UK house prices: Property price growth will slow over next three years, EY Item Club predicts

House price growth will slow over the next three years, according to new forecasts, as continued growth puts owning a property out of reach for many.

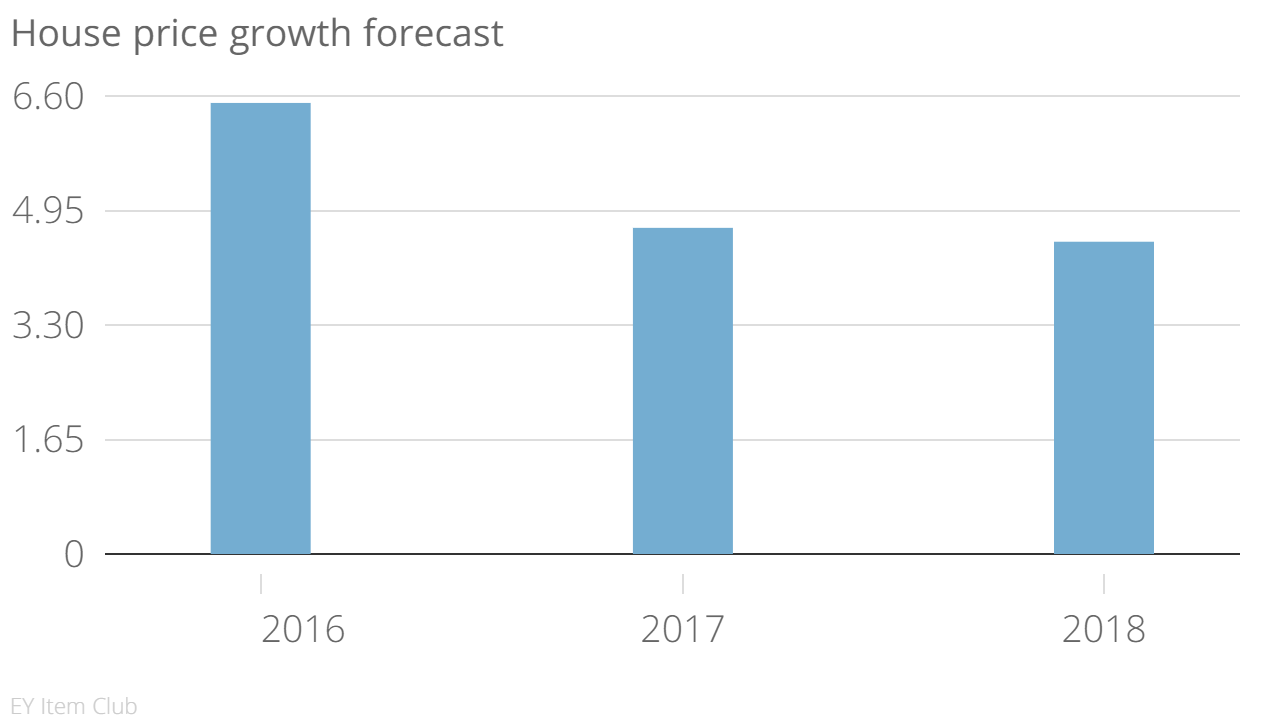

Property prices are expected to rise by 6.5 per cent this year, new analysis by EY Item Club predicts.

That growth will continue in 2017 and 2018, but at a more moderate rate of 4.7 per cent and then 4.5 per cent.

"The chances of demand for housing falling back to any great extent look remote," said the report, with household income set to grow and an interest rate rise looking further away.

"[The] fundamental imbalance between supply and demand should ensure that house prices continue to rise. However, we do expect the growing unaffordability of property – the Halifax reported that the price-to-income ratio was 5.5 in November, the highest since early-2008 – to prevent an acceleration in price growth."

New buy-to-let regulation is also likely to slow things down.

"We expect the mortgage and housing markets to remain buoyant during the quarter as buy-to-let landlords anticipate the higher stamp duty that they will face in April. Combined with a phasing out of mortgage interest tax relief, this is then likely to slow the buy-to-let market."

Investment in house building is expected to recover strongly with the help of government initiatives, however, with 2.1 per cent growth in 2015 increasing to 6.9 per cent this year and 8.3 per cent in 2017, the report forecasts. But, this growth is still unlikely to increase supply as house building remains "well short" of what's needed, "particularly in London and parts of southern England" said the report.