Could gold return as a safe haven with Chinese fears depressing the markets?

The volatile start to 2016 has panicked bankers and left investors despairing, but it may offer a ray of hope for gold miners.

Gold miners have not been immune to the commodities rout, and the price is hovering around a six-year low of $1,045 an ounce, although today the spot price is nearer $1,087.

However, turmoil in markets has seen investors return to gold exchange traded funds (ETFs), which are tradable funds that track the price of gold, as the metal prices rebound along with that of the companies that mine it.

Read more: What will happen to the gold market in 2016?

In the first two weeks of 2016 there have already been $778m (£539m) of inflows into gold ETFs, compared to outflows totaling $49.3bn over the last three years, and gold is outperforming most global indices at the moment, according to analysis from Markit.

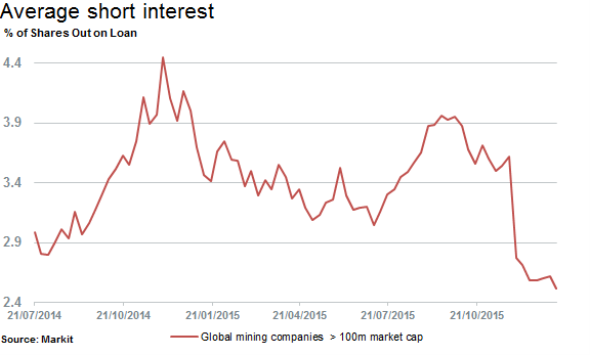

Short selling interest in gold miners has also fallen by 21 per cent to 3.6 per cent of shares outstanding since early 2015. This contrasts with the average short interest of the S&P 500 which is at the highest level seen in over three years, at around three per cent.

Read more: Gold hits new lows: is it all over for the precious metal?

Short selling is effectively betting a company’s share price will fall. An investor borrows shares to sell and buy-back at a pre-arranged price, profiting when the price falls. Short interest is the percentage of shares are on loan.

Some gold miners have seen stock rise on the assumption gold fever will return to investors, for example FTSE 100 member Randgold Resources, which has seen shares rise 5.9 per cent so far this year, outperforming the FTSE.

However, it won't be all plain sailing: gold trades in the opposite direction to that of the US dollar. So when the dollar is rising in value the price of gold falls, which means further Fed movement and a strengthening US economy could derail the resurgence.

Despite this, analysts seem cautiously optimistic. UBS sent out a note saying: "gold's performance amid broader risk-off sentiment could be an opportunity to regain investor interest."

Edith Southammakosane, director and multi-asset strategist at ETF Securities, said: “Gold maintained its safe-haven status in the opening week of 2016. The [Chinese stock market] panic led to gold prices rising 4.4 per cent and gold ETPs witnessed net inflows of $11m.”

However, FXTM chief market analyst Jameel Ahmad warned: "Optimism over a possible recovery for gold is being helped by a sequence of increased geo-political concerns around the globe. However, it is important to highlight that despite different geo-political tensions being ongoing for quite some time, that there has been no significant bounces in the valuation of the metal so far."