Car industry revival turbo charged in US – GM, Fiat Chrysler, Ford, Toyota, and Nissan all pull in record sales for December and 2015

Oil prices at an 11 year low, an easy line of credit, pent up customer demand, and a rebound in the jobs market all contributed to a record breaking 2015 for the US car industry, crowned with one of the best December trading periods ever.

The picture is looking similar in UK, with many of the same factors boosting the industry, and the Society of Motor Manufacturers and Traders are expected to put out data tomorrow showing big numbers for car registrations in 2015. The industry has come a long way since the global financial crisis six years ago lead to General Motors (GM) and Chrysler Group declaring bankruptcy after total industry sales tanked to 10.4m in 2009 resulting in massive job loses.

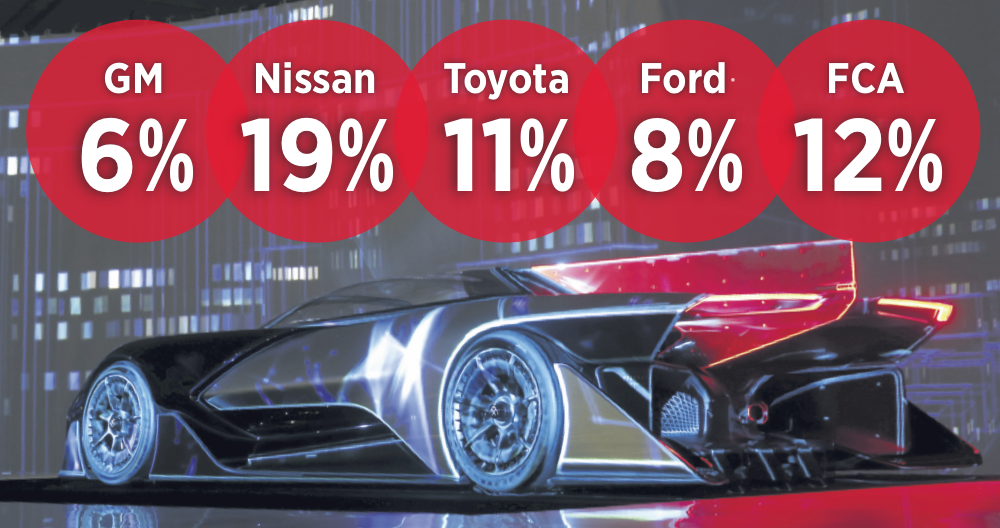

In 2015 US sales hit a record of 17.5m vehicles, breaking the mark of 17.4m vehicles in 2000, according to Autodata. GM, the top seller in the US, said its monthly December sales rose 5.7 per cent from a year ago.

Not a lot will be able to derail this level of demand from the market

Fiat Chrysler Automobiles (FCA) posted a 12.6 per cent rise in sales to 217,527 for December, bringing its streak in sales to a whopping 69 months. Ford posted sales up by 8.3 per cent to 237,606 vehicles, making it the car makers best December ever.

Read more: 1956 Ferrari sells for £18m to become most expensive car of the year

Manufactures outside the US also pulled in double-digit percentage gains. Toyota was up 10.8 per cent to 238,350, while Nissan accelerated 18.7 per cent to 139,300 vehicles sold in December. Even coming off the back of such a strong period of sales, analysts expect 2016 to be just as busy on the forecourt. Tim Fleming, an analyst with vehicle data specialist Kelley Blue Book, tells City A.M.: “There aren’t many things that would derail the demand we’re currently seeing.”

“An oil price rebound would certain dent the sale of bigger SUVs that have done well with gas prices so low, but the general market would hold up.”

Analysts, including Fleming, are surprised the industry has been able to pull off this kind of turnaround.

“Back in the recession people were questioning whether we’d ever hit the highs that we saw before,” Fleming says. While the industry surges in a hospitable environment, it’s also fostering challenges that could one day put established players out of business.

“Google, Apple, Tesla, Uber and Lyft are all going to make big changes,” says Fleming and it wouldn’t be the first time the tech titans have caused upset in an unsuspecting industry, though the car makers aren’t sitting idle. GM just invested $500m in taxi app Lyft and it is certainly not alone in shoring up its defences against newcomers. Fleming adds: “Car companies are investing billions of dollars to make sure they’re a part of the future.”

Read more: Ford invests billions in electric vehicles as it adds 13 new electric vehicles to its line

Consumer tech show CES has become a stage for car makers, with California based Faraday Future’s electric concept car (picture) turning heads yesterday. While Tesla remains aloof from CES, BMW, VW and Chevy are all expected to give us a glimpse this week of how the old guard are planning to stay on top in a world of self-driving and electric cars.