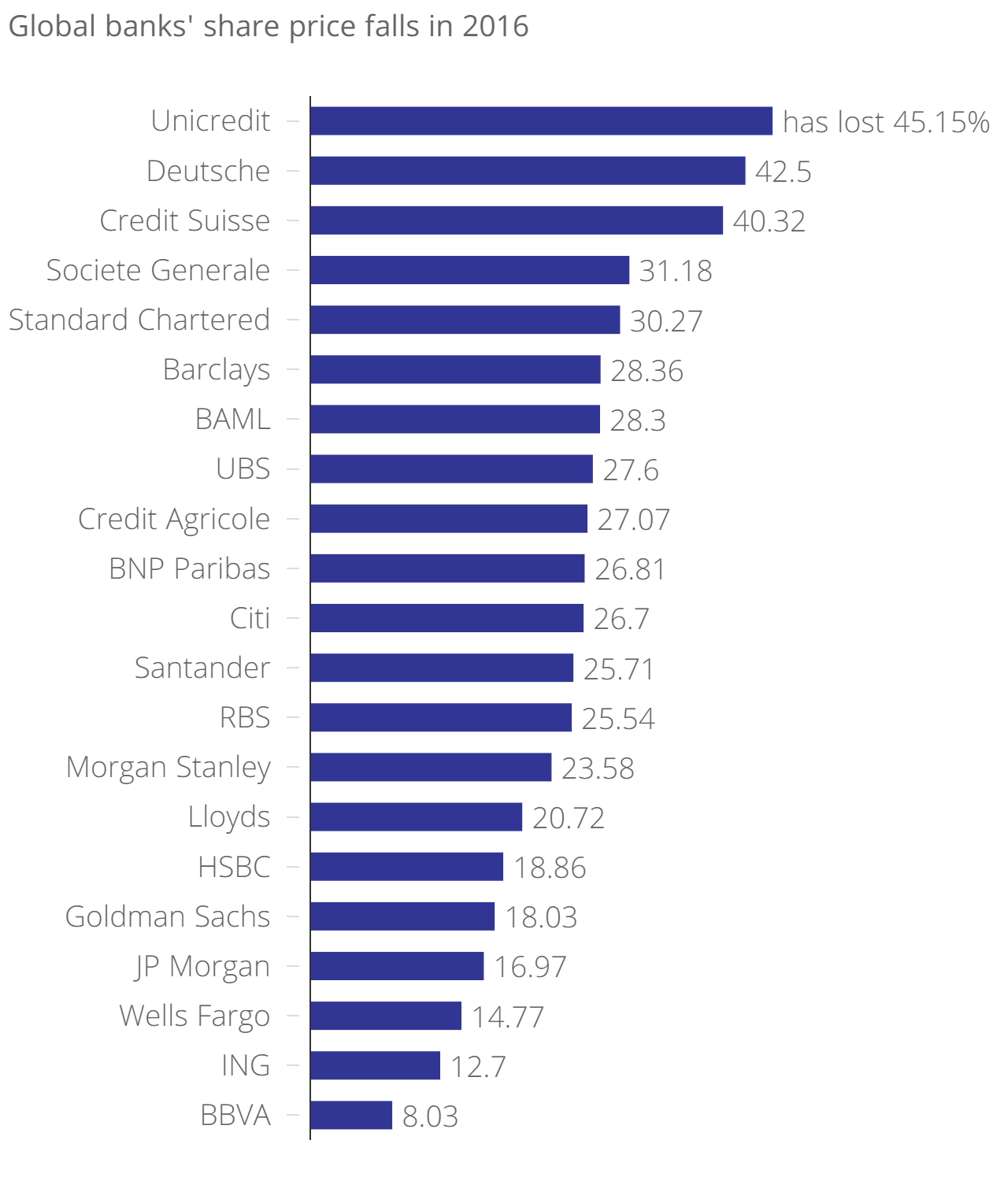

The biggest loser in the UK was emerging market focused bank Standard Chartered, with shares finishing down by 5.5 per cent. Close behind was Barclays with shares ending down by around 4.5 per cent.

Lloyds Banking Group and Royal Bank of Scotland both closed down by over two per cent.

The government recently put on hold its plans to sell the remainder of Lloyds shares due to the market volatility this year, and that the shares would be sold at a loss to the tax payer.

RBS is also due to sell more shares this year, though that has now come into question, despite Chancellor George Osborne saying he wants it off government books as soon as possible.

European banks had an even worse day. It was Credit Suisse’s turn to get bashed by investors today, ending the day down 8.4 per cent.

Deutsche Bank has added to yesterday’s massive sell offs, down 4.2 per cent today after co-chief executive John Cryan failed to reassure investors, issuing an open letter to the market declaring the bank’s balance sheet “rock solid”.

[charts-share-price id="78"]

Read more: Worries over German economic growth after industrial production dives

BNP Paribas has not been spared the market’s wrath. Shares in France’s biggest bank by assets are down by 4.5 per cent.

Markets are continuing to reel from a global equity sell off, despite hopes that markets would get some respite from the ongoing rout as China and much of East Asia is on holiday celebrating the Lunar New Year.

The FTSE 100 has fallen deeply back into bear market territory, finishing one per cent lower at 5,632.19 despite starting the day up for the first couple hours of trading.

In the US markets have turned it around thanks to a rally in tech stocks, though financials are still weighing on the market.

Everyone’s favourite measure of volatility, the Vixx index in Chicago yesterday climbed by 11 per cent throughout trading.

Not all banks are faring badly however. Clydesdale Bank, recently put on the market by National Australia Bank, is up by 15p from its opening price of 180p last week.

That said, the long awaited float of challenger Metro Bank is looking less likely to reach its sought after near £2bn valuation as fund managers question the bank's three times book value.